Welcome to my Website: A Climate for Hope

I am a Professor in the School of Earth & Ocean Sciences at the University of Victoria and the former MLA for Oak Bay-Gordon Head from 2013-2020.

On this website I preserve, for archival purposes, the blog posts I wrote while serving as an MLA in the BC Legislature and the Leader of the BC Green Party. I have merged my academic website into this location and I plan to continue to write on the issues facing our community.

My focus moving forward will continue to be on climate solutions.

Best wishes,

Andrew Weaver

By Andrew Weaver

/ March 14, 2024

I recently penned an article arguing that fear-based climate messaging often drives people to despondency and apathy rather than climate...

Read More

When ideology trumps evidence: The decision to cancel the school liaison officer program in School District 61

By Andrew Weaver

/ February 25, 2024

On May 31, 2023 and in what can only be described as a textbook example of ideological decision-based evidence-making, Trustees...

Read More

Earth: The final frontier and the failure of fear-based climate messaging

By Andrew Weaver

/ February 15, 2024

While I was not surprised that another young adult reached out to discuss their struggles with climate anxiety, their email...

Read More

The climate impact of plastic pollution is negligible – the production of new plastics is the real problem

By Andrew Weaver

/ October 24, 2023

My colleagues Karin Kvale, GNS Science, New Zealand, Natalia Gurgacz and I published a piece in The Conversation last week....

Read More

Yellowknife and Kelowna wildfires burn in what is already Canada’s worst season on record

By Andrew Weaver

/ August 18, 2023

The devastating wildfire that destroyed the historic Maui town of Lahaina in Hawaii was still making headlines when the Northwest...

Read More

The ‘Gulf Stream’ will not collapse in 2025: What the alarmist headlines got wrong

By Andrew Weaver

/ August 3, 2023

Those following the latest developments in climate science would have been stunned by the jaw-dropping headlines last week proclaiming the...

Read More

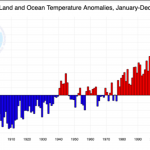

Temperature records shattered across the world as tourists flock to experience the heat

By Andrew Weaver

/ July 21, 2023

I was asked by The Conversation to reflect upon the most recent record setting heat waves. This is the piece...

Read More

Advancing nature based climate solutions: a cautionary tale

By Andrew Weaver

/ July 15, 2023

In recent years, governments and industry have become more and more interested in supporting so-called nature based climate solutions. So...

Read More

Privilege, agency, and the climate scientist’s role in the global warming debate

By Andrew Weaver

/ January 1, 2023

The climate science community holds agency and a position of privilege in the global warming debate. Rather than denying this...

Read More

Thoughtful voices: Sacha Christensen, Mark Leiren-Young & Rishi Sharma

By Andrew Weaver

/ October 9, 2022

In 2012, as I started my journey to become the BC Green MLA for Oak Bay Gordon Head, I was...

Read More

Advancing lasting policy through good governance

By Andrew Weaver

/ September 7, 2022

It's election season here in the CRD and true to form, political rhetoric is escalating. In the City of Victoria,...

Read More

Sustainable Aviation Fuel — Opportunities for Innovation in Aviation Sector

By Andrew Weaver

/ August 17, 2022

As the summer holiday season comes to an end, and after hearing no end of COVID-related horror stories (delays, cancelled...

Read More

Moving on from Provincial Politics: A Climate for Hope

By Andrew Weaver

/ August 16, 2022

To bring closure to my 7 1/2 years as an MLA for Oak Bay-Gordon Head and 5 years as leader...

Read More

Thank you to the Residents of Oak Bay-Gordon Head

By Andrew Weaver

/ September 22, 2020

With the announcement yesterday that the province is heading into a general election on October 24, my term as the...

Read More

Celebrating youth in our community – Olivia Friesen

By Noah Conrad

/ September 1, 2020

This is the twenty-seventh installment in our series on exceptional youth where we celebrate the outstanding achievements of youth in...

Read More

Celebrating youth in our community – Anna Friesen

By Noah Conrad

/ September 1, 2020

This is the twenty-sixth instalment in our series on exceptional youth where we celebrate the outstanding achievements of youth in...

