Budget

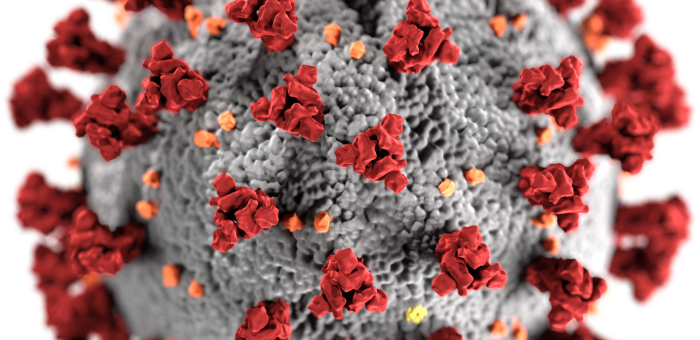

The opportunity for change in a post covid-19 economy

Today the Vancouver Sun published an opinion piece that I recently wrote.

Undoubtedly, the COVID-19 pandemic has introduced uncertainty into all echelons of daily life. But uncertainty need not inspire fear. Uncertainty is the precursor to innovation and innovation is the precursor to change. We are offered two choices today. To fear uncertainty and to fear change, or to see this generational challenge as a generational opportunity.

Below I reproduce the text of the opinion piece. The original is available on the Vancouver Sun website.

Text of Article

It’s been just over two months since BC declared a state of emergency in response to the COVID-19 pandemic and only a few days since relaxed restrictions were introduced in stage 2 of our provincial response. Yet judging from the myriad communications my office receives, British Columbians are still very nervous about the future.

While various commentators are suggesting we are heading into a “new normal” for business and, more generally, society as a whole, it’s far from clear what that “new normal’ looks like. Therein lies an incredible opportunity for the creation of long-term socially, environmentally and fiscally resilient and sustainable policies for British Columbia. For right now “uncertainty” seems to be the only thing “normal” in our daily lives.

Every challenge, whether it be global climate change, poverty reduction, the opioid crisis, the changing nature of work or even the COVID-19 pandemic, presents us with an opportunity for creativity & innovation; in other words, an opportunity to do things differently moving forward. For often the single biggest impediment to change is fear of the uncertainty that it will bring. Many entrench and defend themselves in the comfort of the status quo.

Jurisdictions that emerge from the COVID-19 pandemic stronger than before the deadly virus took hold will be those that adapt and respond in a timely fashion. Standing by and waiting for the holy grail of a vaccine or herd immunity, which may or may not ever occur, is simply not an option.

We are incredibly fortunate to live in British Columbia. Our provincial response to the pandemic to-date has been nothing short of exceptional. We’ve had calm, collected, evidence-based leadership by provincial Health Officer Bonnie Henry and Health Minister Adrian Dix. And most individuals and business have responded quickly to their requests, suggestions and orders.

As a direct consequence, British Columbia is now in a position to capitalize on the opportunities for change that the COVID-19 pandemic has created. But this will require an ongoing commitment to focus on the sage advice offered in a number of reports that were recently presented to the province.

On January 30, B.C.’s Food Security Task Force report was publicly released. “The Future of B.C.’s Food Systems” issued four recommendations designed to situate BC on an innovation pathway to capitalize on our strategic advantages in this sector. The report notes that the Netherlands ranks 131st in the world in terms of land area but is the world’s second largest exporter of agricultural goods. This is only possible because of the country’s focus on high value products, investments in innovation ecosystems, support for supply chain development, and strong land use policies. That’s what we should be doing in BC.

On May 11th the Emerging Economy Task Force final report was publicly released with 25 recommendations to assist British Columbia capitalize on global trends and technological advancements in the years ahead. That same day the final report from BC’s inaugural Innovation Commissioner, Dr. Alan Winter, was also publicly released. Dr. Winter provided five recommendations to government to encourage and assist the transformation of our economy to one that is resilient, based on our strategic strengths, and ready to lead in the 21st century.

And we will soon learn more from three distinguished scholars who are putting the finishing touches on their report exploring the role that basic income might play in reducing poverty and preparing for the emerging economy. A sneak peak of what we might expect from them appeared in an article entitled “Considerations for Basic Income as a COVID-19 Response” that was published Thursday by the University of Calgary’s School of Public Policy.

