Issues & Community Blog - Andrew Weaver: A Climate for Hope

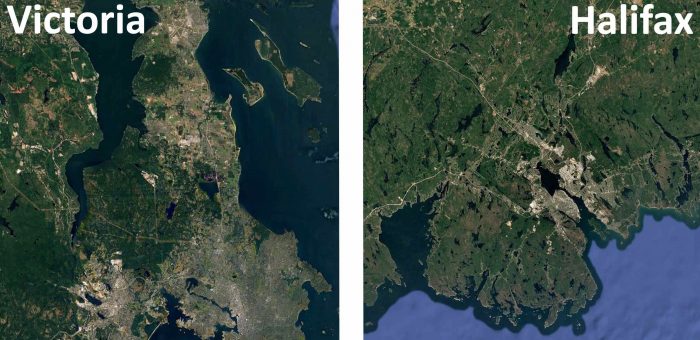

A Tale of Two Cities – Halifax and Victoria

This post was written by my father, John Weaver, and originally published on March 22, 2016 on his blog: beorminga.wordpress.com. I am preserving them on my website as his blog posts are remarkable in their thoroughness and depth of research. Enjoy!

A Tale of Two Cities – Halifax and Victoria

Background

Halifax Regional Municipality and Greater Victoria have much in common. They are both provincial capital cities, they are of similar size (Halifax 414,000, Victoria 359,000 according to official Statistics Canada estimates1 in 2014), they are respectively the home ports of the Royal Canadian Navy’s Atlantic and Pacific fleets, within their regions they are relatively old cities founded by the British (Halifax in 1749, Victoria in 1843), and they both include suburban and rural communities in addition to their urban cores.

But there are significant differences as well. Halifax is not only the capital of Nova Scotia and the largest city in the province but is also the leading commercial centre and transportation hub for the maritime provinces. Victoria, on the other hand, is overshadowed by its younger but very much larger neighbour Vancouver which is not only the dominant city in British Columbia and the third largest metropolitan area in Canada but is also the location of the largest port and the second busiest airport in the entire country.

An even more striking difference between Halifax and Victoria, however, is how the two regional cities are governed. Greater Victoria comprises 13 separate municipalities each with their own mayors and councils (91 of them!), and 3 electoral areas, all overseen by a Capital Regional District (CRD) with limited authority and responsibilities, and whose Board members are appointed or elected by the various municipalities and districts themselves. The Halifax Regional Municipality is a single entity having been created in 1996 through an amalgamation of Halifax City, Dartmouth, Bedford and the County of Halifax. It is governed by the Halifax Regional Council (HRC) of 16 councillors and an elected mayor. Local matters are considered by three community councils, composed of several councillors from the HRC, which make recommendations to the Regional Council. This is the exact opposite of the situation in Victoria where it is the CRD that is subservient to the individual councils rather than the other way round. Board members of the CRD are accountable not to the region but to their municipalities and can, through their councils, block any recommendation from the CRD that would benefit the region as a whole but which they perceive as unfavourable to their own small municipality (and their own prospect of re-election!).

Whereas the Government of Nova Scotia, concerned that the disunity of its largest metropolitan area was hindering its economic development, decided to commission a study of governance in the Halifax region and subsequently introduced an Act to Incorporate in 1995, the present Government of British Columbia prefers a “hands-off” approach to municipal affairs and anyway appears to be totally disinterested in Victoria as it focusses almost exclusively on Vancouver where its support is based.

Andrew Sancton, a well-known expert on municipal amalgamations, states that the Halifax Act was largely the pet project of the Liberal Premier, John Savage, who as mayor of Dartmouth had, ironically, previously opposed amalgamation when it was first mooted by the former Progressive Conservative Premier Donald Cameron. His motives apparently were to reduce public spending and foster economic development, but Sancton claims there was little public interest in the matter and certainly no pressure from external sources for him to pursue this course of action, or in Sancton’s own words2:

“It is extremely difficult to argue that there were strong societal forces urging Canadian provincial governments in the 1990s to implement sweeping municipal amalgamations in major metropolitan areas. In Halifax, the Royal Commission on Education, Public Services, and Provincial-Municipal Relations called for a single municipality as early as 1974. In 1992 the provincially appointed Task Force on Local Government arrived at a similar conclusion. In neither of these cases was there great public interest in the issue. … Such policies were brought in with little or no thought by provincial premiers who acted as they did in response to the particular political circumstances in which they found themselves. They made little or no effort to mobilize consent for these policies beyond a small group of cabinet ministers who in turn helped control obedient caucuses.”

Circumstances in Victoria couldn’t be more different. The amalgamation question has been alive and debated for decades: numerous public discussions have taken place; several well-attended forums featuring panels of experts and distinguished guest speakers have been organized; citizens’ groups seeking an independent study of local governance have been formed (Amalgamation Yes, Grumpy Taxpayer$ of Greater Victoria, Greatest Greater Victoria Conversation); countless articles and letters on the topic have been published in the local press3; radio and TV interviews on amalgamation are a regular occurrence; and so on. In 2014 an Angus Reid poll determined that 84% of residents in the Capital Region favoured some sort of amalgamation with 50% “strongly in favour”. An overwhelming majority of 89% supported a non-binding referendum on the issue, and 80% expressed support for an independent study and cost-benefit analysis of amalgamation in the region, extraordinarily high figures for a poll of this nature.

Local councils and mayors have traditionally been opposed to any change in the present governmental structure which is not surprising since many of them would be losing their positions in a unified region. Possibly influenced by the poll results, however, and reacting to pressure from various business, professional and citizens’ organizations, eight of the thirteen municipalities agreed to put some sort of question on the ballot when the municipal elections were held in November, 2014, asking if voters favoured a non-binding, independent review of governance in the region. It was perhaps a reflection of the disunity in the region that there was no agreement on a simple, common question; rather each municipality phrased the question to suit their own purposes – one was so convoluted that the result could be open to various interpretations, another was worded virtually to invite a ‘No’ vote. Five municipalities (fairly small ones) deemed the topic of no interest to their residents and declined to place any question on the ballot. Despite this lack of enthusiasm by local politicians, the public responded with a higher than average turnout in those municipalities with a question on the ballot and a resounding 75% vote in favour of a review of local governance.

It is tempting to ask if Professor Sancton would regard the case for amalgamation in Greater Victoria different from and more compelling than that in Halifax given that it has grown out of a grassroots campaign rather than a top-down imposition by the provincial government.

