Race to the bottom economics and the great BC natural gas giveaway

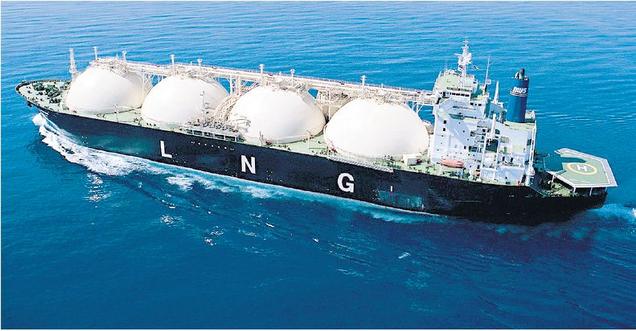

On Tuesday during budget estimates I had the opportunity to ask the Minister of Energy, Mines and Petroleum Resources a series of questions that quite clearly demonstrate the race for the bottom economics at play as BC continues to pursue an LNG industry. The exchange afforded me the opportunity to get on record the issues I raised earlier this year concerning the fact we are literally giving away a natural resource in order to blow through our greenhouse gas reduction targets.

I asked the Minister to explain the myriad natural gas royalty credit programs and to outline the aggregate amounts claimed under each program in recent years. I conclude with a question regarding deep well royalty credits and the Minister reveals that as of December 31, 2017 there are $3.1 billion in unclaimed credits.

Below I reproduce the text and video of the exchange.

Text of Exchange

A. Weaver: I don’t need the minister to read it. I’ll go afterwards and make sure I follow up with the people I’ve been communicating with to get access to the exact quote.

I have a number of questions with respect to natural gas royalties. I’ve provided these to the minister in advance. There’s a clear theme in here. My first question is this. Would the minister please describe the clean infrastructure royalty credit program?

The Chair: Just before the proceedings continue, I’d like to read to the members the section of Standing Order 17A(1). “Electronic devices must not be used by a Member who is in possession of the floor, or during the following proceedings: (a) Speech from the Throne; (b) Royal Assent; (c) Prayers; (d) Oral Question Period; (e) Speaker’s rulings; (f) divisions; (g) at any other designated time pursuant to instructions by the Speaker.” So the relevant piece is that when the member has possession of the floor, an electronic device shouldn’t be used. Thank you, Members.

Hon. M. Mungall: I’ll answer the question in two parts, essentially. First, I’ll kind of speak to the broader concept, and then secondly, I’ll speak specifically to how this particular program works.

The broader concept around this is a tool that governments in many jurisdictions often use to incentivize, whether it’s individual behavior or industrial behavior, to change. This type of incentivization, using financial incentives as well, is often used, particularly when we want to change behaviors or practices to make them more environmentally friendly.

Just as a really quick example…. I don’t want to use all the member’s time in giving these examples. But when I was on city council in Nelson, we wanted people to start recycling more — a good environmental practice. So we made the payment of garbage…. To just dispose of things into the landfill, we charged everybody $1 for a garbage bag. But putting recycling into a blue bag that we were then going to start to pick up from door to door — we made that free.

In this type of scenario, what we’ve done is made a royalty credit program to incentivize industry to advance clean technologies and solutions for reducing greenhouse gas emissions specifically that are linked to the development and production of the oil and natural gas resources. That’s specifically what this program is, and that’s the concept behind it. It’s accomplished through a provincial royalty deduction of up to 50 percent for eligible products that are approved by the ministry.

So applicants are required to, first off, fund the entire project themselves and then make applications. Then the ministry determines whether or not they’re eligible, and then how much they might be eligible, for a royalty credit.

A. Weaver: I’m wondering if the minister could please provide me with information as to how much was claimed under this program in the aggregate sense for 2014, 2015, 2016, 2017 and what is projected for 2018?