Read More

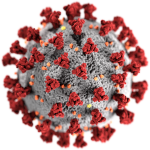

On the use of face masks to mitigate the spread of COVID-19

By Andrew Weaver

/ July 29, 2020

Today in the Legislature I rose during Members' Statements to speak for two minutes about the scientific literature clearly demonstrating...

Read More

Unfortunately BC Greens force baby to get thrown out with bathwater on Clean Energy Bill

By Andrew Weaver

/ July 28, 2020

I am profoundly disappointed in the BC Greens for forcing the baby to be thrown out with the bathwater on...

Read More

Bill 17, Burrard Thermal, BC Hydro self sufficiency & clean electricity

By Andrew Weaver

/ July 24, 2020

When the BC NDP introduced Bill 17: Clean Energy Amendment Act, 2020 on June 23, I immediately determined that it...

Read More

On the potential closure of Richardson Street at Foul Bay Road

By Andrew Weaver

/ July 20, 2020

Over the last few days my office has received a number of emails concerning the City of Victoria's proposed closure...

Read More

On the clean energy economic opportunity for Indigenous communities in BC

By Andrew Weaver

/ July 15, 2020

Today in the legislature I rose during question period to ask the Minister of Energy, Mines and Petroleum Resources how...

Read More

Socially & Environmentally Responsible Corporations & Investing: The Opportunity

By Noah Conrad

/ July 9, 2020

There is a coming paradigm shift around the purpose of investment and businesses. The last decade has seen growing pressure...

Read More

Effective today, BC businesses can now incorporate as Benefit Companies

By Andrew Weaver

/ June 30, 2020

In May 2019, my private Member's bill: Bill M209: Business Corporations Amendment Act, 2019 received royal assent but required an Order...

Read More

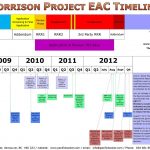

Ongoing regulatory inconsistencies facing Pacific Booker’s Morrison mine project

By Andrew Weaver

/ June 24, 2020

Yesterday I published a blog post detailing the apparent regulatory inconsistencies facing the advancement of Pacific Booker's Morrison Mine project....

Read More

Tribute to a Canadian Hero: John Hillman

By Andrew Weaver

/ June 24, 2020

Today in the legislature I rose to pay tribute to a constituent, John Hillman, who, at the age of 101,...

Read More

Response to government investment in pedestrian and cyclist infrastructure

By Andrew Weaver

/ June 24, 2020

Today the BC government announced a number of investments across the province to improve active transportation options for British Columbians....

Read More

Pacific Booker Minerals and their quest to develop Morrison Mine near Smithers

By Noah Conrad

/ June 23, 2020

In 2002, Pacific Booker Minerals began the formal environmental assessment process required to obtain Ministerial certification for Morrison Mine, their...

Read More

Opportunity in Recovery: A Discussion of BC’s post COVID-19 future

By Andrew Weaver

/ June 19, 2020

On Wednesday June 17 we held a virtual town hall to discuss BC’s post COVID-19 future and answer any related...

Read More

Opportunity in Recovery: Discussing BC’s post COVID-19 future

By Andrew Weaver

/ June 8, 2020

Join us on June 17 for a virtual town hall hosted by Dr. Andrew Weaver, MLA for Oak Bay-Gordon Head....

Read More

The opportunity for change in a post covid-19 economy

By Andrew Weaver

/ May 25, 2020

Undoubtedly, the COVID-19 pandemic has introduced uncertainty into all echelons of daily life. But uncertainty need not inspire fear. Uncertainty...

Read More

Innovation as the foundation of a post-COVID19 economic recovery plan

By Andrew Weaver

/ May 11, 2020

Today the BC Government released the final report from Dr. Alan Winter, BC's former Innovation Commissioner. Dr. Winter's report makes...

Read More

Valerie Murray receives 2020 BC Achievement Community Award

By Judy Fainstein

/ May 11, 2020

Valerie Murray of Victoria has been awarded a BC Achievement Community Award for 2020. A long-time resident of Oak Bay,...

