Issues & Community Blog - Andrew Weaver: A Climate for Hope - Page 157

Bill 21: Fish and Seafood Act

Summary of the Bill

Yesterday, Bill 21, 2015: Fish and Seafood Act passed third reading and now awaits Royal Assent. All members in the Legislature supported it. The Fish and Seafood Act replaces and updates the Fish Inspection Act and the Fisheries Act, last updated in the 1960s, with a modern framework that builds on British Columbia’s local and international reputation as a source of sustainable and trusted seafood products. It further improves operating conditions for British Columbia’s seafood sector.

The new legislation will update the licensing and regulation of the buying, selling, handling, storing and processing of fish, shellfish and aquatic plants. The legislation will also include the following to support sustainability and consumer confidence in the safety of B.C. seafood:

- Enabling the creation of a seafood traceability system to ensure seafood processed in British Columbia is both safe and legally caught, cultured, bought and sold. The system will ensure British Columbia seafood products are responsibly produced and harvested, and can be traced from the processor to the consumer.

- Prohibiting the possession of illegally caught, cultured, harvested or processed seafood products, and the unlicensed sale of fish, ensuring only sustainably harvested and safely handled seafood products enter the food chain.

The new act also increases inspection and enforcement.

Banning the Sale, Trade and Distribution of Shark Fins

On November 19, 2014 I was visited by a remarkable group of students from Glenlyon Norfolk School who, together with their teacher, had been working tirelessly to do what they can to make people aware of the plight of the world’s shark population. Following my meeting with the students I asked the Minister of Agriculture two questions during Question Period:

1) Will the government introduce legislation to ban the sale, trade and distribution of shark fins in British Columbia?

2) Will the government commit to working with me and other MLAs to develop a strategy that would eventually lead to banning the sale, trade and distribution of shark fins in British Columbia?

In response, the Minister subsequently committed to meet with me to discuss the issue. We met and at the meeting I promised to put together a package of information that he committed to pass along to Ministry staff for a thorough review.

Shortly after the meeting, I presented the Minister with a binder containing detailed and comprehensive information outlining the rationale for implementing shark fin legislation. The response to my information package that I received from the Minister in February was disappointing. The Minister did not respond to my specific question as to whether the government would consider introducing legislation to ban the sale, trade and distribution of shark fins in British Columbia.

The good news and new reality is that the government has since introduced Bill 21: Fish and Seafood Act. This Bill opens the door for moving forward on a ban on the sale, trade and distribution of shark fins in British Columbia. The key and relevant aspects of this bill are contained in section 6:

Possession or distribution of restricted fish or aquatic plants

6 (1) In this section, “restricted fish or aquatic plants” means prescribed fish or aquatic plants that

(a) are subject to prohibitions or restrictions on harvesting under an enactment of Canada or an international agreement to which Canada is a party, or

(b) may be subject to harvesting practices that are inhumane or unsustainable.

(2) A person must not possess or distribute for human consumption restricted fish or aquatic plants except as authorized under

(a) a licence, permit or other authorization issued under an enactment of Canada, or

(b) a permit issued by a licensing officer.

Yesterday at committee stage for the Bill I probed the minister on the implications of section 6 with respect to the sale, trade and distribution of shark fin products in British Columbia. I pick up the questioning immediately after Gary Holman, the MLA for Saanich North and the Islands asked the Minister if the list of restricted species would be published in the regulations attached to Bill 21.

Please note that this was the first time that I stood to speak on Monday. I had surgery on my nose last Friday and showed up in the legislature wearing a nose splint. The beginning of our conversation involves some back and forth banter about the dangers of texting while you walk.

Bill 21 Committee Stage Questions/Answers

G. Holman: There’s this reference to “restricted fish or aquatic plants,” and there are references to prohibitions or restricted “under an enactment of Canada or international agreement.” Will this list of restricted species be published in the regulations?

Hon. N. Letnick: Yes.

A. Weaver: Could the minister please expand on what basis this list will be determined?

Hon. N. Letnick: Thank you to — I believe — the member opposite for the question. I’m not too sure. We’re going to have to get an explanation of that in a minute, I’m sure.

The restricted fish and aquatic plants are those that are under two categories: (a) are subject to national or international prohibitions or restrictions on harvesting, and (b) may be subject to harvesting practices that are inhumane or unsustainable.

A. Weaver: That was an opening for me. I recognize it’s very hard to take me seriously when I look like Beak Man here. There’s always a teachable moment in everything that we do in our lives, and the teachable moment that I have here is that one should not text and walk. We hear a lot about texting and driving and the dangers of texting and driving, but let me tell you, hon. Chair, also texting and walking can be very dangerous, particularly if you’re jogging downstairs quickly while texting and not looking where you’re going.

A. Weaver: That was an opening for me. I recognize it’s very hard to take me seriously when I look like Beak Man here. There’s always a teachable moment in everything that we do in our lives, and the teachable moment that I have here is that one should not text and walk. We hear a lot about texting and driving and the dangers of texting and driving, but let me tell you, hon. Chair, also texting and walking can be very dangerous, particularly if you’re jogging downstairs quickly while texting and not looking where you’re going.

With that, if I could continue on this. Does this mean that if an organization called the United Nations International Union for the Conservation of Nature, through their red list, were to deem a particular species to be protected and subject to international restrictions, this law would then apply in the province of British Columbia to those on the IUCN red list?

Hon. N. Letnick: Thanks to the member opposite for the question and the teachable moment. I’ve always thought — because I am one of those who is guilty of texting and reading messages while I’m walking — that someone should create an app so that while you are doing your thing, you can actually have a proximity indicator. So if you are about to bump into something, it would flash at you to look up. Or if not, at least maybe a little part of the screen with the camera in the front so that you can see before you bump into that pane of glass, or whatever else it is that caused that unfortunate accident on your face. I wish you the speediest of recoveries, hon. member. I honestly do. That must have hurt.

Back to the question. The answer is if the prohibition is part of an international agreement which Canada is a party of, then the answer is, yes, it could be.

The Chair: Member, perhaps we should keep the discussion and discourse to Bill 21. It would probably be in the best interest of all members.