Financial Considerations

The first thing opponents of the Halifax amalgamation will point out is that the promised savings were never realized in the short term. They will mention the fact that salaries rose to the level of the best paid equivalent positions among the pre-amalgamation municipalities and that economies of scale were a dream never realized. According to Robert Bish4 the cost of implementing the amalgamation alone was four times the original estimate and he further stated that:

“It is not yet apparent that any cost savings will result. From 1996 to 2000, user charges increased significantly and average residential property taxes rose by about 10% in urban areas and by as much as 30% in suburban and rural areas.”

All that was some time ago, of course, and although proponents of amalgamation are primarily interested in delivering a more efficient, more equitable and less complicated model of governance rather than in any potential cost savings that may result, it is nevertheless interesting to compare the current costs of government in the two regions, Halifax and Victoria, and their economic development. The Executive Summary in Halifax’s proposed operating budget5 for 2015/16 begins with the statement:

“As a municipality, Halifax is in a strong, healthy financial position. The long term financial position of the municipality is generally sustainable as evidenced by its debt position. In line with the long-term trend, the Tax Supported Debt of the Municipality continues to steadily decline. Debt had peaked in 1998-99 at nearly $350m but at the end of 2015-16 is expected to total $256.3m, a decline of nearly $100m, more than 25%. This has been achieved despite a substantial increase in the population and higher demands for capital expenditures.”

On this same theme, Halifax Councillor, Reg Rankin, was quoted in the February 4th, 2016, issue of ‘The Coast’, a Halifax newspaper, as stating

“Today, this is the equivalent of paying off two-thirds of our mortgage. We’re so pleased it has been accomplished over a generation, a generation I guess since amalgamation.”

Whatever Professor Bish’s post-amalgamation prognosis in 2001 might have been, it is apparent that in 2016 the Halifax Regional Municipality is in a strong and still-improving financial position.

Further evidence6 of its economic health is provided by its admirable economic development since 2005 when it was placed 15th out of Canada’s 28 large city regions in terms of GDP growth. It rose to 8th place in 2014 and is predicted to be 1st in 2015, while over the same period Greater Victoria has fallen from 4th to 27th position in the same table. One cannot simply attribute Halifax’s remarkable economic growth to amalgamation, of course, but it certainly hasn’t hampered it! Meanwhile the Greater Victoria Development Agency has recently identified the lack of collaboration and common goals among the region’s multiple jurisdictions as a major reason for its sluggish performance and lack of success in attracting available funding. It proposed formation of a South Vancouver Island Development Association, funded by all constituent municipalities, to rectify the situation. The proposal had to be ratified (or not!) by all 13 councils, of course, an obstacle and delay that would have been entirely unnecessary if Greater Victoria were a unified city-region. In the end 11 municipalities and the Songhees First Nation signed the agreement with only two small semi-rural municipalities, Metchosin and Sooke, opting out.

A detailed comparison of revenues and expenditures in the two metropolitan areas is not a simple task that requires little more than a straightforward perusal of their operating budgets. The figures for Halifax are readily extracted from the published Consolidated Financial Statements for the Regional Municipality that are available on the internet7, but the corresponding amounts for Greater Victoria are spread over 14 different financial statements which are not fully consistent in the way the data are presented. A further complication arises because Halifax shows totals for the fiscal year ending on 31st March while the Greater Victoria municipalities use the calendar year for their financial statements.

There is also the “apples and pears” problem of trying to ensure that comparisons are like with like, since some services listed as part of the operating budget in one region may be treated differently in the other. One obvious example is the cost of transit. Halifax Regional Transit is a responsibility of the municipality whereas the Victoria Regional Transit Commission is a branch of BC Transit, which is partially financed by the Provincial Government. In 2014-15, for example, the total cost of operating transit in Victoria was $120.5 million to which local municipalities contributed only $28.8 million from their property taxes8. In the same fiscal year, expenditure for Halifax Transit was $110.9 million with property tax revenues contributing $76.3 million9, a far higher proportion than in Victoria. The three school districts in the Capital Region receive funding from the Ministry of Education which in turn receives municipal taxes collected on its behalf by the constituent municipalities themselves. The financial statement for Halifax clearly defines a single line item for ‘Educational Services’ but it is not at all clear in Greater Victoria what proportion of the Ministry’s grants to the school districts are funded by the various amounts collected by the municipalities. ‘Amortization’ is another significant entry on all the financial statements; these recorded amounts will depend on a number of factors that require detailed examination beyond my expertise.

There may be other examples of inappropriate comparisons that I am not aware of and, in any case, the different conditions existing in two separate provinces make meaningful interpretations of results somewhat tricky at best. Harsher winters in Nova Scotia, for example, mean heavier road maintenance and snow removal costs, and the sheer size of Halifax Regional Municipality is a factor not reflected in population figures alone. It covers a huge land area of 5490 km2 which is nine times larger than the area of Greater Victoria (696 km2) and even over twice that of the entire CRD (2341 km2) which includes the largely undeveloped and sparsely populated Juan de Fuca Electoral Area. Halifax region hugs the coast for a linear distance of roughly 150 km and extends about 50 km inland. The CRD would have to expand as far as Nanaimo in order to encompass a comparable area. No-one on Southern Vancouver Island is advocating an amalgamation on that scale.

Thus it soon became apparent that an unravelling of all the intricacies of these revenues and expenditures were best left to a qualified financial auditor. Two parts of the financial statements, however, which can be retrieved relatively unambiguously, appear to lend themselves to a direct comparison. They are wages and salaries, and protective services. It is also a fairly simple exercise to compare the grand totals of revenues and expenses (slightly modified to account for differences arising from some incompatible ways of reporting revenues and expenses in the two regions). The financial statements in these three areas are compared in the following paragraphs.

Wages and salaries. Wages and salaries, including benefits, are stated in the first line of expenses in the Table of Segmented Information included in one of the ‘Notes to Financial Statements’ in the audited Consolidated Financial Statements for each municipality. They are shown here in Table 1 which suggests that Greater Victoria residents pay about $100 more per person for the salary and wages of mayors, councillors and municipal staff than the residents of Halifax Regional Municipality. With 13 councils plus the CRD all employing their own administrative officers and staff this is perhaps hardly surprising. Halifax’s one mayor receives a salary of $168,449 while the 13 mayors of Greater Victoria are paid a combined total of roughly $450,000. All available evidence suggests that the cost of wages and salaries would be reduced in an amalgamated region.