A common theme in all these reports emerges. In light of the threat of pandemics, growing income inequality, and climate change, as well as the changing nature of work, modern economies need to quickly prepare. What has worked in the past will not work in the future.

As British Columbia emerges from the COVID-19 pandemic over the next year or so, we must learn from our mistakes and capitalize on opportunities that have arisen. The global shortage of protective medical equipment highlighted the importance of shoring up local supply chains and ensuring we have diversified manufacturing capacity locally. The complete chaos unfolding in the United States and Brazil as COVID-19 runs rampant there also underpins the importance of evidence-based decision-making in policy formulation.

British Columbia must also rethink its approach to the resource sector. Globalization has meant that we’ll never compete with jurisdictions that don’t internalize the social and environmental costs of resource extraction unless we are smarter, more efficient, cleaner and innovative in our extraction methodologies, and focus on value-added products for export. Sadly, our approach in recent years has been to literally give away our raw natural resources with little focus on the long-term effect this will have on the well-being and sustainability of rural BC.

British Columbia has three strategic advantages that set it aside from other jurisdictions around the world. 1) British Columbia is one of the most beautiful places anywhere to live. As such, we can attract to BC and retain the best and brightest worldwide because of the quality of life and the stable democracy that we can offer. 2) We have one of the best K-12 and postsecondary education systems in the world. They produce a highly skilled and educated workforce ready to meet the challenges of the 21st century. 3) We have boundless renewable resources in the form of clean energy, wood, water and agricultural land. And we have an economic plan embodied in CleanBC that recognizes these strategic strengths at its very core.

We should be using our strategic advantage as a destination of choice to attract industry to BC in highly mobile sectors that have difficulty retaining employees in a competitive marketplace. We should be using our boundless renewable energy resources to attract industry, including the manufacturing sector, that wants to brand itself as sustainable over its entire business cycle, just like Washington and Oregon have done in attracting a large BMW manufacturing facility and Google data centre to their jurisdictions.

We should be setting up seed funding mechanisms to allow the BC-based creative economy sector to leverage venture capital from other jurisdictions to our province. Too often the only leveraging that is done is the shutting down of BC-based offices and opening of offices in the Silicon Valley.

Undoubtedly, the COVID-19 pandemic has introduced uncertainty into all echelons of daily life. But uncertainty need not inspire fear. Uncertainty is the pretext to innovation and innovation is the pretext to change. We are offered two choices today. To fear uncertainty and to fear change, or to see this generational challenge as a generational opportunity. I prefer the latter and I’m excited to continue working with the BC NDP government in our attempts to capitalize on this opportunity.

Support for small business as the COVID-19 pandemic plays out

Over the last two weeks governments across Canada have introduced some of the most far reaching and ambitious programs in recent memory to deal with the economic fallout of COVID-19. The policymakers and civil servants behind these supports deserve to be commended for the speed at which they have acted and for their ingenuity. Despite these unprecedented government interventions into the economy it is becoming increasingly clear that the measures introduced so far are not enough. Many businesses are slipping through the cracks of the available supports and are struggling to make ends meet.

Statistics released by the BC Chamber of Commerce (BCC) and the Canadian Federation of Independent Business (CFIB) on the scale of the economic devastation brought about by COVID-19 are staggering. Two-thirds of the 1,900 businesses polled by the BCC have experienced at least a 50% decrease in revenue and over half are worried that they will face bankruptcy or be unable to resume operations when the crisis subsides. Almost 40 percent of independent businesses surveyed by the CFIB have said that the Canada Emergency Wage Subsidy will not help them and 56% said that they have no fiscal capacity to take on new debt. These statistics released by business advocacy groups are consistent with the daily emails my office has received informing us that the existing measures are not enough. Messages received by my constituency office, ongoing conversations with small businesses and reports from the media highlight gaps in the existing programs. Some of the gaps are outlined below.

Eligibility for the Canada Emergency Business Account

The Canada Emergency Business Account is open to businesses with a total payroll between $50,000.00 and $1,000,000.00 in 2019. However, there are many small businesses with 10 to 20 employees whose payroll exceeds the program’s upper limit. For instance, small health, technology and manufacturing companies whose growth the province has been trying to cultivate will be particularly hard hit by the program’s restrictions.

BC Hydro Small Business Credit

The BC Hydro Small Business Tax Credit defines “small business” as those that qualify for their Small General Service Rate. The effect of this restriction is that numerous businesses with narrow profit margins that use high amounts of electricity (i.e. local restaurants using the medium general service rate) will not be eligible for the benefit. Although BC Hydro does allow payments to be deferred, many of these bills will be due at precisely the same time when businesses will be trying to recover from the crisis.