A. Weaver: Hon. Chair, I will do that, but let me please point out that in British Columbia we have an incredible health care system too. I had a very luxurious time in the Royal Jubilee Hospital here on Friday last week, and I do compliment the staff there. On that note…

Interjection.

A. Weaver: I had a nurse-to-patient ratio of four nurses to one patient, too, and that was pretty impressive.

Anyway, back to the question. That is actually quite exciting. What’s interesting there is that…. You will recall that during the session last time, I raised a number of questions with respect to banning the sale, trade and distribution of a variety of shark fin products. In fact, there are a number of sharks that are actually protected on the red list of the IUCN to which Canada is a party.

So my question then, following this up, would be: to what extent will these laws be enforced, and what penalties will be put in place and how is the province going to enforce this legislation?

For example, if some people were to go in and purchase a product and have it genetically analyzed and that product was then determined to contain hammerhead sharks, for example, which we know are on the IUCN red list, would the province then step in ban the sale, trade and distribution of this? How would this be enforced?

Hon. N. Letnick: Thank you to the member opposite for the question, including his support for our health care system.

First of all, as I said before, this would be subject to Canada and the other parties being part of an international agreement. So that’s one. Then we could have this provision take effect. There would have to be genetic testing to make sure that the species is on the list. That would usually happen, I’m informed, at the point of purchase. It could be restaurants or a fish store or something like that. So the Ministry of Health would be involved.

If there’s an issue, an offence, then the maximum penalties are dealt with in section 57 of the act. We’ll canvas that, I’m sure, in a few minutes. Specific penalties, subordinate to the maximum penalties, will be described in regulations.

A. Weaver: My final question on this section is with respect to 6(1)(b) where it talks about harvesting practices that are “inhumane.”

My question on that is: inhumane is a value judgment. Who is making the value judgment as to what is or is not defined as inhumane?

Hon. N. Letnick: It would be defined in regulation. It’s not defined in the definitions of the act. And, of course, it would be applied by our inspectors, who would use their judgment in making that call.

Asking the Select Standing Committee on Health to Examine MSP Premiums

In January of this year I wrote about the importance of transforming our regressive approach to funding health care via flat-rate MSP premiums to a more progressive approach like that in place in Ontario. A month later I tabled a petition in the legislature of 6,662 British Columbians who agreed and then, during question period, I asked the Minister of Finance if the government would empower the Select Standing Committee on Health to examine innovative, progressive ways of revising how MSP premiums are charged in British Columbia. In his response, the Minister noted that he believed that the mandate of the committee was sufficiently broad for “members of the committee, and those that they might invite in, to have the kind of conversation that the member is alluding to”. He further offered “and it will be interesting to see what results from that conversation.”

On April 13th I followed up by formally writing to the Chair of the Select Standing Committee and asking two specific questions regarding the possibility of initiating a conversation with respect to the funding of MSP in British Columbia. Below is the text of my letter. I await a response.

Letter to the Select Standing Committee on Health

April 13th, 2015

Mrs. Linda Larson, MLA and Chair

Select Standing Committee on Health

Room 224, Parliament Buildings

Victoria, British Columbia

V8V 1X4

Dear Mrs. Larson,

I am writing to you with respect to the question that I raised during question period earlier this session concerning Medical Services Plan (MSP) premiums. Minister de Jong’s response suggested that this Select Standing Committee on Health’s mandate could include a discussion regarding how MSP Premiums are collected.

Every month single British Columbians earning over $30,000 pay $72 in MSP premiums. This health insurance plan plays an important role, providing funding for medically required services, however in the last fifteen years fees have doubled. Furthermore the cost remains the same whether someone makes $30,000 or $300,000 a year. British Columbia’s regressive approach to collecting MSP Premiums unfairly burdens those least able to bear it and increases pressure on small business owners.

I believe that it’s time for B.C. to replace MSP premiums with a more progressive and equitable approach to funding our health care system. Overhauling our current, regressive approach would be a positive step in addressing poverty and income inequality, and ensuring a sustainable health care system for now, and future generations.

With this in mind I stood in the house and asked the Finance Minister to expand the Select Standing Committee on Health’s terms of reference to allow for the committee to examine more progressive and more innovative ways of charging MSP Premiums. He responded,

“I think the power exists now. I think the committee, charged as it is to ‘examine the projected impact on the provincial health care system of demographic trends to the year 2036 on a sustainable health care system for British Columbians’ […] I think that’s probably sufficiently broad for members of the committee, and those that they might invite in, to have the kind of conversation that the member is alluding to, and it will be interesting to see what results from that conversation.”

He pointed to two specific sections of the terms of reference. The committee has been empowered to:

Outline potential alternative strategies to mitigate the impact of the significant cost drivers identified in the Report on the sustainability and improvement of the provincial health care system;

Consider health capital funding options.

I recognize that the committee has already begun reviewing submissions regarding rural health, addiction recovery, integrated teams and end of life care. I also recognize that the committee has decided to first look at the submissions it has received, in fairness to those who have given them. Going forward I have the following questions for the committee:

- The Select Standing Committee on Health has been given the task of examining the projected impact on the provincial health care system of demographic trends on a sustainable health care system for British Columbians. Their terms of reference came from the Finance Minister who has stated that, in his opinion, they are sufficiently broad for members of the discuss MSP Premiums. This regressive tax generates 2.3 billion dollars in government revenue, comparable to corporate income taxes. This tax can be charged in a more equitable fashion. I believe this is a conversation that British Columbians deserve and that this committee is an appropriate venue. Will the Select Standing Committee on Health agree to include MSP Premiums as part of their next discussion and call for submissions?

- When first given this new mandate the committee was given the option to consider both the original and the new mandates, concurrently. This option is still available. The committee can begin discussing their new terms of reference without taking away from the submissions review. This would allow for more clarity and could allow the committee to begin a new call for submissions while still reviewing those they have already received. I recognize that proper deliberation requires time and should not be rushed. With this in mind would the committee be open to discussing their expanded terms of reference at the same time as they review their current submissions?

I look forward to the committee’s response and thank the members for their time.