Table 1

Expenditures on Salaries and Wages

(Figures in millions of dollars except last column);

| Municipality | 2013/14 | 2014/15 | Average | Per Capita |

| Halifax | 324.0 | 343.5 | 333.8 | $806 |

| 2013 | 2014 | |||

| CRD | 49.5 | 51.8 | ||

| Victoria | 104.1 | 107.3 | ||

| Saanich | 87.9 | 90.7 | ||

| Esquimalt | 12.9 | 13.5 | ||

| Oak Bay | 19.8 | 19.6 | ||

| Central Saanich | 10.5 | 11.0 | ||

| North Saanich | 5.2 | 5.4 | ||

| Sidney | 6.6 | 6.8 | ||

| View Royal | 4.1 | 4.3 | ||

| Colwood | 6.7 | 7.0 | ||

| Langford | 8.1 | 9.3 | ||

| Metchosin | 1.0 | 1.1 | ||

| Highlands | 0.6 | 0.6 | ||

| Sooke | 3.0 | 3.1 | ||

| Total Victoria | 320.0 | 331.5 | 325.8 | $908 |

Protective services. The police, fire and emergency preparedness services provided for citizens in all municipalities across Canada must be fairly standard. Thus one would expect the cost per person for such services to be fairly uniform in communities of similar size. “Protection services” is also a separate category of revenues and expenses on financial statements so a direct comparison between regions of similar size is fairly straightforward. There are, of course, significant differences between Greater Victoria and Halifax in how the delivery of such services is organized. The Fire and Emergency Services Organization Chart for Halifax shows one Fire Chief supported by a Deputy Chief of Operations, a Deputy Chief of Operations Support, and a Manager of the Emergency Management Office. Every municipality in Greater Victoria has its own Fire Chief and fire department, some of which are run on a volunteer basis, as are some of the rural components of the Halifax Regional Fire Department. The three former police forces in Halifax, Dartmouth and Bedford have been amalgamated into one Halifax Regional Police department responsible for policing those three former municipalities along with some neighbouring districts. Policing in the rural areas is contracted out to the RCMP. Greater Victoria, by contrast, maintains four separate departments in Victoria/Esquimalt, Saanich, Oak Bay and Central Saanich each with their own Police Chiefs and with markedly different caseloads per officer.

Two RCMP detachments, one based in Langford and the other in Sidney, serve the Westshore and north Peninsula respectively. Small detachments are also present on Salt Spring and Pender islands which fall within the jurisdiction of the CRD. The Senior Manager of the CRD’s protective services is also the Emergency Manager for the entire region.Table 2 shows compares the cost of protective services in the two regions. The per capita expense in Greater Victoria is slightly greater ($20) than in the Halifax Regional Municipality.

(Figures in millions of dollars except last column)

| Municipality | 2013/14 | 2014/15 | Average | Per Capita |

| Halifax | 192.1 | 203.0 | 197.6 | $477 |

| 2013 | 2014 | |||

| CRD | 8.5 | 8.7 | ||

| Victoria | 64.2 | 65.9 | ||

| Saanich | 47.2 | 50.3 | ||

| Esquimalt | 11.3 | 11.9 | ||

| Oak Bay | 8.9 | 8.6 | ||

| Central Saanich | 6.9 | 7.3 | ||

| North Saanich | 2.7 | 2.8 | ||

| Sidney | 4.0 | 4.1 | ||

| View Royal | 3.0 | 3.1 | ||

| Colwood | 5.2 | 5.5 | ||

| Langford | 8.6 | 10.1 | ||

| Metchosin | 0.7 | 0.7 | ||

| Highlands | 0.4 | 0.4 | ||

| Sooke | 3.0 | 3.2 | ||

| Total Victoria | 174.6 | 182.6 | 178.6 | $497 |

Total revenues and expenditures. The grand totals of revenues and expenditures in each jurisdiction are prominently displayed on all financial reports. While the figures themselves provide a simple overview of how much tax and other revenue is generated in the two regions and what their overall operating costs are, they are not directly comparable in a meaningful way because of the “apples and pears” reasons given earlier. Their interpretation is further complicated by the different formats used in reporting year-end financial statements in different municipalities. For example, Sooke clearly identifies taxes received as “Net taxes available for municipal purposes” and in an explanatory note lists the actual property taxes collected less taxes levied on behalf of schools, CRD, hospitals, Municipal Finance Authority, BC Assessment and BC Transit. North Saanich and Sidney also state that taxes shown under revenues are for municipal purposes, but others simply state “Taxes”. I have assumed these are all net taxes since there are no payments to the various outside agencies listed under expenses and proportionally the amounts seem consistent with those for municipalities reporting net taxes. Payments to the CRD are included under revenues in the CRD’s Financial Statement of course. Halifax also collects taxes for its school system but records the amount as a separate item in Revenue under Educational Services. The identical amount is then shown under Expenses as a lump sum payment to Educational Services. The funds simply flow through the Financial Statement without having any effect on the overall surplus or deficit. In Greater Victoria such payments to outside agencies do not appear at all. Thus for a fair comparison the amounts appearing under Educational Services have been omitted from the totals for Halifax in Tables 3 and 4 which show the total revenues and expenses for Halifax alongside the corresponding totals for the combined Capital Region. (An even fairer comparison would have resulted if the taxes for transit in Halifax and its net operational expenses had also been removed from the totals because transit in Greater Victoria is run by BC Transit, not by the CRD or individual municipalities.) Note that the total of expenses in the tables is not a measure of property taxes levied in the two regions. It excludes all the taxes collected on behalf of other agencies in Greater Victoria and those for educational services in Halifax.