Hon. M. Mungall: This would be our newest royalty credit program. It started in 2016. The first installment had approved royalty deductions of $10.7 million to successful applicants. To date, no amount has been released, as the projects have not yet been completed. So that $10.7 million has not been released and will only be released once the projects are actually completed.

The second installment for 2018 is currently underway. We’re thinking we might be looking at $19.3 million, which to us means that it’s showing greater interest in terms of taking opportunities to reduce greenhouse gas emissions and receive the benefits of doing that. The incentivization is working as we hoped it would be.

A. Weaver: In my view, this is…. It’s the first of many credits that I’ll allude to, discuss. The first one. In my view, government is giving natural gas companies a royalty credit to clean up their own pollution. Remarkable that this was done in 2016.

A second credit that I’m hoping the minister could describe — as opposed to the clean infrastructure royalty credit program, just the infrastructure royalty program…. Could she please describe that program for me? To ask the second question at the same time, what was claimed under this program in the last five years?

Hon. M. Mungall: The infrastructure royalty program has a different focus, obviously, than the previous credit program that we were talking about, the clean infrastructure royalty credit program. This is for infrastructure in general that industry may have not been incentivized on their own to develop. So there is a variety of infrastructure that goes with the industry. Rather than minimizing the type of infrastructure that can benefit the community, we want to maximize the infrastructure. So this is part of the purpose behind all of this.

In terms of the numbers for the last few fiscal years, in 2014-15, the following royalty deductions have been released, and that was $56.8 million; in 2015-16, $54 million; ’16-17, $28.6 million; and in 2017, $1844.4.

A. Weaver: I very much appreciate the thoughtful and thorough answer from the minister. This is a royalty program, as the minister meant, that can pay up to 50 percent of the costs of building roads and pipelines, for example.

One of the concerns, of course, I have and that I raised to the minister is that there are concerns arising from this in terms of the destruction of natural habitat, which creates costs to society and wildlife populations because of predator routes and lack of biodiversity that is not paid for. We’re in some sense, through this program, incentivizing the buildings of roads, and the taxpayer is on the hook to deal with any concomitant effects on wildlife and ungulate populations in the affected regions.

Next credit program. This is the third one. I’m wondering if the minister could please describe the low-productivity well royalty reduction production program.

Because I suspect we’re going to have a recess after this, if we might, at the same time, get the projected revenues that were claimed for 2014 through to now as well.

Hon. M. Mungall: What we’re trying to incentivize with this particular royalty program is the continuation of a well rather than an early shutdown. To explain this, I’ll do my best.

For example, a well will have a predicted 30-year lifespan, right? So you get to year 25, and there’s less gas in the well. Rather than have a company just shut it down, walk away and start up something new, we want to keep that production going so that we have the full lifespan of the well. So we want to incentivize them continuing the work. There’s less gas in that well at that time, so it’s going generate less revenue. Rather than get nothing and still have this well that is there but is not operating, we want to get something out of that well and get some kind of revenue for it as well.

This incentivizes them to continue that well until its full lifespan, to make sure that they’re paying people to go there, inspect it and maintain it appropriately. That’s the purpose of this. And I would argue the effects of that make sure that the wells we have continue their full lifespan, rather than a shorter lifespan and then that company saying, “Okay, we’re going to go start up a new well that’s going to generate more gas right away,” and therefore increase the number of wells that we have in a particular area.

The amount of money that was claimed under this program in 2013-14 was $6.4 million; in ’14-15, $6.2 million; in 2015-16, $2 million; and ’16-17, $1.8 million.

A. Weaver: The fourth royalty credit program I’d like to discuss. I’m wondering if the minister could please describe the marginal well royalty reduction program, as opposed to the low-productivity well royalty reduction program that we just discussed, and if she could please let us know what was claimed under the program in the same years.

Hon. M. Mungall: The marginal well royalty reduction program is very similar to the one that I was just talking about, which is the low-productivity well royalty reduction program, except that it’s not at the end of the lifespan of a well. Rather, what’s happened is that the operator has drilled the well, and not much is coming out. Specifically, the natural gas is coming out at a rate below 23 cubic metres of gas per day, per metre of well depth.