Sincerely,

Andrew Weaver

MLA Oak Bay-Gordon Head

Cc: Judy Darcy, Deputy Chair

On the Wisdom of Dumping Contaminated soils in the Shawnigan Lake Watershed

Background

On August 21, 2013 the Ministry of Environment (MOE) granted South Island Aggregates Ltd. (SIA)/ Cobble Hill Holdings (CHH) a 50-year permit to receive up to 100,000 tons of contaminated soil annually (a total of five million tons). The proposed location of the site for the contaminated soils is the SIA quarry located at 640 Stebbings Road (Lot 23 owned by CHH). This is located off South Shawnigan Lake Road between Shawnigan Lake and Highway 1. SIA proposed to back fill their quarry with contaminated soils while they continued to blast for new aggregate material. The permit was granted subject to “requiring complete containment of the soils to be introduced into the quarry.”

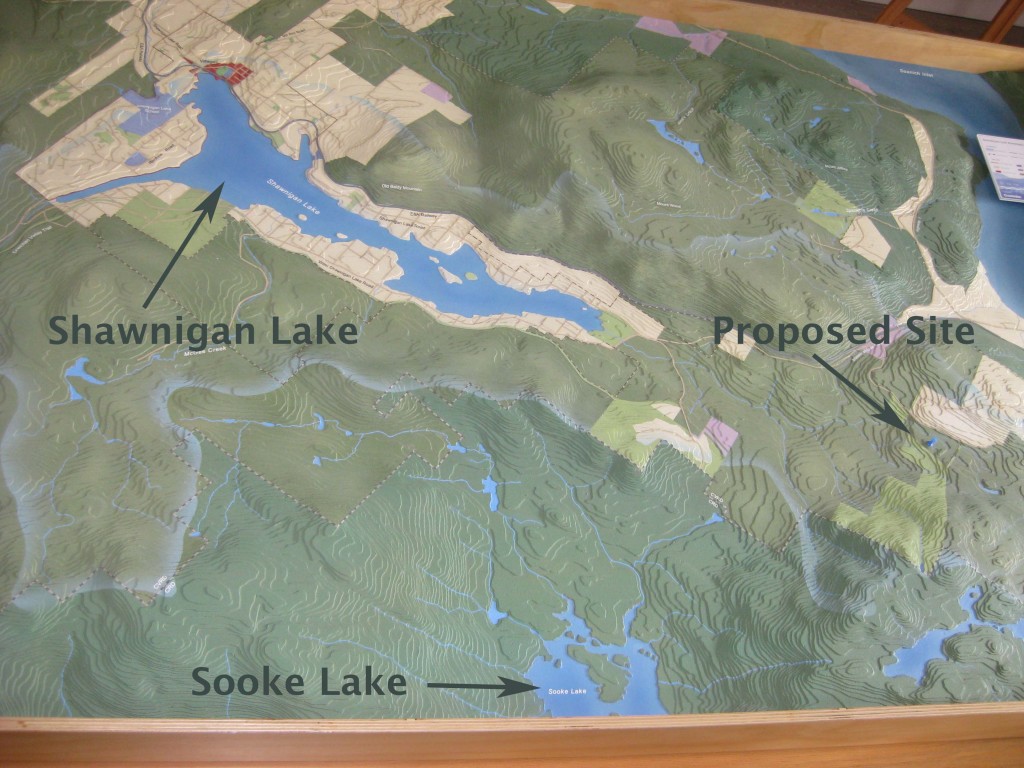

Figure 1: Photograph of a topographic map showing the locations of Shawnigan Lake, Sooke Lake and the proposed site for the contaminated soils.

Figure 1: Photograph of a topographic map showing the locations of Shawnigan Lake, Sooke Lake and the proposed site for the contaminated soils.

Five days later, the Shawnigan Residents Association (SRA) appealed the Ministry’s decision to issue SIA a permit. They cited five reasons for their appeal. The first three were:

1) The testing and assessment of the suitability of the site’s geology and hydrogeology was inadequate and incomplete.

2) The monitoring and water treatment plans were deficient.

3) The MOE failed to apply the appropriate test for the issuance of the Permit in that it failed to:

(a) ascertain the degree of scientific uncertainty about the hydrogeology, water monitoring and treatment technologies and plans;

(b) in view of the uncertainties, identify the degree of risk that the facility will not succeed in permanently containing the contaminants and toxins in the five million tons of contaminated soil to be deposited at the site.

Initially, I was reluctant to wade into this issue. But as time rolled on I started to receive a number of emails and letters from concerned constituents who had vacation properties on Shawnigan Lake.

Initially, I was reluctant to wade into this issue. But as time rolled on I started to receive a number of emails and letters from concerned constituents who had vacation properties on Shawnigan Lake.

The proposed location of the contaminated soil site (Figure 1) is at an elevation above both Shawnigan Lake, the water source for about 5,000 local residents who draw directly from the lake, as well as Sooke Lake, the reservoir for Greater Victoria’s water. An additional 7,000 or so residents get their potable water from within the Shawnigan Lake watershed. Surface water runs into Shawnigan Lake while the path taken by groundwater is plagued with great uncertainty.

In its application for a stay pending a decision from the Environmental Appeal Board, Shawnigan Residents Association noted expert testimony from hydrogeologist Dennis Lowen that argued: “The site is not suitable for a landfill”. They further submitted:

“The ground on which the landfill is to be located is fractured bedrock… The site itself is an active rock quarry… The quarry has only been 4% mined, so blasting and excavating is ongoing… backfilling will be accomplished using contaminated soil instead of clean fill …the site would not, for example, be acceptable for a secure landfill under Hazardous Waste Legislation.”

On September 13, 2013, the Cowichan Valley Regional District also filed an appeal to the Environmental Appeal Board. They too took a very strong position against the proposed contaminated soils site. Amongst a variety of other concerns, they argued that:

a. There is a divergence of professional opinion and significant uncertainty in the geology and hydrogeology of the area and the associated risks to drinking water resources.

b. The characterization of the geology and hydrogeology of the area is based on a limited amount of data and a limited number of wells and boreholes not evenly distributed around the property and surrounding area.

c. The design of the proposed contaminant soil treatment facility and landfill facility does not adequately ensure that contaminated soil and ash or the associated effluent will not adversely impact drinking water resources or the environment.

