Housing

Ongoing saga of BC NDP’s botched speculation and vacancy tax rollout

A few weeks ago I wrote a piece expressing my concerns about the botched rollout of the BC NDP’s speculation and vacancy tax.

Since that time we have continued to receive a high volume of feedback, including thousands of emails, many scores of phone calls and numerous in-person visits to our constituency office. Many have expressed frustration about the tax, particularly the difficulty in making contact with government to speak to a live person about the specifics of the tax and its potential exemptions. We have received countless reports that the phone number provided to the public leaves people on hold for hours. This is unacceptable.

In fact, my own staff attempted to phone this number to get clarification about the tax and gave up after being on hold for 90 minutes. This is unacceptable.

The fact is, there are myriad nuances in the various situations affecting the people to which the tax may apply. My office is doing the best we can to help out, but I can tell you that our frustration levels are very high as we believe it is inexcusable for the government to have introduced this new tax measure without ensuring that adequate resources are present to help people navigate through its complexities.

Some of the most frequent concerns regarding the speculation and vacancy tax expressed to my office are listed below:

1. Privacy of Information

- Concern has been expressed about private information that is required to complete the declaration form, including having to provide a Social Insurance Number.

We have been advised that the government requires personal information such as Social Insurance Numbers to confirm that homeowners claiming the personal residence exemption do meet the requirements. In addition, the personal information provides confirmation of how much a person must pay if they do not qualify for an exemption.

2. Security of Information

- Given the recent highly publicized breaches of security experienced at major corporations and governments across the globe, concern has been frequently expressed about security of private information and risk of it being compromised.

We have been advised that the information collected through the government’s eTaxBC application is encrypted upon entry and masked. As a result even government employees cannot access the information without specific authorization.

3. Use of Information

- Concern has been expressed about how personal information will be used by government and for what purpose, now and in the future

We have been advised that the personal information collected under the Act is protected in a manner consistent with the BC Government’s Information Security Policy, Federal Security Standards and provisions of the Freedom of Information and Protection of Privacy Act.

4. Access to timely information

- We have been advised of, and experienced directly, excessive wait times on the phone to speak to an agent for clarification of the tax and eligibility for exemption.

The government has provided information on its website regarding the application of the Act and the various categories of exemption available to homeowners. Many of our constituents have found the website lacking in almost every way. The explanations are not clear and there are very few concrete examples to examine.

For instance, in order to claim a Personal Residence exemption the website says a person must be “… a Canadian Citizen or permanent resident of Canada who’s a B.C. resident for income tax purposes …”. If one of the owners had to move for work related purposes the website says the parties could claim for 2 principal residences if both were still in BC. However, the website is silent about situations where the spouse has had to move out of the province or country for work and is therefore no longer a BC resident for income tax purposes. There is a section regarding the situation if a person lived in the property and had to move out of the province. That section says an exemption could be claimed. However, that section directly contradicts the original section which says the applicant has to be BC resident for income tax purposes.

This is just one example of the many problems people are facing. Attempts to resolve issues by phone are stymied by an incomprehensible and contradictory website and the completely inadequate resources the government provided to deal with public inquiries.

And there are two issues we are still struggling to get answers to.

i) Appeal

- What process is in place to appeal the tax

Update: since publication of this blog we have been informed that you can “appeal” by writing to the Ministry or the Minister outlining your situation and requesting an appeal; that will trigger the appeals process.

ii) Cost to taxpayer

- What is the cost to the taxpayer to administer this tax

I will continue to raise the concerns I am hearing with government to ensure that people are able to get the information they need. In particular, I will press government to take action to improve the accessibility and timeliness of information and make sure people can reach speculation and vacancy tax agents on the phone who can answer their question. Thank you for your patience. You are not alone in your frustration.

B.C. Green Caucus calls for public Inquiry into money laundering scandal

Today I rose during Question Period to call on the BC Government to initiate a full scale public inquiry into Money Laundering in British Columbia. The purpose of such an inquiry is to remove the investigation from partisan influence, protect the public interest and restore public trust. The B.C. Green Caucus does not ask for this lightly. However the financial impact money laundering has had — and that it continues to have — on the province is staggering: the federal Ministry of Finance estimates the problem at least $1 billion annually.

Over the past two weeks, my colleagues Adam Olsen, Sonia Furstenau and I have been using Question Period to explore what government is doing to deal with British Columbia’s money laundering scandal. The responses to our questions suggest that while the government has been doing a good job on a variety of fronts, we should bring the investigation into one, independent public inquiry.