Read More

Island Medical Program students stepping up in response to COVID-19

By Judy Fainstein

/ April 28, 2020

Over 60 Island Medical Program students are participating as volunteers in a student-led initiative to serve the community in response...

Read More

On the gaps that exist in economic supports available to individuals & businesses during the COVID-19 pandemic

By Noah Conrad

/ April 24, 2020

Without a doubt, British Columbia has led the way in North America in terms of introducing measures to curb the...

Read More

Celebrating Earth Day during a global pandemic lock down

By Judy Fainstein

/ April 22, 2020

As we celebrate the 50th anniversary of Earth Day we recognize that we live in a world that is vastly...

Read More

Resources for those facing economic hardship during the COVID-19 Pandemic

By Noah Conrad

/ April 18, 2020

Breaking the chain of transmission of COVID-19 poses an enormous challenge for society on multiple fronts. While we should do...

Read More

Mental health support for frontline health workers & the general public during COVID-19 pandemic

By Noah Conrad

/ April 16, 2020

In recent weeks, the strain of the COVID-19 pandemic on our healthcare and economic systems has received no shortage of...

Read More

COVID-19 resources for BC seniors

By Judy Fainstein

/ April 10, 2020

As part of BC’s response plan to COVID-19, supports to seniors have been bolstered throughout the province to address immediate...

Read More

Support for small business as the COVID-19 pandemic plays out

By Noah Conrad

/ April 8, 2020

Over the last two weeks governments across Canada have introduced some of the most far reaching and ambitious programs in...

Read More

A brief video message to the OBGH residents on the topic of COVID-19

By Andrew Weaver

/ March 31, 2020

Today I recorded a brief video message from home to the residents of Oak Bay Gordon Head on the topic...

Read More

Initial resources for those facing economic hardship during the COVID-19 Pandemic

By Noah Conrad

/ March 26, 2020

Breaking the chain of transmission of COVID-19 poses an enormous challenge for society on multiple fronts. While we should do...

Read More

Statement from political leaders on COVID-19 financial aid package for people, businesses

By Andrew Weaver

/ March 23, 2020

Today Premier John Horgan, Opposition Leader Andrew Wilkinson, interim third party Leader Adam Olsen and I issued a joint statement...

Read More

Serving our Community during COVID-19

By Judy Fainstein

/ March 20, 2020

In this difficult time, it is easy to be consumed and feel overwhelmed by the rapidly evolving situation with the...

Read More

A COVID-19 Message to OBGH Constituents

By Noah Conrad

/ March 18, 2020

I continue to closely monitor the rapidly evolving COVID-19 pandemic. I follow and I urge you to follow the advice...

Read More

Responding to Finance Minister James’ statement that she will not seek reelection

By Andrew Weaver

/ March 5, 2020

Today Carole James announced that she won't be seeking reelection in the next provincial election. Carole has had an exemplary...

Read More

Exploring regulatory inconsistencies facing Pacific Booker’s Morrison mine project

By Andrew Weaver

/ March 5, 2020

Today during question period I rose to ask the Minister of Energy, Mines and Petroleum Resources about what appears to...

Read More

Tribute to a Canadian Hero: Lorne Frame

By Andrew Weaver

/ March 4, 2020

Today in the legislature I rose to pay tribute to a constituent Lorne Frame who has recently been selected to...

Read More

Congratulations to all 2020 Oak Bay Young Exceptional Star (Y.E.S.) Award Winners

By Andrew Weaver

/ February 29, 2020

On Thursday last week the 13th annual Oak Bay Young Exceptional Star (Y.E.S) awards ceremony was held at the Oak...

Read More

Why I support and will vote for BC Government Budget 2020

By Noah Conrad

/ February 24, 2020

On Thursday this week members of the BC Legislature will vote on the BC NDP's 2020 budget. In my view,...

Read More

Responding to the BC NDP 2020 Budget

By Andrew Weaver

/ February 18, 2020

Today the BC NDP delivered the budget for the next fiscal year. I was pleased with Budget 2020 and I...