Table 3

Revenues

(Figures in millions of dollars except last column)

| Municipality | 2013/14 | 2014/15 | Average | Per Capita |

| Halifax | 778.9 | 815.0 | 797.0 | $1925 |

| 2013 | 2014 | |||

| CRD | 181.8 | 191.6 | ||

| Victoria | 209.5 | 221.2 | ||

| Saanich | 189.1 | 187.5 | ||

| Esquimalt | 31.1 | 33.3 | ||

| Oak Bay | 34.0 | 36.7 | ||

| Central Saanich | 25.1 | 25.2 | ||

| North Saanich | 17.5 | 17.9 | ||

| Sidney | 18.8 | 20.1 | ||

| View Royal | 18.0 | 12.5 | ||

| Colwood | 19.7 | 19.4 | ||

| Langford | 55.1 | 51.1 | ||

| Metchosin | 5.3 | 4.8 | ||

| Highlands | 3.8 | 2.6 | ||

| Sooke | 13.6 | 16.2 | ||

| Total Victoria | 822.4 | 840.1 | 831.3 | $2316 |

Table 4

Expenses

(Figures in millions of dollars except last column)

| Municipality | 2013/14 | 2014/15 | Average | Per Capita |

| Halifax | 733.0 | 779.1 | 756.1 | $1826 |

| 2013 | 2014 | |||

| CRD | 147.6 | 148.7 | ||

| Victoria | 173.9 | 174.0 | ||

| Saanich | 151.1 | 164.4 | ||

| Esquimalt | 29.5 | 30.2 | ||

| Oak Bay | 32.2 | 32.5 | ||

| Central Saanich | 25.8 | 25.2 | ||

| North Saanich | 15.1 | 15.9 | ||

| Sidney | 17.9 | 17.9 | ||

| View Royal | 12.1 | 12.4 | ||

| Colwood | 17.7 | 18.5 | ||

| Langford | 53.0 | 39.3 | ||

| Metchosin | 4.4 | 4.6 | ||

| Highlands | 2.7 | 2.8 | ||

| Sooke | 11.6 | 12.0 | ||

| Total Victoria | 694.6 | 698.4 | 696.5 | $1940 |

What can we conclude from this discussion? First, I think one can immediately put to bed the alarmist claims by some politicians that amalgamation would dramatically increase the costs of local government in the Victoria region. The tabulated data, unprofessional as they are, indicate that after amalgamation Halifax has possibly lower rather than higher operating costs per person than the combined costs of the Capital Region’s 13 separate municipalities. Indeed, they suggest that in certain areas there are probably modest savings to be gained through amalgamation of a mid-size city-region with a population of about 400,000.

Other Factors

Potential fiscal savings are not the main reason proponents support amalgamation, however, a point that defenders of the status quo seldom recognize. There are more compelling grounds of a wider nature admirably summarized by Rudiger Ahrend et al.10 who state in their abstract: “A city’s metropolitan governance structure has a critical influence on the quality of life and economic outcomes of its inhabitants.” … “Administrative fragmentation, which complicates policy coordination across a city, has a negative effect on individual productivity. This finding, combined with benefits from good governance such as improved transport and lower pollution levels, highlights the importance of well-designed metropolitan authorities.” Referring to the Organisation for Economic Co-operation and Development (OECD), the authors go on to say: “The OECD Metropolitan database defines ‘functional urban areas’ across the OECD on the basis of a common method that relies on settlement patterns and commuting flows rather than administrative borders.” … “A large number of municipalities in metropolitan areas can complicate policy coordination among local governments. A potential solution to this coordination problem could be the amalgamation of municipalities within a metropolitan area. ”On this definition Greater Victoria is certainly a single functional urban area as anyone who uses the Trans-Canada or Pat Bay highways at commuting time knows. So how do Halifax and Greater Victoria compare when measured against those factors related to economic well-being and quality of life referred to by Rudiger Ahrend et al.? Of course, with its scenic setting, mild climate and general ambience Victoria has a natural built-in advantage with regard to quality of life, and it is fortunate to have a well-educated population including some, especially among those who have retired to the region, who are quite wealthy and willing to support arts and culture. But there are other factors which should contribute to the economic success and efficiency in the two regions which are discussed below.

Policing. With an amalgamated regional police force and one emergency call centre for its core districts it is inconceivable that Halifax could experience the shocking delay in responding to a frantic 911 call that occurred in Oak Bay some years ago. The address was on the artificial border between Victoria and Oak Bay and the resulting confusion eventually involved three different police forces. Six hours later police discovered five bodies inside the house in a murder-suicide crime. This was a terrible failure due to lack of communication between separate police forces. Attempts to create integrated units for Greater Victoria have only had limited success with municipalities joining and subsequently withdrawing because of costs. Kash Heed, a former BC solicitor general (and a former police chief in West Vancouver) is quoted as saying integration is a failed policy that fuels conflict rather than co-operation and that integration is a “band aid solution to a gaping wound”. Another problem is the enormous difference in cost per capita among the municipal police departments within Greater Victoria, $455 for Victoria, $263 for Saanich, $257 for Oak Bay and $245 for Central Saanich in 2013. This is because VicPD is responsible for policing the downtown core where much of the crime, drug-dealing and homelessness exists. Ironically over 50% of downtown crime is committed by residents of other municipalities in the region. Halifax is well ahead of Greater Victoria in policing.

Influence in Ottawa. Halifax is a member of the 21-strong Caucus of Big City Mayors which meets two or three times a year, sometimes with leaders of government, business, labour and the economy, to plan strategies for dealing with infrastructure renewal, homelessness, social housing, sustainability, and related issues. Their most recent meeting in early 2016 was with Justin Trudeau, the newly-elected Prime Minister. With a population of only 80,000 Victoria doesn’t qualify for membership of the Caucus but it is certainly burdened with the “big city” issues listed above. It is frustrating to see smaller (but unified) cities such as Regina, Saskatoon, St. John’s, Windsor, Gatineau, Kitchener, all having the ear of the Prime Minister while Victoria is excluded simply because it is a constricted urban core surrounded by other independent suburban municipalities. Unfortunately, unless the region is represented by a single mayor it will be forever excluded from this influential body. Halifax is poised to take advantage of funding made available to big cities while Victoria, Saanich, Langford etc. will compete with each other for the scraps left over.

Payments in lieu of taxes. Both Halifax and Greater Victoria receive substantial payments in lieu of taxes from the Federal Government for the Atlantic and Pacific Naval Bases and Dockyards respectively. The difference is that while the funds going to Halifax benefit the whole region, in Greater Victoria it is the municipality of Esquimalt (population 16,800) that receives the entire payment representing over 40% of its tax revenue, even though many of the naval and dockyard personnel reside in other municipalities. The general taxpayer in Halifax gets the fairer deal.

Sewage treatment. Although scientific and medical opinion is firmly of the view that secondary sewage treatment in Victoria is unnecessary and a complete waste of money, the fact remains that it has been mandated by the Provincial Government. The CRD took charge of the project and the history of the sorry saga that followed exemplifies all that is wrong with that body and with governance of the Capital Region. After ten years of debate, planning, public consultation and engineering reports, and an expenditure of nearly $100 million there is still no site selected for the treatment plant(s) or a decision on whether there will be one, two or more plants. The estimate of the overall cost now exceeds $1 billion. At one time a site had been selected but Esquimalt council refused to rezone the additional land needed to accommodate the plant. One small municipality’s action caused the collapse of the entire project. In Halifax, where treatment is most definitely needed (its effluent empties into the enclosed, sheltered waters of Halifax harbour) construction of treatment plants didn’t begin until after amalgamation because as separate cities, Halifax and Dartmouth could not reach agreement on the design of the plants. Sewage treatment was completed in 2011 at less than a third of the estimated cost for Victoria. And the moral of the story? It took amalgamation to get things done.