We believe that there is enough evidence now to warrant the provincial government starting down this path, without waiting for more reports. Future reports still outstanding can feed directly into an inquiry. We further believe that the terms of reference for the inquiry must be broad enough to address money laundering, organized crime networks, the real estate market, the opioid crisis, and the links between them.

An independent public inquiry is the best course of action because inquiry commissioners can have the power to subpoena witnesses and compel testimony. Furthermore, it can run parallel to any criminal investigation as was done in Quebéc with the Charbonneau Commission.

We are joined in the call for a public inquiry by the cities of Victoria, Richmond, and Vancouver, more than 76% of British Columbians, Port Coquitlam Mayor Brad West, the BC Government Service Employees Union, and several petitions signed by thousands of British Columbians.

Below I reproduce the video and text of my question period exchange with the Attorney General. I also append a copy of our media release.

Video of Exchange

Question

A. Weaver: Please let me start by thanking members of opposition and the minister for canvassing such an important issue and having the dialogue that led to some very informative answers that we can take back to our constituency. I thank you for the questioning there.

A recent article from the Vancouver Sun pointed out that the scale of money laundering happening here in British Columbia is still unclear. A report last year from the Paris-based financial action task force indicated that $1 billion a year was laundered through a “massive” underground bank in British Columbia that served Mexican cartels, Asian gangs and Middle Eastern crime groups.

Illegal gambling money, drug money and money derived from extortion was laundered in British Columbia to supply cash to Chinese gamblers. Yet, our government continues to take a reactive approach to money laundering. There is a deficit of public trust in our province, and the people of British Columbia deserve a government that will take a more proactive approach to this issue.

My question to the Attorney General is this: will the minister introduce the public inquiry into money laundering in British Columbia?

Answer

Hon. D. Eby: I thank the member for the question and all members for the tone of the Legislature today. I think it’s great.

In terms of the member’s question about the approach that the government is taking, we were clear from the very beginning about why we have taken the approach of doing reviews into money laundering versus a public inquiry. We can move faster. We can get the information we need, and we can stop the activity that is actually taking place in British Columbia. We saw that in the casino file. We were able to stop the activity of bringing bulk cash into the casinos very quickly as a result of a review. A public inquiry takes longer to get to those kinds of results.

But that doesn’t mean that we don’t have the same questions that the member has about who knew what when, what kind of accountable should there be and the kinds of questions that can be answered through a public inquiry. What it does mean is that we need to take action to stop the activity as quickly as we can. The member knows that Dr. German is currently working on questions related to horse racing, luxury cars and real estate. I can tell the member that Dr. German is already uncovering some very disturbing information that’s causing government to take action and enabling us to take quick action. I’m very grateful for Dr. German doing that kind of work for us. But that does not exclude the possibility of a public inquiry.

I thank the member for making his party’s position very clear on this issue and all British Columbians, frankly, who have written to me about this issue to express their interest in a public inquiry as well.

Supplementary Question

A. Weaver: I thank the minister for the answer to the previous question.

While I do appreciate the response I received, the question I’m left with is: how many reports and news stories do we need to be written to convince this government that more resources are required to solve the problem? This government needs to develop solutions, not wait for them to arrive on their doorstep and waiting for other reports to articulate them.

Last week the Attorney General made reference to the fact that one of the top five transnational criminal organizations in the world was getting tax credits from Advantage B.C. A criminal organization getting tax credits in British Columbia to launder money is absolutely unbelievable. It’s an unbelievable allegation. It’s clear that government doesn’t yet understand the scope of this issue and that one or two reports is not enough.

In order to get to the root of this problem, we need an independent approach that can address the broad scope of money laundering in our province.

Previously, the Premier stated that he prefers prosecution over public inquiry. However, transparency watchdogs and lawyers who are experts on transnational crime have called for a public inquiry. That’s the only way to effectively deal with this problem. A public inquiry along the lines of what occurred in the Charbonneau Commission can run in parallel to criminal investigations that may or may not be ongoing.

Again, my question is to the Attorney General: when will the minister institute a public inquiry on the issue of money laundering in our province?

Answer

Hon. D. Eby: A couple of pieces about the member’s question. One is in relation to prosecutions. The member knows that the federal prosecution fell apart. It was expected to go to trial. It didn’t. It was ultimately stayed just before it was going to go to trial. Those materials are being reviewed by provincial prosecutors right now to determine whether or not our independent prosecution service will be bringing charges in relation to those materials. That’s ongoing.