Read More

What’s the BC government doing to protect small-scale power producers in BC

By Andrew Weaver

/ February 18, 2020

Today in the legislature I rose to ask the Minister of Energy, Mines and Petroleum Resources what his government was...

Read More

Responding to the February 2020 Speech from the Throne

By Andrew Weaver

/ February 12, 2020

Today in the Legislature I rose to provide my response to the BC NDP government's Speech from the Throne. The...

Read More

Government stability continues with start of new legislative session tomorrow

By Andrew Weaver

/ February 10, 2020

The next legislative session resumes tomorrow and I look forward to representing the wonderful constituents of OBGH in the coming...

Read More

Weaver to step aside from BC Green Caucus to sit as an independent

By Andrew Weaver

/ January 15, 2020

Today, I announced that effective Monday, January 20 I will sit as an independent MLA in the BC Legislature. As...

Read More

Stepping down as leader of the B.C. Green party in January

By Andrew Weaver

/ November 27, 2019

Today after Question Period in the legislature I held a brief press conference to note that as the BC Green...

Read More

Declaration Act passes unanimously, a crucial step forward for reconciliation efforts

By Andrew Weaver

/ November 26, 2019

Today was an historic day in the legislature as Bill 41: Declaration on the Rights of Indigenous Peoples Act passed...

Read More

Daylight savings or standard time? That is the question

By Andrew Weaver

/ November 21, 2019

Yesterday evening in the BC Legislature Bill 40: Interpretation Amendment Act, 2019 was debated during committee stage. As readers will...

Read More

When will government introduce species at risk legislation?

By Andrew Weaver

/ November 21, 2019

Today in the legislature I rose during Question Period to ask the Minister of Environment and Climate Change Strategy when...

Read More

A statement in advance of Holodomor Memorial Day this Saturday

By Andrew Weaver

/ November 21, 2019

In the legislature today I rose to deliver a statement in advance of Ukrainian Famine and Genocide (Holodomor) Memorial Day...

Read More

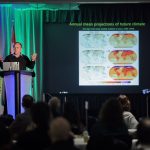

24 hours of climate reality: A presentation at Oak Bay High

By Andrew Weaver

/ November 20, 2019

Today marks the beginning of the 24 Hours of Reality: Truth in Action initiative led by Al Gore’s Climate Reality...

Read More

Bill 40: Interpretation Amendment Act, 2019

By Andrew Weaver

/ November 19, 2019

Today in the legislature we debated Bill 40: Interpretation Amendment Act, 2019 at second reading. This act, if passed, would...

Read More

Bill 38: Climate Change Accountability Amendment Act

By Andrew Weaver

/ November 19, 2019

Yesterday in the legislature we debated Bill 38: Climate Change Accountability Amendment Act at second reading. Working with government to...

Read More

Clean energy in British Columbia: The Opportunity

By Andrew Weaver

/ November 12, 2019

On Friday, November 8 I had the opportunity to deliver a keynote address over lunch to delegates of the Clean...

Read More

Statement on resignation of Elizabeth May as leader of Green Party of Canada

By Andrew Weaver

/ November 4, 2019

In Ottawa today, Elizabeth May announced she was resigning as the leader of the Green Party of Canada. As leader...

Read More

Statement on the importance of Remembrance Day

By Andrew Weaver

/ October 31, 2019

As this is the last day that the legislature will sit before Remembrance Day, the Premier rose to deliver a...

Read More

Bill 38: Climate Change Accountability Amendment Act, 2019

By Andrew Weaver

/ October 30, 2019

In the legislature today, the Minister of Environment and Climate Change Strategy tabled Bill 38: Climate Change Accountability Amendment Act,...

Read More

Bill passes unanimously to recognize the millions of Ukrainians killed in man-made famine

By Andrew Weaver

/ October 29, 2019

Today in the legislature my private member's Bill M225: Ukrainian Famine and Genocide (Holodomor) Memorial Day Act passed unanimously in...