Restrictions in the Wage Subsidy

The original structure of the Canada Emergency Wage Subsidy worked against small businesses who had experienced substantial declines in revenue but were still trying to stay open to provide services to people. Eligibility requirements originally restricted applications to businesses that have experienced at least a 30% drop in revenue when comparing one month this year to same month last year. This restriction would have meant that businesses whose revenue had decreased by 20% or even 29% would not qualify for the subsidy. The direct effects of restricting the availability of the program would have been further layoffs of workers which defeats the announced goal of the support. As it stands, within the foodservice industry 7 out of 10 businesses will continue to reduce staff hours or lay off more employees if their current situation does not improve. Recently announced changes to the bill will allow businesses to qualify for the subsidy if they can demonstrate a 15 percent drop in revenue in March. Companies will also be permitted use January or February as their base line in certain situations. These changes to the legislation show that the government is listening to business owners. However, continued monitoring is needed to determine if they adequately address the bill’s original flaws.

Profit margins and the use of a ‘one-size fits all’ approach

For many small businesses with narrow profit margins, the difference between remaining viable and facing insolvency is extremely thin, making a substantial decline in revenue potentially devastating. Given the financial position of many small businesses, the measures introduced so far may not be enough to keep them afloat. While the wage subsidy does offer some support, many businesses still have substantial fixed costs (i.e. rent, utilities). These businesses are seeing reduced revenue due to disruption in their supply chains and decreased demand in the economy. Furthermore, numerous already overextended business owners feel that they don’t have the fiscal capacity to take out additional loans. The structure of the existing programs also does little to support small businesses reliant on cyclical or seasonally dependent revenue who have recently seen their sales dry up. For businesses in this position tax deferrals or loans will become difficult to finance with their primary revenue source having evaporated.

Looking Ahead

Going forward, both the provincial and federal government will need to work together to quickly address the gaps in support measures introduced so far. Solutions which have been floated by business groups include: direct payments to business (especially those hardest-hit by the crisis), further reductions in taxes, and supports for businesses unable to pay rent. Other countries may provide models for how to respond as well. Both Norway and Demark have introduced schemes to help companies experiencing revenue losses to pay their fixed costs. Switzerland has launched a program where the small business can apply for interest free loans of up to 10 percent of their annual revenue (SFr500,000 maximum) which are fully backed by the government.

Right now, the current collapse in economic activity is happening at an unprecedented pace. Nearly one quarter of the businesses surveyed by the CFIB stated that they will be unable to make it through the next month without additional support. Within the foodservice industry almost 10 percent of restaurants have already closed and an additional 18 per cent could permanently close by the end of April if current conditions persist. Time is of the essence in getting businesses the support they need.

By expanding the available support programs for small businesses, governments will be reducing the amount of economic hardship experienced by countless numbers of people. Supporting hard-hit businesses will be an incredibly expensive in the short-term. There are major long-term benefits to ensuring that businesses are able to remain operational. Keeping more small businesses solvent throughout the pandemic will help to prevent businesses and workers from needing to re-establish their niches in the economy after the crisis abates. By acting now to support small businesses, governments will be saving central pillars within our communities. These businesses help to make our communities feel like home by providing us with a sense of place and identity. Given the importance of small businesses to our economy and communities, governments must take steps to ensure these businesses are able to emerge successfully from this crisis.

Why I support and will vote for BC Government Budget 2020

On Thursday this week members of the BC Legislature will vote on the BC NDP’s 2020 budget.

The BC NDP’s 2020 budget continues to build on the positive work done since my colleagues and I first signed the Confidence and Supply Agreement (CASA) in 2017. The Premier and I reiterated our ongoing support for the CASA agreement in letters we exchanged shortly after I left the BC Green Caucus to sit as an independent as their leadership race unfolds.

In my view, Budget 2020 delivers on multiple fronts by making investments which will benefit numerous demographic groups. And rather than becoming mired in politically expedient short-termism, the budget charts a path forward to an economy centered around sustainable development and innovation.

This budget reflects many of our shared priorities. While no budget will please everyone, and all budgets can be criticized for what’s not in them, taken together I am very pleased with what’s in Budget 2020 and look forward to supporting it in the upcoming vote.