Arts and recreation. Victoria had the foresight and good fortune to retain and restore two lovely Edwardian theatres, the 1416-seat Royal, home to Pacific Opera Victoria and the Victoria Symphony, and the 772-seat McPherson Playhouse used for plays, concerts and amateur productions. Although they serve regional audiences and beyond, Victoria is the sole municipal contributor to the McPherson and only three municipalities (Victoria, Saanich and Oak Bay) contribute to the Royal Theatre. (Professional theatre is also staged at the Belfry Theatre, a converted church building, and the Roxy Theatre, while the 800-seat Alix Goolden Hall and the 1228-seat University of Victoria Auditorium are alternative venues for musical concerts.These are independently run facilities, however.) Despite this rich choice of venues for Victoria’s vibrant cultural scene, what is lacking for a capital city is a modern performing arts centre with a large stage suitable for ballet and major touring productions, and acoustics that befit a fine symphony orchestra. Given the reluctance of other municipalities to provide funds for theatres located in downtown Victoria, it is not surprising that after decades of informal campaigns, studies and proposals there is no sign of any progress having been made towards building such a facility. By contrast, Halifax is not nearly as well provided with performance spaces. Its main professional theatre is the Neptune which seats 479 playgoers. For larger productions and symphony concerts it uses the 1023-seat Rebecca Cohn Auditorium on the Dalhousie University campus. These are meagre facilities compared with Victoria, but the Halifax Regional Council does have a new performing arts centre officially on its agenda as one of the large projects in the concept phase. With the council representing the whole of the region it is likely to be built while unofficial groups in Greater Victoria are still talking. The same can be said for arenas. Many of the municipalities in Greater Victoria have built their own community recreational centres which is excellent, but a city-region of 360,000 also needs a large arena suitable for a semi-professional hockey team, figure-skating and gymnastics competitions, trade shows and rock concerts. Victoria’s tired old 4200-seat Memorial Arena was replaced in 2005 by a new 7000-seater courtesy of the City’s taxpayers alone. Halifax has an arena with seating for 10,600 spectators (12,000 for concerts) but is already considering building a bigger one with a capacity of over 15,000 spectators for hockey games. If this comes to fruition the costs will be distributed equitably across the region. One can only imagine what kind of arena Victoria could have had if it had been an amalgamated city when the aging Memorial Arena was replaced.

Garbage collection. Each municipality in Greater Victoria has its own regulations and methods for garbage pick-up. Whereas Victoria employs several men and one truck for residential services, Saanich, with a more automated system, needs only one man and a truck. Langford doesn’t provide any garbage collection at all as a municipal service − residents have to make their own arrangements with a private company. Some municipalities provide residents with two standard containers, one for general non-recyclable rubbish and the other for organic kitchen waste, others do not. Halifax has a uniform method of garbage collection but it appears to be less advanced than some of those in Greater Victoria.

Neighbourhood representation. Halifax is divided into 16 Districts each electing one councillor. The Districts are grouped into 3 Community Councils comprising the councillors elected in each District. The Community Councils make recommendations to the Regional Council which has final authority. Local public input and consultation is generally made at the Community Council level or, personally, to the District councillor. In Victoria and Saanich, members of neighbourhood associations are ordinary residents interested in community activities, planning, development, and the general character of the areas in which they live. Board members of a neighbourhood association, who meet usually once a month, are all volunteers. Each councillor is assigned to one or more neighbourhoods and attends their board meetings if possible. The associations may draw up neighbourhood plans, advise on land-use management and raise objections to unwanted developments, but they have no final authority which rests with the municipality. It would be possible to copy the model of regional governance in Halifax by dividing the CRD into perhaps four community councils, say (i) East Victoria, Oak Bay, Gordon Head and Cadboro Bay, (ii) West Victoria, Esquimalt, View Royal and South Saanich, (iii) West Shore and Juan de Fuca, and (iv) Cordova Bay, Prospect Lake, Peninsula and Islands, with each “Community” sub-divided into three or four “Districts”. Some members of the neighbourhood associations are ambivalent about amalgamation as they feel it would relegate them to an even more remote position of influence from the ultimate decision-makers, but perhaps they could play a similar role in their District if the Halifax model were adopted.

Rural protection. Some opponents of amalgamation claim it would threaten protection of rural areas. Halifax includes a large rural component and it remains intact. Saanich, the largest of the Greater Victoria municipalities has managed to preserve its rural part despite the encroachment of suburban housing. It is the smaller municipalities that are more worrying, as it is harder for them to resist the temptation of increasing their tax base when presented with attractive offers from developers. Langford cleared forested areas, including a Garry Oak meadow, in order to develop its cluster of box stores. Central Saanich, a mainly rural community, has allowed an ugly strip of light industry, warehouses and commercial businesses to grow along Keating Cross Road, and now a new proposal has emerged to build yet another shopping mall on the outskirts of Sidney, the last thing that compact community needs. A single regional plan for the entire region would surely help to prevent such haphazard developments from happening. In my opinion, amalgamation would provide better rather than less preservation of the rural areas in the Capital Region.

Emergency preparedness. Halifax has one emergency plan and one emergency call centre. Victoria, situated in an earthquake zone, has 13 plans and 3 call centres. The mind boggles at the sort of chaos that will develop if the ‘big one’ occurs with the present administrative structure still in place.