Read More

Ukrainian Famine and Genocide (Holodomor) Memorial Day: A Personal Journey

By Andrew Weaver

/ October 28, 2019

Today in the legislature we debated Bill M225: Ukrainian Famine and Genocide (Holodomor) Memorial Day Act at second reading. This...

Read More

Introducing a bill to establish a Holodomor day of remembrance in British Columbia

By Andrew Weaver

/ October 23, 2019

Over the last several months I have been working towards building all party support for a Private Member's bill that...

Read More

Why is British Columbia not exploiting its geothermal energy resources?

By Andrew Weaver

/ October 22, 2019

Today in the Legislature I asked the Minister of Energy, Mines and Petroleum Resources what her ministry is doing to...

Read More

What’s BC doing to promote a low carbon economy in Northern BC?

By Andrew Weaver

/ October 22, 2019

Northeastern BC will experience the impacts of climate change faster and more profoundly than those of us on southern Vancouver...

Read More

Tribute to Al Martin

By Andrew Weaver

/ October 22, 2019

In the legislature today I rose to pay tribute to my friend, constituent and conservation champion Al Martin. British Columbia...

Read More

Conflicting signals from energy ministry: LNG or a climate plan?

By Andrew Weaver

/ October 22, 2019

Yesterday in the BC Legislature I rose during Question Period to ask the Minister of Environment and Climate Change Strategy...

Read More

Celebrating Connections Place on World Mental Health Day

By Andrew Weaver

/ October 10, 2019

Today, on World Mental Heath Day, I took the opportunity to Celebrate the success and recent opening of Connections Place....

Read More

Announcing I will not seek re-election in 2021; asking party to prepare for a leadership contest

By Andrew Weaver

/ October 7, 2019

It is after a great deal of thought and reflection that I am announcing today that I will not be...

Read More

The power of collaboration: climate change policy now front and center in provincial political conversation

By Andrew Weaver

/ October 3, 2019

Today Minister George Heyman and I had the distinct honour of receiving Clean16 and Clean 50 awards from the Delta...

Read More

Apply for 2019 BC Youth Parliament

By Judy Fainstein

/ October 3, 2019

The 91th British Columbia Youth Parliament will hold its parliamentary session in Victoria at the Provincial Legislative Chambers from December...

Read More

Speech to delegates at the 116 th Union of BC Municipalities Convention

By Andrew Weaver

/ September 25, 2019

Today I was afforded the opportunity to present to delegates at the 116th Union of BC Municipalities Convention in Vancouver.

Read More

The Democracy & Me Art Contest is now open to all BC children & youth

By Andrew Weaver

/ September 20, 2019

The Legislative Assembly of British Columbia and the Lieutenant Governor of British Columbia have co-sponsored The Democracy & Me Art Contest....

Read More

BC NDP government empowered to revisit Trans Mountain pipeline conditions

By Andrew Weaver

/ September 17, 2019

Today the BC Court of Appeal ruled unanimously that the BC NDP government must reconsider the conditions of the environmental...

Read More

BC’s greenhouse gas emissions continue to climb in 2017

By Andrew Weaver

/ September 9, 2019

The BC NDP government released the 2017 greenhouse gas emissions data today. To no one's surprise, BC's 2017 GHG emissions...

Read More

BC Green caucus celebrates equitable access to menstrual products for students

By Andrew Weaver

/ September 5, 2019

Great Victoria School District officially launched its initiative today to provide free access to menstrual products for students. Ensuring equitable...

Read More

Trans Mountain pipeline faces six legal challenges; court rejects all environmental appeals

By Andrew Weaver

/ September 4, 2019

The Federal Court of Appeal ruled today to allow six of the twelve legal challenges against the Trans Mountain pipeline...

Read More

Governments have choices to make: subsidize LNG, remove bridge tolls or support public education

By Andrew Weaver

/ September 3, 2019

Children are starting the school year under a shadow of labour uncertainty. With the first day of the 2019-2020 academic...

Read More

BC & federal governments announce another $680 million to further subsidize future fossil fuel development

By Andrew Weaver

/ August 30, 2019

Yesterday the Premier and Prime Minister made a joint announcement promising another $680 million subsidy of the BC natural gas...