Below I expand upon my media release from last week and provide further thoughts and reflections on Budget 2020.

Affordability

Currently, the high cost of living in urban areas in BC is putting the comfortable middle-class lifestyle enjoyed by previous generations out of reach for large segments of the population, and the government is addressing the issue by continuing to introduce measures designed to make life more affordable. The complete removal of MSP premiums should save a family of four $1,800 per year while raising the earnings exemption for those on income and disability should put more money back into the pockets of those who need it most.

I am absolutely thrilled to see the regressive form of taxation embodied in MSP premiums finally eliminated. I’ve been working towards this end since January 2015 when I first announced that the BC Green Party, if elected, would eliminate the MSP premium and replace it with a progressive form of revenue generation mirroring what was done in Ontario. Public support for this was overwhelming as indicated by the tens of thousands of British Columbians who signed petitions or emailed their MLAs, and by the fact that both the BC NDP and the BC Liberals eventually also embedded a promise to eliminate MSP premiums in their 2017 election platforms.

Ongoing funding increases to childcare in BC should help to alleviate an economic stress for young families while benefiting the entire economy through greater female participation in the labour force, families with more disposable income, and the creation of jobs related to early childhood care.

On the housing front, the combination of the speculation tax (which I spent much time working on collaboratively with the Finance Minister to ensure it was razor focused on urban speculation) and the construction of affordable housing should bring unit costs down, but these measures need to be combined with continued conversations with municipalities about ways to increase density to most effectively deal with the housing crisis. Further work is needed to combat underemployment (only 39,300 of the 65,400 jobs created last year were full-time) and to provide support to those dealing with addictions, homelessness, and mental health issues, but in a time of economic uncertainty the government is continuing to devote resources to ensuring that those who require assistance are able to get it.

Education and Youth

For years, BC has been the only province without an up-front, needs-based, post-secondary educational grant. The 2020 budget rectifies this situation by introducing the BC Access Grant. Making the grant up-front is especially important because it gives students immediate financial aid, allowing them to focus on their studies without the added stress of worrying about how they are going to pay tuition or loans. The grant will also be of medium-term economic benefit to the province, helping to address anticipated shortages of healthcare providers and workers equipped with the skills needed to power an economy driven by green energy and intangibles.

The growing number of students requesting access to on campus mental health supports has been well documented and the government has responded with the introduction of a new 24/7 mental health counselling service. This system will help to provide many students with the support they need to navigate the challenges of living away from home for the first time, the pressures induced by social media, and the financial stressors that come with being a student. The new support network is not panacea to the increasing number of young adults who experience mental health challenges, but its creation demonstrates that the government is taking students’ concerns seriously and is working to address them.

Additionally, after years of inadequate funding, the government is continuing to make investments into supplying the teachers, psychologists, and educational assistants needed to maintain our public education system’s status as one of the best in the world. Indeed, a primary driver of long-term economic growth, a well-educated, skilled workforce, can only be produced through investments into our public education system now.

Strong education systems correlate with positive health outcomes, greater social mobility, and higher levels of civic engagement. However, the mismatch between four-year political timelines and the time it takes to see the benefits of investments into education can create incentives for governments to shirk their responsibilities to adequately fund public education systems. By taking the long view and investing substantial resources into our education system now, the government is continuing to demonstrate that it is committed to sustaining our province’s prosperity.

Capital Projects and Innovation

Government choosing to make record-breaking investments into infrastructure projects while capital is cheap is a prudent choice which will help the province to deal with multiple immediate and looming challenges. Transportation related infrastructure projects such as the Pattullo Bridge replacement, Skytrain expansions, and additional HOV lanes should tackle pressures associated with continued urbanization and help to reduce congestion and pollution while facilitating the smooth flow of goods and services. Hospital overcrowding, another pressing issue in the province, promises to see relief through the construction and renovation of multiple hospitals. Additionally, the construction and renovation of numerous schools will assist areas of the province dealing with demographic pressures, and ongoing seismic upgrading is a much needed investment after years of delayed progress.

Innovative design and the integration of BC engineered wood products and energy/energy conservation systems into these capital projects demonstrates British Columbia’s ongoing leadership in recognizing that the reduction of greenhouse gas emissions can be paired with job creation throughout the province. Although it is true that the province’s debt will increase in order to finance these record-breaking capital projects, our debt to GDP ratio remains at a sustainable level.