Professional Reliance

In 2001 after the BC Liberals were elected to their first term, they began a comprehensive core review to cut the size of government. Premier Campbell asked all government departments to prepare scenarios as to what it would look like with 20%, 35% and 50% cuts to spending. As a direct consequence of government downsizing, technical expertise within the civil service became a casualty. Instead of having technical expertise in house, the government moved towards wide scale use of Professional Reliance in the permitting process. Under the Professional Reliance approach, the Ministry relies on the judgment and expertise of qualified experts hired by a project proponent.

What is particularly important to note is that in March 2014, the Office of the British Columbia Ombudsperson released a scathing report criticizing the Professional Reliance model with respect to streamside protection and enhancement areas. The report, entitled The Challenges of Using a Professional Reliance in Environmental Protection – British Columbia’s Riparian Areas Regulation made 25 recommendations, 24 of which the government agreed to accept. But this acceptance came almost a year after the Ministry of Environment granted SIA their permit.

My own personal view is that the government’s approach to follow the Professional Reliance model is fraught with difficulties. The role of the government is to protect the public interest. When government is making decisions solely based on a project proponent’s expert opinion, it is very troubling. Imagine a judge in a court of law only listening to the expert opinion on one side of a case (plaintiff or defendant) and not allowing expert opinion to be submitted from the opposing side.

As such, the concerns of both the CVRD and the SRA seem particularly relevant in light of the fact that they themselves brought in expert testimony that contradicted the project proponent’s evidence.

638 Stebbings Road

The property located at 638 Stebbings Road (known as Lot 21) is owned by 0782484 B.C. Ltd. and has been in use for quite some time as a fill site. A photograph of the northern boundary wall of deposited soils is shown to the right. This photograph was taken from CVRD Parkland on the north side of Shawnigan Creek. Lot 21 is located immediately adjacent to Lot 23. In November 8, 2013 the Environmental Appeal Board granted a stay in proceeding to the SRA and CVRD until such time as their full appeal was heard. In their decision, the Environmental Appeal Board noted a number of serious concerns regarding Lot 21. For several years, soil has been dumped Lot 21 for later use to backfill the quarry in lot 23.

The property located at 638 Stebbings Road (known as Lot 21) is owned by 0782484 B.C. Ltd. and has been in use for quite some time as a fill site. A photograph of the northern boundary wall of deposited soils is shown to the right. This photograph was taken from CVRD Parkland on the north side of Shawnigan Creek. Lot 21 is located immediately adjacent to Lot 23. In November 8, 2013 the Environmental Appeal Board granted a stay in proceeding to the SRA and CVRD until such time as their full appeal was heard. In their decision, the Environmental Appeal Board noted a number of serious concerns regarding Lot 21. For several years, soil has been dumped Lot 21 for later use to backfill the quarry in lot 23.

My site visit to the region

On the afternoon of Thursday April 2, 2015, I visited the region with Shawnigan Lake Area Director Sonia Furstenau. Together with a few other Shawnigan Lake residents, we hiked around Lots 21 and 23 on parkland owned by the CVRD. I took this opportunity to take a number of photographs. More importantly, I took the opportunity to collect water samples.

Figure 2: Google Earth image showing the location of the SIA rock quarry and the sites where water samples were collected.

Figure 2: Google Earth image showing the location of the SIA rock quarry and the sites where water samples were collected.

The quarry located on Lot 23 (shown in Figure 2 and pictured in the banner image above) is bordered to the west by CVRD parkland and to the north by Lot 21. Our journey took us from Stebbings Road along a parkland covenant on the south side of the quarry to the parkland immediately to the west. We hiked in parkland along the western edge of the quarry and made our first stop at the northwest corner of Lot23 where the photographs below were taken. At this location there exists a pond of water (top) that drains (bottom) eventually into Shawnigan Creek.

Figure 3: Photographs taken from the northwest corner of lot 23 where there exists a pond of water (top) that eventually drains (centre) into Shawnigan Creek.

From this point we continued north along the western edge of Lot 21. Here it was readily evident that fill containing building materials was prevalent on the Lot 21 property. In fact, a significant amount of fill had over run Lot 21 and was on the neighbouring parkland. As we passed through the area I took a number of picture illustrating the type of building material that was present. A few examples are shown in Figure 4.

Figure 4: Photographs taken on CVRD land showing presence of building materials.

As evident in Figure 4, we discovered rebar, piping, concrete, asphalt, tiles, and even a tire. There seemed to be a large amount of fill in the form of building material on Lot 21.

Analysis of Water Samples

It is relatively straightforward to determine metal contents in runoff waters using an inductively coupled plasma mass spectrometry (ICPMS). Given the visible presence of steel products on the surface of the neighbouring CVRD parkland, I decided to collect water samples from two locations.

The first location (Site 1 in Figure 2 and denoted Plat in the analysis tables) was a relatively flat area that had standing water present at the surface. The second location (Site 2 in Figure 2 and donate Outflow in the analysis tables) was collected at the location where Lot 21 runoff entered Shawnigan Creek.

Figure 5: Photographs showing me collecting the water samples: Site 1 (left) and Site 2 (right).

The water flowing into Shawnigan Creek is orange (Figure 6) indicating an abundance of iron in solution.

Figure 6: Photographs of the water that runs from the north end of Site 21 into Shawnigan creek.

I passed the sample to my University of Victoria colleague Dr. Jay Cullen who in turn asked the UVic ICMPS Lab Manager, Dr. Jody Spence, if he would be able to analyse the samples. To process the samples the bottles were vigourously shaken, and the contents divided into two. One of the samples was filtered; one was not. Then 1 mL of environmental grade Nitric Acid was added to the unfiltered portion and left to sit overnight before analysis (this oxidizes and solubilizes more labile components of the precipitate that had formed). For the filtered portion, Dr. Spence used some sample to pre-rinse a clean syringe (all plastic, no rubber), and then filtered about 25 mL of sample through a 0.45 micron disposable filter. To this he added 0.5 mL of Nitric acid and let it sit overnight as well.

The results of the analysis are available in pdf format. All units in this table are in μg/L (micro gram per litre).

Schedule 6 of the Contaminated Sites Regulation of the Environmental Management Act lays out water standards for aquatic life, irrigation, livestock and drinking water. I will only concentrate on the drinking water standard although others may wish to compare my water results for aquatic life standards. As noted in Schedule 6 “Drinking water standards are for unfiltered samples obtained at the point of consumption.”