Infrastructure renewal, traffic and planning. Two bridge replacements demonstrate the unfair burdens placed on individual municipalities when infrastructure serving the entire region is renewed. The Johnson Street bridge is on one of three routes connecting the West Shore to downtown and beyond. Yet it lies entirely within Victoria which must therefore bear the full cost, even though it is Esquimalt which probably receives the most benefit in this case. Much of the funding for the Craigflower Bridge upgrade came from the gas tax, but Saanich and View Royal, the municipalities at either end of the bridge (just – the Esquimalt border nudges up to the corner of the bridge on the View Royal side), each contributed $2.5 million. Much of the traffic on this bridge, especially at commuting time, is to and from the naval dockyard in Esquimalt, which was not financially involved in this project. Planning in the region is not well coordinated. Langford’s box stores were planned by that city alone, yet they attract traffic from other parts of Greater Victoria causing congestion on the Trans Canada highway and on the road leading from the stores to the highway. Langford is, however, anticipating the possibility of a reopening of the E & N railway for commuter trains between the West Shore and downtown while, ironically, Victoria has severed the rail link into the city centre because it couldn’t afford the additional cost of incorporating it into the new Johnson Street bridge. There appears to be no coordinated plan in Saanich and Central Saanich to identify potential arterial routes through their municipalities to the airport and BC ferry terminal, with the result that all through traffic to those destinations is funnelled onto the already busy Pat Bay highway. And surely it is only in Victoria that one encounters such bizarre situations as a plethora of building codes, designated bicycle lanes ending abruptly when reaching an invisible line between two municipalities, a default speed limit that suddenly changes when driving along what appears to be the same road at a constant speed, a suburban road where one side is like a country lane with no kerb or sidewalk while the other is a typical suburban street, a house that receives two partial tax bills because it happens to straddle two municipalities on an ordinary suburban street. All quite hilarious, but unfortunately true. I know little about Halifax in these departments but I’m sure it has a regional plan, a standard building code, uniform traffic regulations and no invisible boundaries!

Conclusion

Amalgamation of the Halifax municipalities was not perfect. Almost certainly it covered too large an area. With its historical urban core centred on Halifax, Dartmouth and Bedford surrounded by vast tracts of rural land dotted with small communities, it is a marriage of barely compatible parts. In such a large region some rural residents probably feel disconnected from the city and with their different priorities may perhaps disproportionately influence policy issues on such urban issues as libraries and transit. Greater Victoria’s geography is rather different. Only the small municipalities of Sooke, Metchosin and Highlands on its fringes are truly rural (and even they also serve as bedroom communities for daily commuters) while Central and North Saanich and parts of Saanich itself contain pockets of productive and protected farmland. It resembles a more cohesive community containing a mix of countryside, suburbia and urban core which geographically, at least, is probably even more suited to amalgamation than Halifax.Otherwise, however, amalgamation of the Halifax region appears to have been a great success. The amalgamated city is thriving economically, it has reduced its debt in spectacular fashion and it punches well above its weight in national affairs. I believe one would be hard-pressed to find local leaders, businesspeople, members of the arts community and government officials yearning for a return to its previous balkanized structure of governance. Amalgamation has worked well for Halifax. It should be held up as an example that Greater Victoria should emulate.

Amalgamation? YES!

John Weaver

February, 2016

References

1Annual population estimates by census metropolitan areas, July 1, 2014, http://www.statcan.gc.ca/dailyquotidien/150211/t150211a001-eng.htm

2Andrew Sancton: Why Municipal Amalgamations? Halifax, Toronto, Montreal, in “Canada: The State of the Federation 2004, Municipal-Federal-Provincial Relations in Canada” (Robert Young & Christian Leuprecht editors), McGill University Press, 2006, pp 119-134.

3See http://www.amalgamationyes.ca/media–events.html for a selection of such articles and letters.

4Robert L. Bish, Local Government Amalgamations; Discredited 19th-Century Ideals Alive in the 21st Century, C. D. Howe Institute Commentary No: 150, March 2001, pp 35.

5Proposed Operating Budget 2015/16, Section A, Executive Summary, https://www.halifax.ca/budget/documents/proposed_operating_book.pdf

6A New Regional Strategy and Model for Economic Development in South Vancouver Island, 2015 Report published by the Greater Victoria Development Agency Board, pp 46.

7Consolidated Financial Statements, http://www.halifax.ca/finance/

8How Victoria Regional Transit is Funded, http://bctransit.com/*/about/facts/victoria

9Proposed Operating Budget 2015/16, Section I3, Halifax Transit Operating Budget Overview, https://www.halifax.ca/budget/documents/proposed_operating_book.pdf

10Rudiger Ahrend, Alexander C. Lembcke, Abel Schumann, Why metropolitan governance matters a lot more than you think, VOX, CEPR’s Policy Portal (Research based policy analysis and commentary from leading economists), 19 January 2016, pp 6: see http://www.voxeu.org/article/why-metropolitan-governance-matters

11Police resources in British Columbia, 2013, http://www2.gov.bc.ca/assets/gov/law-crime-and-justice/criminaljustice/police/publications/statistics/2013-police-resources.pdf

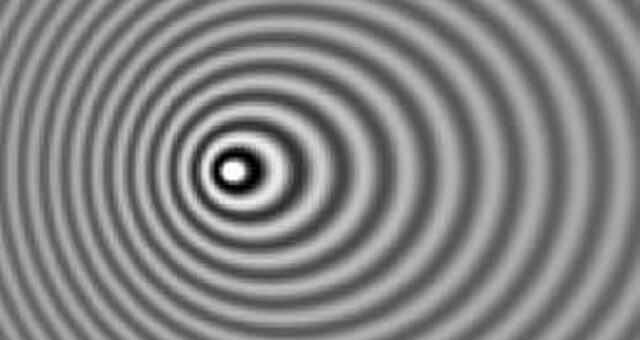

The Doppler Effect

This post was written by my father, John Weaver, and originally published on October 24, 2019 on his blog: beorminga.wordpress.com. I am preserving them on my website as his blog posts are remarkable in their thoroughness and depth of research. Enjoy!

The Doppler Effect

Like most people, I first heard about the Doppler effect in physics lessons at secondary school with references, in my day, to train whistles and the like. Later I encountered the relativistic Doppler effect which was introduced in an entirely different context and, surprisingly for me, was described by an algebraic formula that looked nothing like the classical result I had learnt earlier. Having never had an occasion to use these results beyond understanding the nature of the phenomenon in general terms, I didn’t probe further, but was still left with the unanswered question of how the classical and relativistic Doppler effects were linked. A further exposure to the Doppler effect came when I attended a stimulating lecture on the k-calculus, given by its author Hermann Bondi no less. It was a revelation for me how simple and natural special relativity could be made by considering what is essentially the Doppler effect applied to ‘pocket radars’ used for measuring distance.