I was also pleased to see that government is providing a roadmap to an economy with sustainability and entrepreneurship as its cornerstones, the importance of which I have emphasized to government in countless hours of discussions and negotiations.

We have the resources to transition to an innovation driven, low-carbon economy but businesses require the certainty that comes with a clear commitment from government to supporting emerging industries in order to feel comfortable investing in them. Although there are some measures which push in the opposite direction that I will continue to oppose, on balance, the province is signaling its commitment to supporting an emerging economy that realizes BC’s comparative advantages.

Measures such as targeted investments into the bioeconomy, the exemption of electric aircrafts and electric aircraft conversions from PST, and the pledge to establish a quantum computing institute all aid burgeoning industries capable of becoming areas of economic strength for the province. Ongoing incentives to purchase electric vehicles and charging stations are simple, smart demand-oriented policies which will continue to electrify transportation. More work is needed to encourage retrofitting and the development of renewable energy sectors which harness BC’s natural resources, but the province is well on its way to transitioning to the economy of tomorrow.

Rural Development

Rural areas of the province continue to be connected to high-speed internet, giving them access to the benefits of the digital economy, and forestry dependent communities will see much needed relief through The Forestry Worker Support Program. We need to continue to transition towards a more sustainable model of forestry which produces high value-added exports but the coastal revitalization initiative, investments into the bioeconomy, and the use of made in BC engineered wood are steps in the right direction.

The only way we’re going to compete in the resource world is not to just dig dirt out of the ground and think, somehow, we’re going to compete with a jurisdiction that doesn’t internalize the social and environmental externalities we value here. The way we do that is to be smarter, more efficient and cleaner. We do that by bringing the technology sector together with the resource sector. We do that by focusing on the value-added. We do that focusing on efficiency, being cleaner and selling those technologies elsewhere, like MineSense, Axine or others. I was pleased to see that the BC NDP government has recognized this in both Budget 2020 and their recent Throne Speech.

I feel that this government is on the right track. It understands where the future of our economy is. It doesn’t lie in simply continuing to dig dirt out of the ground. It never will. It lies in innovation. It lies in the harvesting our resources in innovative ways by bringing the tech sector together with that.

Concluding Remarks

Although the scale of action may not be as large as some may desire, there is a lot to like in a budget that devotes resources to raising the standard of living for many now while articulating a positive long-term vision for the province. I look forward to supporting the budget on Thursday.

Responding to the BC NDP 2020 Budget

Today the BC NDP delivered the budget for the next fiscal year. Below I reproduce the media release my office issued in response to it. As you will see from the release (reproduced below), I was pleased with Budget 2020 and I look forward to expanding on these initial remarks when I respond in the legislature hopefully tomorrow.

Media Release

MLA Weaver responds to 2020 Budget

For Immediate Release

February 18, 2020

Victoria, BC — The BC NDP’s 2020 Budget is one that invests in the people of British Columbia and charts a path forward for a sustainable economy that works for everyone.

“I’m delighted to see this government continuing to work towards lowering the cost of living for middle class British Columbians,” said Andrew Weaver, MLA for Oak Bay-Gordon Head. “Actions such as the elimination of MSP premiums which I have long advocated for, the construction of new affordable housing units, the raising of earnings exemptions for those on income and disability assistance, and increased funding for childcare and public education should ensure that the benefits of economic growth in BC are widely shared”.

While the 2020 budget introduces several changes that positively impact the lives of British Columbians now, it is also forward looking, making significant investments into the future of the province and in particular today’s youth. Funding dedicated to increasing the supply of teachers, counsellors, and psychologists contribute to the positive social and cognitive development of our children as they move through school.

The creation of the needs-based, up-front BC Access Grant should equalize post-secondary educational opportunities in the province by allowing students to focus on their studies without worrying about how they are going to pay for their tuition. New 24/7 mental health resources for students at post-secondary institutions should no longer place young adults in a position where they feel like they have to choose between their personal well-being and academic success.

“BC’s 2020 budget also makes necessary infrastructure investments, at a time when access to capital is cheap, to manage a growing population while, at the same time, transitioning the province to a low-carbon economy by linking capital expenditures to Clean BC,” adds Weaver.

The construction of new hospitals, bridges, roads, houses, and schools promise to create numerous good, well-paying jobs in all regions of our province in addition to alleviating strains on public services.