What is readily apparent from the analysed data is that the iron (Fe) levels fail drinking water standards locally. Manganese (Mn) levels are also high. These levels are almost certainly associated with the presence of buried steel (rebar, building materials etc.) on Lot 21. Nevertheless, by the time the water gets into Shawnigan Lake it will be so diluted that it would no longer fail these standards.

What is also important to note is that I have yet to analyse the water for hydrocarbon content. The presence of asphalt throughout the fill area would suggest that one might indeed expect to find hydrocarbons in the outflow.

Summary

What is apparent to me is that there are substantial amounts of building materials that have been placed on Lot 21. There is clear evidence that runoff from this site fails drinking water standards at the point of entry with Shawnigan Creek. And visually, this water looks nothing like any other water in nearby surface and running water. Missing from my analysis is an examination of hydrocarbon contents in the waters. I’ll save that for a later date.

There is conflicting evidence between the expert opinion provided as part of SIA’s application for a permit and that obtained by Shawnigan Resident’s Association. Herein lies the critical problem with the entire permitting process. The Professional Reliance model for project permitting in use in British Columbia is inherently flawed. No matter what project is seeking approval, when the government bases its decision on the professional advice provided by a project proponent, there will always be public concern. In fact basing approval decisions on the Professional Reliance Model makes it difficult, if not impossible, for a project to earn a social license to proceed.

The role of government is to protect the public interest while at the same time giving industry certainty with respect to the project approval process. My own view is that in order for both public and industry interests to be served transparently and fairly, British Columbia should move away from the Professional Reliance Model and instead create arms length and independent expert oversight panel(s). This can be accomplished by expanding in-house government technical expertise and using that expertise to set up independent oversight of a proponent’s project plan, paid for by the proponent. In addition, the Office of the British Columbia Ombudsperson report mentioned above and entitled The Challenges of Using a Professional Reliance in Environmental Protection – British Columbia’s Riparian Areas Regulation outlined a number of ways of improving the Professional Reliance model.

So how do we move forward from here? It makes little sense to me to dump contaminated soils in the Shawnigan Lake watershed. In addition, there are sufficient uncertainties in ground water processes/flow in the region that I don’t believe it is wise to place the contaminated soils at an elevation higher than nearby Sooke Lake (the source of Victoria’s drinking water). While overall risk may be small, it certainly is not zero and so it would be prudent to apply the precautionary principle in light of the stakes involved.

Instead, perhaps one of the three existing sites owned and operated by Tervita on Vancouver Island could take the contaminated soils. One is in the Highlands, one is in Cumberland and one is near Port McNeill. Tervita has a long history of successfully operating contaminated soil sites. If additional capacity is needed, then let’s start the process over again and search for a different location. But this time either follow the advice of the Ombudsperson’s office or establish and independent panel to oversee the permitting process.

Postscript

I discussed this issue further on CBC radio with Gregor Craigie on Earth Day (April 22, 2015).

Bill 23 – A MultiGenerational Sellout

In the not too distant future we will be moving to 2nd reading of Bill 23, The Miscellaneous Statutes Amendment Act. Included within the bill are three profoundly troubling sections.

If these sections pass, powers would be granted to the Minister to single handedly enter into secret agreements with oil and gas companies, without any clear oversight.

These agreements, parts of which can be withheld from the public, would dictate how much—or how little—British Columbians would benefit for our natural gas resources. And given what we’ve seen from this government so far on the natural gas file, it would not be unreasonable for us to be concerned about backroom deals that amount to hand outs of public resources at rock bottom prices.

Here’s what you need to know:

The most concerning points in Bill 23 pertain to changes to the way Royalty Agreements are managed under the Petroleum and Natural Gas Act. Under these changes, the Minister is granted the power to enter into secret agreements with oil and gas companies without the approval of Cabinet.

Once an agreement is signed, the Minister is not required to disclose any sections to the public that could reasonably be withheld under the Freedom of Information and Protection of Privacy Act (FOIPPA).

The question is: who decides? And what oversight exists to make sure our right to know is protected?

If the Minister is able to enter into these agreements without the approval of Cabinet, then does the rest of government even have access to them if they go unpublished?

My concern is that the act doesn’t specify any of this. So presumably right now, a secret agreement could be signed by the Minister without any oversight or approval from Cabinet. The Minister could then potentially keep important sections of that agreement from the public because he or she feels that would be okay under FOIPPA.

Yet, it goes even further.

Those agreements could lock us in for decades. In fact, it’s up to the Minister to determine how long they last, as long as the timeframe does not exceed the maximum timeframe set by Cabinet. The number that has been floating around is 25 years.

Under the agreement, the Minister can also set any terms or conditions he “considers necessary or advisable.” Presumably, these could include conditions the government must meet as well.

For instance, oftentimes agreements include exit clauses and penalties. So if a future government decides that an agreement signed by a current Minister is so egregious that we need to pull out, British Columbians may have to pay the company to do so. The problem, again, is that we may never know how much that would cost until it’s too late.

I am concerned that this is yet another attempt by this government to sell out British Columbians and their natural resources in an absolutely desperate attempt to fulfill their irresponsible election promises which at no time have ever been grounded in reality. The simple fact is – there is a global glut of natural gas in the market, demand is dropping as countries aggressively move to renewables, and BC is just not competitive enough in the LNG industry as we are so far behind other jurisdictions (not to mention that LNG prices have been plummeting and it is no longer economical to ship LNG from BC to Asia unless BC goes so far as to pay a company to do so). And Bill 23 takes the generational sellout, embodied in the Liquefied Natural Gas Income Tax Act, to a whole new level — A multigenerational sellout.

Even if this is not simply a handout for the LNG industry, the fact remains that there are legitimate concerns that the secret deals that this bill would allow could amount to handouts of public resources to companies. British Columbians should be outraged. And I will be vigourously opposing this bill in the weeks ahead.

Bill 26 – LNG Income Tax Amendment Act

On Wednesday, April 15 I rose to speak to Bill 26, Liquefied Natural Gas Income Tax Amendment Act 2015. Bill 26 introduces 109 pages of amendments to Bill 6, the Liquefied Natural Gas Income Tax Act that was introduced and subsequently granted Royal Assent in the 2014 Fall session.