Read More

A renewed call for comprehensive protections against ‘conversion therapy’ in BC

By Andrew Weaver

/ August 2, 2019

Yesterday the BC NDP government published an open letter calling on the federal government to amend the Criminal Code to...

Read More

Statement on Trans Mountain Pipeline expansion project approval

By Andrew Weaver

/ June 18, 2019

Today Justin Trudeau once more announced the approval of the now Canadian Taxpayer owned Transmountain Pipeline project. Those who have...

Read More

From the sublime to the ridiculous: BC Liberals in a tizzy on the last day of the legislature

By Andrew Weaver

/ June 6, 2019

It's been a week since the legislature rose for the summer and it's taken me that entire time to muster...

Read More

Presenting at the Clean Energy BC Spring Conference: Powering Generations — Legacy to the Future

By Andrew Weaver

/ June 5, 2019

Today I had the distinct honour of giving a keynote presentation at the 2019 Spring Conference of Clean Energy BC...

Read More

Responding to the Premier’s Statement on the 75th anniversary of D-Day

By Andrew Weaver

/ May 31, 2019

June 6th, 2019 marks the 75th anniversary of D-Day and the battle for Normandy. The Premier rose yesterday (the last...

Read More

Estimates debate with the Premier on demand side measures affecting the price of gas

By Andrew Weaver

/ May 31, 2019

On Wednesday of this week I rose during budget estimate debates for the Office of the Premier to ask a...

Read More

Impromptu statement on global warming and intergenerational equity

By Andrew Weaver

/ May 31, 2019

Yesterday in the legislature I rose during Members' statements to give an impromptu statement on global warming and intergenerational equity....

Read More

BC Green bill aimed to protect tenants from “household violence” receives Royal Assent

By Andrew Weaver

/ May 30, 2019

Today in the legislature my private member's bill Bill M206, Residential Tenancy Amendment Act, 2019 received Royal Assent. This bill...

Read More

Calling for a closer look into construction industry labour code policy

By Andrew Weaver

/ May 28, 2019

Today in the BC Legislature we continued our debate on Bill 30: Labour Relations Code Amendment Act, 2019 at committee...

Read More

On the government’s approach to collective bargaining with the BCTF

By Andrew Weaver

/ May 27, 2019

In the legislature today I rose during Question Period to ask the Minister of Education what his government was thinking...

Read More

Introducing a bill to end the practice of conversion therapy in British Columbia

By Andrew Weaver

/ May 27, 2019

Today in the legislature I tabled Bill M218: Sexual Orientation and Gender Identity Protection Act, 2019. This bill seeks to...

Read More

Public Consultation on the 2020 BC Provincial Budget

By Judy Fainstein

/ May 21, 2019

The Select Standing Committee on Finance and Government Services Committee’s Budget 2020 Consultation is taking place in June, 2019.British Columbians...

Read More

Committee stage for Bill M209: Business Corporations Amendment Act, 2019

By Andrew Weaver

/ May 16, 2019

On Tuesday and Wednesday of this week we debated Bill M209: Business Corporations Amendment Act, 2019 at committee stage. As...

Read More

Responding to Decision to Call for a Public Inquiry Into Money Laundering in British Columbia

By Andrew Weaver

/ May 15, 2019

After calling for a public inquiry into money laundering in British Columbia for many months, my BC Green Caucus colleagues...

Read More

BC Green bill aims to protect tenants from “household violence”

By Andrew Weaver

/ May 14, 2019

Today in the legislature my Private Member's Bill M206, Residential Tenancy Amendment Act, 2019 was called for debate at second...

Read More

Recent Comments

- Marilyn Goode on Global warming: An intergenerational conversation and plea for action

- Mary Kelly on When ideology trumps evidence: The decision to cancel the school liaison officer program in School District 61

- Andrew Weaver on Earth: The final frontier and the failure of fear-based climate messaging

- Russ Q on Earth: The final frontier and the failure of fear-based climate messaging

- Diane Perry on Earth: The final frontier and the failure of fear-based climate messaging