A public inquiry, itself, will not result in criminal charges. It provides accountability. It provides the public with transparency into what took place — who knew what and when. It is a political accountability tool, but it is not a prosecution tool. So just to draw that important distinction. Now, that’s not to say it doesn’t have an important place in the tools of accountability of government. It’s just to say that it has that limitation.

The work that we’re doing right now is not reactive. We’re out there. We have experts on this issue. The Minister of Finance — I mean, she cancelled Advantage B.C., right? That is the program that gave the tax credits to Pacman. I mean, we are taking the steps that are needed. We’re getting the experts to provide advice. We’re actually taking steps — the Ministry of Finance on the beneficial ownership registry, so we actually know who owns property, an important tool for police and for tax authorities. We have Peter German out there, working on important issues so that we can take action in relation to those other areas that I told the member about. We’re taking a lot of action on this.

As I said to the member and as I would say to all British Columbians, that does not mean — and the Premier has been very clear — that we have ruled out a public inquiry on this issue. It just means that we’re taking these steps and these necessary steps first.

Media Release

B.C. Green Caucus Calls for Public Inquiry into Money Laundering Scandal

For immediate release

February 26, 2019

VICTORIA, B.C. –The B.C. Green Caucus calls on its fellow MLAs to stand united in calling for an independent public inquiry into the issue of money laundering, which has strong ties to the province’s housing affordability and opioid crises.

“We are calling for an immediate public inquiry into money laundering in BC so to remove the investigation from partisan influence, protect the public interest and restore public trust,” said MLA Andrew Weaver, leader of the B.C. Green party. “The B.C. Green Caucus does not ask for this lightly. However the financial impact money laundering has had- and that it continues to have- on the province is staggering: the federal Ministry of Finance estimates the problem at $1 billion annually.”

The province made international headlines last year when a report by the Paris-based Financial Action Task Force, a body of G7 member countries fighting money laundering, terrorist financing and threats to the international financial system, was leaked to the press. The report highlighted B.C. money laundering activities, of which the province admitted it was not fully aware.

“An independent public inquiry is appropriate as it can have a broad scope, functioning outside of partisan influences or criminal jurisdictions and extensive enough to include all senior public officials and elected members of the Legislature. Public inquiry investigations can involve interviews and oral testimony, and commissioners can have the power to subpoena witnesses. These investigations get to the heart of the complexity of what exactly happened and how it was allowed to happen.

“Although inquiries are not courts, they often exist alongside criminal investigations-such as the Charbonneau Commission in 2011- supplementing those criminal charges with real, actionable recommendations to identify, reduce and prevent such events from happening again. This is something purely punitive criminal charges do not address.

“The BC Green Caucus is not alone in its call for an independent public inquiry into the issue of money laundering in BC. We are joined by cities of Victoria, Richmond and Vancouver, and more than 76 percent of British Columbians polled last year support an inquiry. The chorus grows daily.

“An inquiry of this nature will take time, but so too did this money laundering scheme with evidence going back at least a decade. And the financial repercussions of a skyrocketing housing market and the devastating impacts the of opioid epidemic on the health and wellbeing of British Columbians will possibly span many years into the future. We owe it to ourselves and our children to investigate the links between money laundering, real estate, drug trafficking, and organized crime.”

-30-

Media contact

Macon McGinley, Press Secretary

250-882-6187, macon.mcginley@leg.bc.ca

Cleaning up money laundering in BC casinos

Today in the legislature I rose during question period to ask the Attorney General what action he’s taking to crack down on money laundering in BC casinos. I also inquired as to what he is doing to ensure that those involved are held accountable for their actions/inactions.

Below I reproduce the video and text of our exchange. I was very impressed with the comprehensive and thoughtful answers that I received to my questions.

Video of Exchange

Question

A. Weaver: Last week’s explosive investigative report on CTV’s W5 alleged that the B.C. Lottery Corp. displayed wilful blindness to money laundering in B.C. casinos. Since the early 2000s, multiple whistle-blowing attempts were allegedly ignored. From 2008 up until last year, these warnings were coming with increasing frequency, yet they were still ignored.

But it goes deeper than that. Those who tried to expose the racket were penalized. Does this sound familiar? The reports issued on the escalating crisis by the previous executive director of the B.C. gaming policy and enforcement branch were shelved, and at times, senior staff were even told that they should not talk about money laundering. It’s astounding.

After continually warning of a massive escalation of suspected dirty money infiltrating casinos, the top gaming investigators in B.C. lost their jobs.

My question is to the Attorney General: what action is this government taking to clean up this alleged culture of corruption?