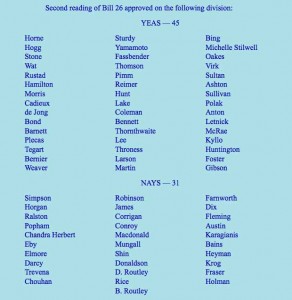

In the fall I stood alone in the house opposing Bill 6. During second reading of the bill I spoke out against it. I described it as a “generational sellout” that was incomplete and full of loopholes. I noted that in a desperate attempt to fulfill outrageous election promises, the BC Government did what it could to give away our natural resources with little, if any, hope of receiving LNG tax revenue for many, many years to come. Every single member of the legislature apart from me voted in support of the bill at second writing (see the image to the right).

In the fall I stood alone in the house opposing Bill 6. During second reading of the bill I spoke out against it. I described it as a “generational sellout” that was incomplete and full of loopholes. I noted that in a desperate attempt to fulfill outrageous election promises, the BC Government did what it could to give away our natural resources with little, if any, hope of receiving LNG tax revenue for many, many years to come. Every single member of the legislature apart from me voted in support of the bill at second writing (see the image to the right).

During the committee stage for the bill after 2nd reading, I identified a number of potential loopholes that could be exploited by LNG companies to further reduce the already meager amount of tax that they would pay to BC. And then, at third reading, I moved an amendment that would have sent Bill 6 to the Select Standing Committee on Parliamentary Reform, Ethical Conduct, Standing Orders and Private Bills, so that British Columbians could get answers to unresolved questions about the government’s LNG promises. The bill would have benefitted from a more thoughtful analysis by the Select Standing Committee. Third parties could be brought in for consultation, including the public, including First Nations and including the companies involved.

When it came to the vote, only independent MLA Vicky Huntington (Delta South) stood with me in the Chamber in calling for more time. The official opposition and the government voted together. It was truly remarkable to witness the opposition collectively stand in favour of this bill. So many of them had offered scathing condemnations of it during second reading.

When it came to the vote, only independent MLA Vicky Huntington (Delta South) stood with me in the Chamber in calling for more time. The official opposition and the government voted together. It was truly remarkable to witness the opposition collectively stand in favour of this bill. So many of them had offered scathing condemnations of it during second reading.

Imagine my surprise when the 109 page LNG Income Tax Amendment Act (Bill 26) was brought in for debate during this session. As I outline in my speech below, the actions taken by this Legislature in the fall, I believe firmly, were a dereliction of our duty. As MLAs, we should have explored the incomplete bill in greater detail. That could and should have been accomplished by sending it to the Select Standing Committee.

Bill 26 puts me in a quandary. I was fundamentally opposed to passing Bill 6 in the Fall. Yet the BC Liberals and the BC NDP voted to move it through quickly and so it is now law in British Columbia. Many of the objections I raised concerning the incompleteness of Bill 6, including the many loopholes and lack of completeness, were addressed in the LNG Income Tax Amendment Act (Bill 26). It is important that we fix bad law.

But at the same time, Bill 26 introduces an unacceptable revision to section 56. Now the minister is granted the power to use regulation to allow corporations involved in the LNG industry to use their natural gas tax credit to pay an 8 percent corporate tax instead of 11 percent. Obviously the government is so desperate to try and land an LNG industry that it is sweetening the pot still further. Back in the fall, when I put an amendment to send this to committee, I specifically stated in speaking to that amendment that one of the reasons this had to go to committee was because “I would have wished to explore, in particular the one-half percent natural gas tax credit.”

Section 56 represents one section of the bill that I will propose an amendment to during committee stage. I will propose to revert it back to its original fall version.

The BC NDP took a different approach. They too opposed changes to section 56. But instead of waiting to committee stage they decided to vote against the 2nd reading of the bill (which means all the Bill 6 loopholes would be left in place).

Below are the video and text of my speech.

Second Reading Speech Video

Second Reading Speech

A. Weaver: I find it, frankly, deeply troubling that we’re here debating Bill 26, LNG Income Tax Amendment Act. This is a 109-page act which is designed to amend an 87-page act — that is, Bill 6, which was introduced back in the fall. Bill 6, as you will recall, hon. Speaker, was the Liquefied Natural Gas Income Tax Act.

You will recall that in third reading of Bill 6, I moved a motion. I moved a motion to send the LNG Income Tax Act to the Select Standing Committee on Parliamentary Reform, Ethical Conduct, Standing Orders and Private Bills for further review. The reason why I did that was because Bill 6 was incomplete. It was full of loopholes so big you could drive a bus through.

Let me read some of the concerns I had. The reason why I would like to do that is to point out that quite a number of these concerns have been addressed in this, the amendment act, this 109-page act — bigger than the original act.

In the fall, when I moved an amendment at third reading to send this to committee, I stated the following.

“There have been questions that would benefit exploration at committee stage. In particular, there are questions on revenue projections, the modelling, the assumptions into the modelling that have not been forthcoming and transparent in terms of us as a Legislature being able to assess this legislation.

“There’s section 32(c)” of Bill 6. “There are issues that came up…with respect to a loophole for earned credits that could be sold by a company, the income from that not being claimed as taxable, yet the person purchasing it can claim the income as a deduction.”

There were questions about section 46, with respect to the rate being left out. We never got guidance as to what the rate and the formula there was.

There were questions on section 47 regarding “a potential LNG loophole for tax avoidance through capital acquisitions and leaving the 1.5 percent net LNG tax rate for significant times.”

There were questions on section 122 with respect to the polluter-gets-paid instead of a polluter-pays model.

There were questions on section 172 that we did not have as much time as I would have liked to explore, in particular that one-half percent natural gas tax credit. Let me reiterate that. Back in the fall, when I put an amendment to send this to committee, I specifically stated in speaking to that amendment that one of the reasons this had to go to committee was because “I would have wished to explore, in particular the one-half percent natural gas tax credit.” Well, as we will discuss later in my speech here, we do have more details about that one-half percent tax credit.