We can pull out our calculators and do the math on that, but the point is that it’s producing very, very low. The same purpose behind the previous royalty reduction program that I spoke of is behind this one as well. It’s so that we don’t have a company just walking away, but rather, we’re incentivizing them to maintain operations of that well so that the taxpayer and British Columbians are getting something in return for that well.

The numbers associated with that particular program. In 2013-14, it was $43 million; ’14-15 is $41.9 million; ’15-16 was $12 million; and in ’16-17, $13.1 million.

A. Weaver: The fifth royalty credit program I’d like to get some information is the ultramarginal well, as opposed to the marginal well royalty reduction program. I’m wondering if the minister could please describe the ultramarginal well royalty reduction program and also let us know what was claimed under this program over the last five years.

Hon. M. Mungall: I thank the member for this line of questioning, because it allows us to get into describing the various types of wells that we have in our gas fields and also to give definition to some of the lingo in the industry.

An ultramarginal well is, I guess, kind of your next step below a marginal well. It’s slightly different in the sense that what makes it ultra-marginal is that it’s a shallow gas well and it’s a single vertical drill. That’s what makes it distinct from the previous types of wells that we’ve been talking about.

What was claimed over the last few years — I’ll give those numbers to the member. In 2013-14, it was $23.5 million, and in 2014-15, it was $24.6 million. In 2015-16, $6.1 million, and in ’16-17, $5.9 million.

Do you mind if we have a quick recess?

A. Weaver: Not at all.

Hon. M. Mungall: Chair, would we be able to have just a five-minute recess?

The Chair: This committee stands in recess for ten minutes.

A. Weaver: Thank you to the minister for her comprehensive answers to these. We’ve discussed a number of credit programs that were designed to incentivize marginal or unproductive wells to keep them going.

Now I would like to move on to some other credit programs. The next one I was hoping the minister could describe is the net profit royalty program. Again, as per the previous ones, if she could let us know what was claimed under this program for the last five years.

Hon. M. Mungall: The net profit royalty program is all about, in terms of timing, when we anticipate a well to be profitable. If a well starts off, and it’s not producing as much as it will in the future, we want to make sure that that well is still developed and that we get the economic benefits of that eventually. The program allows producers to pay a lower royalty rate in the initial stages of a project in exchange for higher royalty rates once the producers have recovered their initial capital costs.

What was claimed under this program in previous years? For 2013-14, it was $16.4 million. In 2014-15, it was $19.1 million. Then in 2015-16, something good must have happened, because it was only $2.9 million and, in 2016-17, $2.3 million.

A. Weaver: My understanding is that it’s also used to promote the development of high-risk resources that would otherwise unlikely be developed — in some sense, taking risk out of the investment nature of the natural gas sector. Again, thank you for the answer.

The next credit program I’d like to get some information on — hon. Chair, through you to the minister — is: I’m wondering if she could describe the natural gas deep re-entry credit program and, once more, let us know what was claimed under this program in the years 2014, 2015, 2016 and 2017.

Hon. M. Mungall: Before I get the answer for the next question, I will say that I just checked, and yes, your understanding for high-risk activity is correct as well. Sorry I missed that.

This particular program is for wells that already exist, and it’s to incentivize companies drilling further down, drilling deeper. Rather than a new well and all of the impacts that are associated with a new well and a new pad, we would keep the existing well, and we would incentivize the company to drill deeper.

Wells receiving this credit are subject to either a 3 percent or a 6 percent minimum royalty. So they will be having to definitely pay some kind of royalty. The figures for this are released within the public accounts. For 2013-14, it was $261.9 million; in ’14-15, $486.8 million; in 2015-16, $171.7 million; and in 2016-17, $178.3 million.

A. Weaver: Again, I think the minister is seeing the direction I’m heading with this line of questioning. These are some very big numbers here as credits. I’m only on the seventh, with more to come, of royalty credit programs that exist.