When I discovered that my grandchildren were studying the Doppler effect at high school I was inspired to look back to my own schooldays and to consider how the theory could be presented in a more modern context. Virtually everyone is now familiar with the speed traps enforced by traffic police with hand-held radar or Lidar guns. They operate on the principle of the relativistic Doppler effect of course, while the siren of a police car following a speeding driver offers an example of the classical Doppler effect for sound waves. Altogether this familiar, commonplace setting seemed ideal for comparing the relativistic and classical Doppler effects while developing the main features of the special theory of relativity without the need for reference to imaginary space ships travelling at great speed or the abstract space-time diagrams normally used to develop the k-calculus.

In the linked article on The Doppler Effect I first calculate how two police officers measure with Lidar and radar the speed of a vehicle receding from one officer and approaching the other. This leads directly to the definition of Bondi’s k-factor and the k-calculus. An event measured by both the first police officer and the driver of the vehicle is defined by the activation of a traffic light at some given time and at a fixed distance from the officer in the inertial frame in which both the officer and traffic light are at rest. This leads to a simple development of the Lorentz transformation using the k-calculus. A third inertial frame is introduced in the form of a police car chasing the speeding vehicle which enables a derivation of the transformation formula for relativistic velocities and also affords an opportunity to discuss the Doppler effect for sound waves emitted from the car’s siren. A full relativistic Doppler effect for sound waves is obtained despite the relativistic factor being negligible for sound waves. It becomes important, however, when the magnitude of the wave velocity is formally put equal to the speed of light. Its presence then ensures that the exact formula developed for sound waves propagating in a fixed medium (the air in the example discussed here) transforms into the relativistic Doppler effect for light waves.

Tweedledum and Tweedledee

This post was written by my father, John Weaver, and originally published on June 8, 2016 on his blog: beorminga.wordpress.com. I am preserving them on my website as his blog posts are remarkable in their thoroughness and depth of research. Enjoy!

Tweedledum and Tweedledee

Two unlikely politicians have recently risen to prominence on both sides of the Atlantic. Although one is on the extreme left and the other on the far right, both show uncanny similarities in the way they have risen to prominence and in their popular appeal. Jeremy Corbyn was elected as Leader of the U.K. Labour Party against all odds, and Donald Trump has unbelievably become the Republican Party’s de facto candidate for President of the United States. The mind boggles at the prospect of two of the free-world’s major economic and political powers being led by such implausible characters, but it could come to pass.

Their appeal appears to lie in populism, a simplistic view of world affairs and a promise to ‘do things differently’ by divorcing themselves from the governing establishment that has dominated politics in both countries for decades. Of course, their differences in policy and style are enormous as one would expect of politicians at opposite ends of the political spectrum. Trump would abolish Obamacare and abhors any state intervention, while Corbyn is a full-blown socialist who would re-nationalize major industries; Trump wants to ban Muslims from entering the USA while Corbyn embraces Hamas and Hezbollah; Trump believes in a USA respected world-wide for its military might, but Corbyn would scrap Trident and has talked about withdrawing from NATO; Corbyn’s open-door policy on immigrants contrasts with Trump’s intention to keep them out by building a wall along the US-Mexico border; Trump is the archetypical proud American who wants to “make America great again”, but republican Corbyn seems almost embarrassed by any display of patriotism; Trump is brash, outrageous and rude compared with the outwardly reserved and polite Corbyn who nevertheless has a barely concealed streak of ruthlessness; with his dyed blonde hair brushed forward and his comfortable and jovial presence on TV, Trump seems more of a politically-incorrect comedian than a politician, while Corbyn’s neatly trimmed beard and often scruffy manner of dress suggests a college lecturer rather than the leader of a party. A surprising area of agreement, however, is that they both have favourable leanings towards Vladimir Putin and his policies.

How then, have two such extreme individuals gained prominence and positions of potential power despite the strong opposition of their respective parties’ mainstream politicians? The answer seems to lie in support from the grassroots membership of the parties they represent − not the gun-lobby, the National Rifle Association or members of the Tea Party wing of the Republican Party who are Trump’s natural allies, nor the Marxist trade union leaders, militant socialists or radical students who would support Corbyn under any circumstances, but rather the rank and file Republicans from ‘Middle America’ and ordinary members of the Labour Party many of whom joined in order to elect Corbyn. Thus many of Trump’s supporters are the smalltown blue-collar workers and rural folk, “the silent majority” as Richard Nixon called them, who haven’t travelled outside the USA, are worried about immigration and terrorism, are concerned that globalization and distant wars are damaging America’s economy and stature in the world, and who sense a decline in their way of life. They are uneasy about the future and are beginning to wonder if they live in ‘God’s country’ after all! On the other hand, Corbyn has garnered much support from relatively well-off middle-class members of the Labour Party − academics, media types, ‘luvvies’ in the arts world, educators and the like − who are burdened with a guilt-complex about Britain’s imperial past and who are disillusioned with the previous ‘New Labour’ governments led by Tony Blair and Gordon Brown, which in their view encouraged all the excesses of free-market capitalism that resulted in obscene salaries for bankers and financiers and a general widening of the wealth gap between rich and poor. Among them are the so-called ‘champagne socialists’ and ‘chattering classes’, characterized by those who express deep concern about social injustice, the under-privileged and poverty while enjoying and protecting their own comfortable lifestyles.

My personal hope is that neither Tweedledum nor Tweedledee will ever be elected to positions of power. It is a terrifying thought that a President Donald Trump would be just an arm’s length away from pressing the nuclear button, not against Russia but possibly as a reaction to cheeky provocations from North Korea or as an offensive attack on a territory controlled by Islamic State. Moreover, America’s withdrawal from free-trade agreements and its retreat under Trump into isolationism and protectionism would have a far-reaching, damaging effect on the global economy. The election of a well-meaning but inexperienced (and some would say naïve) Jeremy Corbyn as Prime Minister would, I believe, have equally damaging consequences for the British economy, returning it to the bad old days when dictatorial union leaders wielded a disproportionate amount of power that greatly contributed to the demise of the manufacturing industries (as Hugh Scanlon, one of the most militant union leaders at the time, later admitted). I fear also that a Corbyn government would surrender its responsibilities in helping to maintain the security and defence of the free world, and would try to seek an accommodation with fanatic terrorist groups that have no interest in compromise. There is a danger, in my opinion, that Great Britain would be reduced to an insignificant, weak and economically depressed country that would no longer be regarded seriously by its international partners.

With any luck we shall never know whether or not these depressing predictions make any sense because I am optimistic that Hillary will be elected President and there is always the possibility that the ineffective Corbyn will be replaced as leader of the Labour Party before the next general election. We’ll see what happens.