“Innovative design and the integration of BC engineered wood products and energy/energy conservation systems into these capital projects demonstrates British Columbia’s ongoing leadership in recognizing that the reduction of greenhouse gas emissions can be paired with job creation throughout the province,” notes Weaver.

Although the budget does continue to devote resources to projects which I continue to oppose, such as the Site C dam and LNG developments, I am pleased that the government is now demonstrating its commitment to the economy of tomorrow by supporting the emerging bioeconomy, the quantum computing sector, the agri-tech and life sciences. The continued backing of renewable energy projects, ZEVs, and electric aircrafts will make our economic growth largely sustainable.

At its heart, the 2020 budget is one that places people first while embracing the opportunities created by technological and climatic change, ensuring that BC is well positioned to thrive moving forward.

MLA Weaver will monitor the progress and implementation of these budget measures to ensure they benefit the people of British Columbia.

-30-

Media contact

Judy Fainstein

Executive Director

Legislative Office of Andrew Weaver, MLA

+1 250-744-7615 | Judy.Fainstein@leg.bc.ca

Government stability continues with start of new legislative session tomorrow

My sincere thanks to everyone who has been so supportive these past few weeks as my family struggles with some very serious health issues.

The next legislative session resumes tomorrow and I look forward to representing the wonderful constituents of OBGH in the coming months as an independent MLA. Mike Smyth’s article provides an excellent and accurate analysis of my decision to leave the BC Green Party and sit as an independent. Further insight as to why I believe that it is important for the BC Green Party to develop a new vision and voice independent from mine is provided in Keith Baldrey’s column published today.

Moving forward, I will be prioritizing several key issues:

1) First and foremost, I will prioritize constituent issues. In this regard, I have incredible support from Judy Fainstein, Noah Conrad and Perry Fainstein;

2) Second, I will continue to work with the Ministers of Environment (George Heyman) and Energy (Bruce Ralston) to advance the economic agenda embodied in CleanBC;

3) I am also very much looking forward to working with Michelle Mungall, MLA on the innovation file. We had a very productive initial conversation and I can tell she is the perfect Minister for this portfolio.

Finally, the Premier and I exchanged letters that were made publicly available today on the Confidence and Supply Agreement website. In these letters we reaffirm our commitment to working together and building on the successes of the last two and half years.

Below I reproduce a copy of the letter I sent to the Premier. His response is available here.

Thank you to all the residents of Oak Bay Gordon Head for giving me the opportunity to represent you.

Text of My Letter

27 January 2020

Honourable John Horgan

Premier and President of the Executive Council

West Annex Parliament Buildings

Victoria, BC V8V 1X4

Premier Horgan,

As you know, the Confidence and Supply Agreement (CASA) is an agreement signed by all members of the BC Green Caucus and the Government Caucus.

As I am no longer a member of the Green Caucus, I am writing to you to clarify my intentions regarding my support of this Government and propose a path forward.

I intend to continue to support Government on all matters of confidence and to support the spirit of the CASA. Going forward, my relationship with Government will continue to be based on the founding principles of the CASA, “good faith and no surprises.”

As an independent MLA I do not intend to engage on all matters before Government, however I would like to retain the option to meet with Government on a limited number of priority policy areas of key importance to me. I propose that my legislative office will work with CASA Secretariat staff to facilitate such meetings and coordinate follow-up as necessary. I and my legislative staff will happily sign new undertakings of confidentiality with Government to enable continuation of these consultation meetings.

If any serious concerns or issues arise, I propose that I raise them directly with political staff in your office, as I will no longer be party to the CASA Consultation Committee process.

As for my participation in Question Period and the House, I will make any requests to the Government House Leader, with the understanding that allocation of speaking time to independent members is an issue that is negotiated between the House Leaders of all parties.

While the Agreement for Coordination of External Communication between the BC Green Caucus and the BC New Democrat Government will no longer apply to me, I will endeavour to provide the Government with advance notice of any public communications from my office, and I propose that the Government reciprocate on subjects that I have identified as having particular interest to me. I propose that my office continue to work with the CASA Secretariat staff in this regard.

The new Leader of the BC Green Caucus will properly take my place in regular meetings with you, but as partners who have accomplished so much together in the past two and half years, I hope and expect the two of us will still be able to sit down together to advance our common goals, and to find solutions if circumstances require it.

Sincerely,

Andrew Weaver, MLA

Oak Bay-Gordon Head