The next one is my favourite, which is called the natural gas deep-well credit program. I’m wondering if the minister could please describe what the natural gas deep-well credit program is prior to 2014, and what that program is after April 1, 2014? What occurred in the transition on April 1, 2014?

Hon. M. Mungall: I’m just going to go back to the numbers that I shared with the member in my previous answer about the natural gas deep-well re-entry credit program.

A. Weaver: Were those the deep-well credits?

Hon. M. Mungall: They’re both. They are both the deep-well credits as well as the deep-well re-entry program. Sorry to say, but the Ministry of Finance doesn’t separate the two out. So that actually is the total for two different credit programs.

For the natural gas deep-well credit program, the issue here is less the incentivizing that I was speaking to in some of the previous wells, where we were trying to incentivize a very distinct behavior. That means that the company is already here. They’re dedicated to setting up, and this is the type of behaviours or practices that we want from them as they are beginning their activity.

This particular one is addressing our competitiveness on the global stage — making sure that B.C.’s upstream in the northeast is competitive on that global stage. What it does is it provides a royalty credit for wells, for deep wells specifically.

The member wants to know…. There was a change that was made on April 1, 2014, and he wants to know what the change was specifically. What it was is that this credit program was expanded to cover wells with a vertical depth of less than 1,900 metres. Prior that that, it was 1,900 metres or more.

That’s not to say that you can drill 1,500 metres, and — that’s it — you’re eligible. What it is, is that you can drill less than 1,900 metres, but you still need to keep drilling. You just go horizontally rather than straight vertically. So there is less depth, but there still needs to be length in terms of accessing the actual resource.

A. Weaver: I assume that the numbers that were claimed are the numbers that were given earlier for the…. I believe the minister’s nodding, so I won’t ask what the numbers for the deep-well are.

Essentially, what we’ve got, in summary of these credit programs…. In British Columbia here, we provide a credit for infrastructure construction. We provide a credit for cleaning up your pollution. We have a credit to ensure marginal, cost-ineffective wells are kept in production. We provide a credit, actually, for deep wells, and we provide a credit for horizontal fracking as well. In essence, we provide credits in all areas of our natural gas sector here to incentivize natural gas drilling. Oh, were that to be the case in other sectors of our economy.

With that said then, credits are important to actually incentivize — and I get that — emerging technologies and sectors. Let’s take a look — and perhaps the minister can help us through illustration — at some of the revenues we’ve been getting, then, from the natural gas sector. I’m wondering if the minister could please provide the net royalties received by the province of British Columbia for natural gas for each of the fiscal years from 2007 through 2017.

Hon. M. Mungall: I’ll start with 2007 and the fiscal year 2007-2008. The net royalties received were $1.132 billion. The following year, ’08-09, was $1.314 billion; ’09-10, $406 million; 2010-11 was $313 million; 2011-12, $339 million; 2012-13, $169 million; 2013-14, $445 million; 2014-15, $493 million; 2015-16, $139 million; and 2016-17, $152 million.

A. Weaver: Thank you. I very much appreciate those answers. In essence, in summary, in 2009, we were at a high of $1.3 billion in royalties coming to the province of British Columbia. And in fiscal year ending 2017, were $152 million — almost ten times less.

The next question then is in the area of how much natural gas we have produced. I’m wondering if the minister could please let us know what the net production of natural gas in the province of British Columbia was in thousands of cubic metres for each of the fiscal years 2007 through to 2017.

Hon. M. Mungall: These are all in cubic metres. For 2007-2008, we have 27,084,782 cubic metres.

A. Weaver: Say that again.

Hon. M. Mungall: It’s 27 million. If the member wants, I can just round it out to the million rather than giving the entire number. If he likes, for the full detail right down to the last cubic metre, I’m happy to provide that in writing.