I would have thought in the fall that this was such an important piece of legislation that government would have wanted to send this to committee to actually gain the insight of British Columbians, of First Nations, of industry from across the province. Instead, with the exception of the member for Delta South, every member in this Legislature stood and voted against sending this to committee, to rush this bill through when it wasn’t ready.

Today we stand here to debate Bill 26, the Liquefied Natural Gas Income Tax Amendment Act, a full 109 pages, compared to the 87-page act which was incomplete and introduced in the fall. This is troubling. This is very troubling. It, frankly, disturbs me that we have to be in this position here today.

Let me emphasize that the changes made in this bill are important. They’re important, and I’m in a quandary. They’re important because I stood passionately and spoke against the introduction of Bill 6 in the fall. But I recognize that we have passed Bill 6. Bill 6 has now received royal assent and is a matter of law within British Columbia. Bill 6 is incomplete. We cannot conduct business in the province of British Columbia with Bill 6 standing before us now. We either need to repeal it or we need to pass some form of legislation to fill those loopholes.

Let me address some of that. In essence, my own view is that this bill closes quite a number of those massive loopholes that I referred to earlier. In particular, if I could read the…. I have so many notes here. I’ll find it in a minute. Let me say it provides greater clarity on the administrative requirements, bankruptcy and insolvency issues and debt forgiveness rules. It sets requirements for registration, for filing tax returns and for paying and refunding taxes. It establishes penalties for failing to meet the requirements of the act.

Most importantly, it introduces section 124.412, which is the anti-avoidance rule, which was so critical in my criticism back in the fall, that there were so many loopholes that companies could avoid paying taxes even though they were hardly paying any taxes in the first place. This anti-avoidance rule introduction is critical legislation that needs to have been in place and should have been in place in the fall and should have been discussed and raised in committee, had we passed this legislation and sent it to committee. Instead, here it is now in the 109-page liquefied natural gas amendment act.

There are essential aspects in this bill for the tax regime. Without them, LNG income tax payers could avoid paying a significant amount of the tax because of the massive loopholes and others that I discussed earlier.

The real question is how the LNG Income Tax Act got passed last fall without any of these very basic provisions laid out for us to discuss, number one. Two, not sending this to committee so that we could have an opportunity to discuss it is deeply, deeply troubling. Frankly, in my view, this has been an abdication of the responsibility on behalf of this Legislature to do due diligence on the legislation that was tabled and brought to us. It doesn’t end there.

Here I do agree entirely with the official opposition — that is, with the concern they raised, which I agree with, concerning the problematic natural gas tax credit. Before I come to that, I think it’s important to set the context.

What is the context? Why is it now that in section 56 we essentially allow the minister, through regulation and in perpetuity, to allow corporations involved in the LNG industry to use this natural gas tax credit to pay 8 percent instead of 11 percent?

Let me tell you a little bit why we’re where we are. And this isn’t new. For two years now I’ve been saying the same thing. British Columbia’s hype of hope and wealth and prosperity for one and all from a hypothetical LNG industry was nothing more than a message of hope wrapped in hyperbole. The promises of 100,000 jobs, a $100 billion prosperity fund, a $1 trillion increase to GDP, debt-free B.C., no PST, thriving schools and hospitals and on and on were nothing more than a pipe dream.

The global markets, the economics, did not support these statements in the fall of 2012. They do not support these statements now. This is the reason why we’re seeing this natural gas tax credit — essentially, yet another generational sellout on top of the existing generational sellout — being brought to us for approval today.

What has happened since 2012 was entirely predictable — entirely predictable — given the fact that we are not the only ones in the world who have discovered horizontal fracking technology. Our shale gas reserves pale in comparison to others. We have massive reserves in Australia, in Russia, even in China, in the United States, in Iran, in Qatar. I could go on and on. There is shale gas all over the world. Yet somehow B.C. thinks that it, and it alone, is going to fill Asian markets with natural gas.

This is what happened. I’m reading here from a Reuters piece published on December 11, 2014. The title of that says this: “Asian LNG Prices Seen Falling by up to 30 Percent in 2015.” Well, they’re talking about LNG prices falling 30 percent in 2014. But in fact, they talk here about things like if brent crude trades at $85 next year, the price could be $12.60 per million Btu. It continues on that it could drop still further and further. If brent trades for $70 a barrel — $70 a barrel; hmm, lot of oil companies out there right now are looking for $70 a barrel — the price of low-sulphur oil will cap LNG spot prices at — guess what — $10.50 per million Btu.

I’ll repeat that. If brent trades at $70 a barrel — it doesn’t matter that we’re trading at $50 a barrel now — this Reuters article is quoting Wood Mackenzie’s Thompson as saying that LNG spot prices will be capped at $10.50 per million Btu. That makes sense.

Russia has just entered into long-term 30-year contracts at below that price. Yet British Columbia thinks that somehow companies will invest tens of billions of dollars to transport liquefied natural gas from our coast across the ocean, when it costs $7 to $8 per million Btu to do that. They’re going to have to pull this out of the ground at negative prices.

That is why we have this LNG tax legislation before us, because it introduces so many giveaways that, essentially, we avoid paying tax to British Columbians, and we give away a natural resource. Well, we try to. This is still not coming.

I reiterate, and I say it one last time. If brent trades at $70 a barrel, the price of low-sulphur oil will cap LNG spot prices at about $10.50 per million Btu.

It doesn’t end there. What other things have happened to cause this desperate Hail Mary pass of hope after the previous Hail Mary pass of hope was caught? They didn’t win the game. We thought they did, but they didn’t, because they can’t land this.

Let’s see what else has happened. I’ll read to you from a Toronto Star article entitled “Shell-BG Deal Could Dampen B.C. LNG Projects.” Well, that’s a surprise. I thought we were going to have Shell and BG and three others up and running by…. Well, one of them should have been this year, maybe a couple by next year.

The Shell and BG amalgamation is troubling. Why is that? Because they have…. Let me read here. British Gas, BG, has liquefication plants in Australia, Egypt, Trinidad and Tobago, and another being developed in Louisiana.

Shell has LNG operations under construction — not planned, under construction — in Russia, Qatar and Australia. We now have dropping demand. We have the amalgamation of two major players in the liquefied natural gas world with projects under construction. B.C. is not a player here. We can say goodbye to those companies.