John Weaver

May, 2016

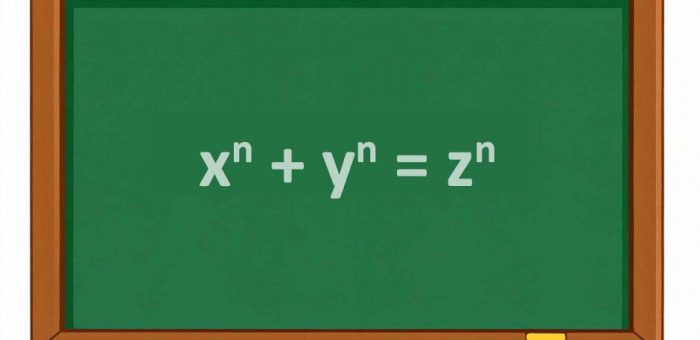

Arithmetic

This post was written by my father, John Weaver, and originally published on April 5, 2016 on his blog: beorminga.wordpress.com. I am preserving them on my website as his blog posts are remarkable in their thoroughness and depth of research. Enjoy!

Arithmetic

Counting and arithmetic are a child’s first introduction to mathematics and would be regarded by those who go on to study algebra, geometry, trigonometry and perhaps calculus at high school as the most elementary branch of mathematics. Paradoxically, however, advanced arithmetic or number theory as it is usually called, is one of the most complex and difficult areas of mathematical research. It includes still unsolved problems that can be stated in simple-to-understand language and which appear to be true by trial and error, but which are fiendishly difficult to prove.

One famous example, of course, was Fermat’s Last Theorem, first postulated in 1637, but not proved until over 3 centuries later by Andrew Wiles. The theorem states that there are no positive integers x, y and z satisfying xn + yn = zn for integers n > 2 (that the equation has solutions for n = 1 is obvious and there is also an infinity of solutions for n = 2, for example 32 + 42 = 52, 52 + 122 = 132, etc.). Although no one could find a solution for n > 2 it took until 1995 to show that none existed.

p – 1, the first few of which are 3, 7, 31, 127, corresponding to p = 2, 3, 5, 7 respectively? Whether or not there is an infinity of them is still an open question even though the continual discovery of ever larger prime numbers of this type suggests they must be infinite in number (presently the largest one discovered corresponds to p = 74,207,281). Likewise, it is not known if there are infinitely many twin primes (prime pairs such as 11 and 13 that differ by 2) or perfect numbers (numbers such as 6 or 28 that equal the sum of their divisors excluding the number itself), nor indeed if there are any odd perfect numbers. Seemingly simple problems, but no solutions yet.

In the accompanying note Foundations of Arithmetic I mainly discuss the Fundamental Theorem of Arithmetic. Although it is the basis of elementary arithmetic, it is related in its analytical form to the Riemann zeta function thereby showing how arithmetical problems can lead one straight into advanced analysis. That to me, as a total non-expert, is one reason why number theory seems such a fascinating subject requiring very special mathematical insights. I can understand why it is an area of research that has always attracted some of the world’s most gifted mathematicians.

The topics of Legendre’s formula, congruences, modular arithmetic, the totient and Euler’s theorem are also treated. The article concludes with a discussion of RSA encryption, a surprising application of what has always been regarded as the purest branch of mathematics with virtually no practical use. It has turned out to be of great importance, however, in protecting the security of the internet and electronic data transmission.

This is all thoroughly well-known material, of course, expressed here in my own style and notation. The books The Higher Arithmetic (Hutchinson, 1952) by H. Davenport, An Introduction to the Theory of Numbers (Oxford, 1960) by G. H. Hardy and E. M. Wright, and Number Theory (Oliver & Boyd, 1964) by J. Hunter were my principal sources of information. For the section on encryption, I found various postings on YouTube helpful.

1 + 2 + 3 + … = – 1/12 and Related Results

This post was written by my father, John Weaver, and originally published on October 15, 2015 on his blog: beorminga.wordpress.com. I am preserving them on my website as his blog posts are remarkable in their thoroughness and depth of research. Enjoy!

1 + 2 + 3 + … = – 1/12 and Related Results

The seemingly bizarre result in the title of this article has surprisingly found its way into some branches of advanced physics including string theory. Its ‘proof ‘ is demonstrated in one of the Numberphile videos on YouTube where divergent series are manipulated in an easy-going manner, along the following lines:

T = 1 − 1 + 1 − 1 + 1 − 1 + 1 − 1 + …

Add zero

T = 0 + 1 − 1 + 1 − 1 + 1 − 1 + 1 − …

hence

2T = 1 + 0 + 0 + 0 + 0 + 0 + 0 + … = 1, ⇒ T = ½

Similarly

U = 1 − 2 + 3 − 4 + 5 − 6 + 7 − 8 + …

U = 0 + 1 − 2 + 3 − 4 + 5 − 6 + 7 − …

2U = 1 − 1 + 1 − 1 + 1 − 1 + 1 − 1 + … = T = ½, ⇒ U = ¼

S = 1 + 2 + 3 + 4 + 5 + 6 + 7 + 8 + …

U = 1 − 2 + 3 − 4 + 5 − 6 + 7 − 8 + …

S − U = 2(2 + 4 + 6 + 8 + … ) = 4(1 + 2 + 3 + 4 + … ) = 4S, ⇒ 3S = − U = − ¼

whence S = − 1/12. Mathematically this result can be recognised as an expression of the Riemann zeta function ζ(z) evaluated at z = − 1.

It occurred to me that it should also be possible to sum powers of the natural numbers using the same carefree operations on divergent series as in the Numberphile video. In the linked discussion Some Fun with Divergent Series, I first evaluate the sum of the squares of the natural numbers S2 and then, after a digression on Abel summation and the Riemann zeta function, I generalise the method to find the sum Sn of the series of natural numbers raised to the nth power. Initially a recursion relation is found for a related quantity Tn , the sum of powers of the natural numbers with alternating signs. This leads directly to the formula for Sn and its connection with the well-known Bernoulli numbers.

After completing this articleI discovered a WordPress blog by the eminent Australian/American mathematician Terry Tao. In one of his published articles there, entitled The Euler-Maclaurin formula, Bernoulli numbers, the zeta function, and real-variable analytic continuation, he explores the summation of powers of the natural numbers in much greater detail and, of course, with considerably more insight than anything I could offer. Nevertheless I have kept my approach posted here as it is a natural generalisation of the informal method shown in the Numberfile video referred to above.