For 2008-2009, it was 28 million; 2009-2010, we’re at 27.6 million; 2010-2011, 31 million; 2011-2012, 36.5 million; 2012-2013, 35.8 million; 2013-2014, 39 million; 2014-2015, 42.5 million. And the last year that we have the available numbers is 2015-2016, at 44.7 million.

A. Weaver: I’ll have to get under…. Those numbers differ from the numbers that I have, being 32 million in 2007, 33 million in 2008, 33 million in 2009, 35 million in 2010, 41 million in 2011, 41 million in 2012, 44.5 million in 2013, 47 million in 2014, 49 million in 2015, 51 million in 2016 and 51.5 million in 2017. Hopefully we can, I can, reconcile where our differing sources are from, down the road.

The point here is that we’ve had close to a 50 percent increase in production over the last decade or so, at a time when in fact royalties have gone from $1.3 billion to $152 million.

My second-last question in this line of questioning is this. I’m wondering if the minister could please let us know what the net royalty per thousand cubic metres of natural gas produced in the province of British Columbia is for the fiscal years 2007 through 2017.

Hon. M. Mungall: I’ll answer this question, and then I think we’re going to have to wrap up for the day, if that works for the member. He has one more? Okay.

For B.C., the net royalty per 1,000 cubic metres for natural gas in 2007-08 was $40.45. I’ll do the same as I did before. I’ll round up or down, using those grade-school math skills.

In 2008-09, it was $45. In ’09-10, it was $14. In 2010-11, it was $10. In 2011-12, it was $9. In 2012-13, it was $4 — closer to $5, pardon me. In 2013-14, it was $11. In 2014-15, it was closer to $12; it was just $11.55. And then in 2015-16, it was $3. In 2016-17, it was $3.

This type of increase and decrease situation — if you look at Alberta numbers, it’s very similar. For example, in 2007-2008, the net royalty per thousand cubic metres was $38.30. Then, fast forward nine years into the future to 2016-17, it was $4.93. The reason why you see this, is that the royalties are not based necessarily on the volume of gas being extracted; it’s based on the price. And the price of gas is determined by the marketplace. So what we have here is that the price of gas was quite high in 2007-08, 2008-09 fiscal years, and it has come down quite substantially.

What I’d like to do for the member here, so that he has this information, is I’d just like to table this so that he can access it. Am I able to table in budget estimates?

D. Routley (Chair): I would ask you to share it informally. To properly table, we would have to do it in the main chamber.

Hon. M. Mungall: Okay. No problem. I’ll do that. Great. I’ll just hand that to the member opposite so that he has that as well.

A. Weaver: I do appreciate the response. We had slightly different numbers, from my calculations — again, based on the natural gas production estimates and the source of values — versus the sources you’ve got there.

The bottom line here is the net royalties, in using the government’s numbers, were $45 for every thousand cubic metres produced in B.C., and now it’s $3, despite a 50 percent increase in natural gas production over that same time. This is race-for-the-bottom economics at its finest.

My final question is this: what is the total accumulated and outstanding natural gas deep-well credits available to companies in British Columbia? When I asked this question in the fall, it was something of the order of $3.2 billion. I’m wondering what that number is now.

The Chair: Minister, and noting the hour.

Hon. M. Mungall: Absolutely, Chair.

The total outstanding deep-well royalty credits since the inception of the program as of December 2017, are estimated at $3.1 billion. Now, this includes all credits for all wells, whether or not they’re in production. So that’s what we have.

I just want to make sure that the public knows that a company can’t come up and say, “I have all these credits; pay me out,” and somehow they’re walking away with a bag full of money. That’s not how it works at all. They’re able to use their credits to reduce their royalties down to a 3 percent or 6 percent rate. They still have to pay royalties.

Noting the hour, I move that the committee rise, report completion of the resolutions of the Ministry of Advanced Education, Skills and Training and report progress on the Ministry of Energy, Mines and Petroleum Resources and ask leave to sit again.

Videos of Exchange

| Part 1 | Part 2 | |

| Part 3 |

Leave A Comment