Why would anyone invest in British Columbia right now? Why would anyone invest? Because they would need a supply gap. These companies don’t buy to fill spot prices. They buy to make long-term investments to fill in supply gaps down the road. Petronas had a supply gap — 2018-2019. They’ve deferred their investment decision, deferred it again and again. Do we really think Petronas is going to make a final investment decision to go ahead to meet a 2018-2019 supply gap? I don’t think so. They may be back in the mid-2020s, where another supply gap emerges there. But for the short term, this is nothing but hope.

Frankly, it’s irresponsible to put our entire provincial economy, to retool our education systems, to essentially send to business a message, a singular message, that if you want to come to British Columbia to do business in our province, you’ve got to hang your hat on LNG, an industry that doesn’t exist now, but we hope maybe someday will exist. What we’ll do for you, hypothetically, is retrain our education system. We’ll do whatever you want. We’ll create a natural gas credit, which is 1/2 percent plus some random number to bring it down to 8 percent — your corporate income tax that you pay.

Here’s another article, published on April 5. This one’s important, because this government has pointed out for us many, many times how proud they are to get the triple-A credit rating from Moody’s. Well, low and behold, here’s the title: “Moody’s Puts a Damper on B.C.’s LNG Dreams.” I’ll say it again. “Moody’s Puts a Damper on B.C.’s LNG Dreams” — published in the Canadian Press and syndicated across our beautiful country.

Meanwhile, what’s actually happening in the world? Well, we don’t have to go very far. Let’s go to Bloomberg Business today — not tomorrow, not yesterday but today’s Bloomberg Business newspaper. Let me quote the title article. It says this: “Fossil Fuels Just Lost the Race Against Renewables.”

Why is that the case? Because, around the world, people recognize that there are stranded carbon assets in the ground that cannot be extracted. The existing plans and development to extract those resources that are there are already meeting existing demand down the road, so there are no supply gaps.

Instead, places like China, Russia, Europe, Australia and America, whose emissions dropped last year, are going all into the renewable clean tech sector, a sector that British Columbia used to be a leader in.

Now this government is saying to British Columbians: “If you want to be a leader in an economy in B.C., forget everything else. Let’s go LNG.”

This article, which I recommend that all read, entitled “Fossil Fuels Just Lost the Race Against Renewables,” is published today in Bloomberg Business. There are actually some lovely charts and graphs in there too. It’s not just some person writing their opinion. It’s actually an analysis with graphs, bar charts. It’s quite interesting to read, because they’re saying what I have been saying for two years — that this is nothing but hyperbole.

This brings me to the most serious aspect of this bill again, and that is the natural gas tax credit. Under this tax credit, an LNG taxpayer can decrease their corporate income tax from 11 percent to 8 percent by claiming credits for the cost of natural gas. Under the old version from last fall, they could only claim 0.5 percent of their natural gas costs.

I agree with the opposition. This is simply unacceptable. This should’ve been brought in, in the fall. However, my approach to deal with this is to amend this at third reading and offer this Legislature an amendment to refer us back to the fall legislation, which had this fixed value of 0.5 percent — as opposed to voting against this at second reading.

Under the new version an LNG taxpayer can claim that amount as well as an additional prescribed amount that is to be set by the Lieutenant-Governor-in-Council. It could be 0.5 percent or, given that that brent crude drop is going to cap LNG prices, you might as well make it 0.5 percent plus minister’s 2½ percent to make it 3 percent to drop the corporate tax down to 8 percent. We weren’t told that in the fall, and it behooves us in this House to amend this, to take it back to what was given us in the fall with a straight face by this government that this number would be a half-percent.

What’s worse here is that if is a taxpayer claims for credits than they can use in a year, those additional tax credits will carry over to future years, which means that if the prescribed rate is high enough, a company could end up paying 8 percent corporate income tax in perpetuity. Yet another loophole is brought in here, and based on the changes that are being made, it’s is hard to imagine any other intention.

Clearly, the government did not think that 0.5 percent of a taxpayer’s natural gas costs was sufficient enough to lower their corporate income tax rate to 8 percent. It was not a sufficient enough gift — a piece of candy — to give to the LNG industry that they introduced greater cuts because the industry is not coming here. What is next? Are we going to have to promise them a free workforce? Are we going to promise them that they pay no tax? They’re not coming, even as we introduce this generational sellout of Bill 6, amended through Bill 26.

Let me discuss now the quandary we find ourselves in, because this is important. This bill puts us, all of the members in this Legislature, in a quandary, in a very difficult position. Last fall the government and the official opposition together passed the LNG Income Tax Act prematurely. At second reading I was the only member of this Legislature to stand in opposition to the generational sellout embodied in Bill 6. I would have argued that this should never have happened. But now we are debating an amendment that is longer than the actual act, and this amendment actually dramatically changes the original act.

The problem here we face is…. I tried in the fall to put this to committee, because it was clear that there were so many loopholes in this bill — loopholes, as I described, that you could drive a bus through. I was voted down by every member in this House except my dear friend from the riding of Delta South, who also recognized that while her position was that it was important to move forward with an LNG tax regime, we could not do so at this time in light of lacking information before us, and so sending this to committee was critical.

The problem now is that we’re not really able to debate the merits of the original act. We are debating the amendment act, with the original act now standing as a matter of law before all British Columbians. So I’m in a quandary, as I’m sure others are, and I say it again very clearly that I believe that the LNG Income Tax Act, Bill 6, should be repealed. It should never have passed.

Here we are today with a government not willing to do so, a government instead amending — amendments that I support — many of the loopholes in the previous act but introducing section 56, which, to me, is critically flawed in actually, essentially, giving regulation to the minister to allow him or her to grant 3 percent income tax cuts to LNG corporations in perpetuity.

As I said, the actions taken by this Legislature in the fall, I believe firmly, were an abdication of our duty, a dereliction of duty. As MLAs, we should have explored that in greater detail.

I am grateful to the minister for allowing me to be briefed by his staff, a briefing that I was able to probe many of the loopholes that I raised earlier and find that many of them have been addressed. I was satisfied with the answers I got, and I was pleased by the level of detail provided.

Clearly, I’m unhappy with section 56. While I support the amendments, I will not support section 56. But I will do that at the committee stage through the introduction of an amendment if the official opposition does not.