Answer

Hon. D. Eby: I thank the member for the question. One of first things that we did on forming government was actually let British Columbians know about what was happening in our casinos, that our regulator believed that our casinos were the hub of an international large-scale money-laundering ring. British Columbians did not know that.

The member mentioned the Vancouver model in his two-minute statement. The reason British Columbians know about that now is because Peter German talked with the university professor who was teaching anti-money-laundering professionals about the Vancouver model of money laundering at the same time as officials here were saying that there was no issue with money laundering in our casinos. Can you imagine that?

The action we’ve taken is to, first of all, let British Columbians know about what was going on, and second, to tell the casinos, even though we knew there was a potential $30 million hit to the budget — even though we knew that — to stop accepting the cash. It cut suspicious cash transactions by 100 times from the peak of July 2015.

I can also tell the member that we have the regulator in the casinos at peak hours now. Previously they were only there Monday to Friday, nine to five. I don’t know if the member has ever found himself in a casino, but it probably wasn’t Monday to Friday, nine to five. Now the regulator’s there when people are actually in the casino, which seems like a good idea to us.

B.C. Lottery Corp., under the supervision of the regulator…. The member was in the House when we passed the legislation to make those 40-plus recommendations from Peter German all underway.

I thank the member for the question very much. We’re taking a lot of action on this file.

Supplementary Question

A. Weaver: There’s little doubt that this problem occurred under the watch of the previous government. However, it is now this government that’s in power, and it’s this government’s responsibility to actually get to the bottom of this.

As the Province reporter Mike Smyth pointed out, the NDP loves talking and talking about money laundering. According to other whistle-blowers in the industry, there was not only a culture of wilful blindness, but some executives were actively justifying the money laundering. Some said it would occur anyway, and therefore, at least the government casinos could be used to recycle the dirty money into productive uses. The seemingly pervasive theme across casino executives and within the BCLC was that the money should not be questioned.

According to whistle-blowers at the centre of this, their behaviour was not unwitting. It was deliberate. A former senior director of investigation for B.C.’s gaming policy enforcement branch has even said that the BCLC could have stopped this at any point. They did not.

My question, again, is to the Attorney General. Those responsible in his ministry must be held accountable. What is his ministry doing to ensure that British Columbians are getting the answers they deserve today, not some time in the future, but now?

Answer

Hon. D. Eby: You know, it’s a bit ironic to be given information that was in the Peter German report as evidence of the fact that the government hasn’t been taking action to get the information out. The reason why CTV and others knew about Joe Schalk and others who were fired when they tried to ring the alarm bells was because that was in Peter German’s report. I’ve actually written to them to congratulate them and thank them for their work in defending British Columbia’s interests. We’re getting the information out to British Columbians. We’re trying to stop the activity that’s taking place.

I’ve heard the members on the other side, in the official opposition, say: “Oh, we had lots going on. We were trying to stop money laundering.” We asked them: okay, well, give us the cabinet documents. Give us access to cabinet documents. We’ll keep that confidential. We won’t release that information. We’ll use that to inform our anti-money-laundering response so we don’t repeat the work. Did they give us the documents? No, they did not.

I can tell the member that it was just about eight weeks ago that the Silver International federal prosecution fell apart. We expected that British Columbians would hear a lot of information on that prosecution. We were incredibly concerned when it fell apart. I presented to a federal finance committee on this issue.

We now have a federal minister tasked directly to work with B.C. on this issue. The federal government is committed to work with us. We have a civil forfeiture action underway that I can’t talk about that is currently in front of the courts. The Ministry of Attorney General lawyers resisted an application to give the money back to the alleged money launders in the Silver International case. This case is ongoing.

The independent prosecution service, provincially, is looking at the federal materials and seeing if there are provincial charges that are appropriate. I could go on and on and on, and I would love to.

On the botched rollout of BC NDP’s Speculation and Vacancy Tax

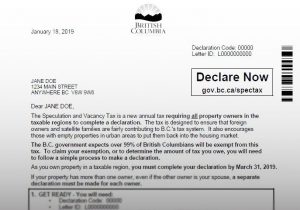

Residents across the Lower Mainland, the Capital Regional District, Nanaimo and  Kelowna/West Kelowna are beginning to receive letters from the BC NDP government concerning the Speculation and Vacancy Tax. To the surprise of most, every property owner registered on title will have to fill in a declaration to claim exemption from the tax. Widespread concern has emerged that this form of “negative billing” will lead to myriad problems. I agree.

Kelowna/West Kelowna are beginning to receive letters from the BC NDP government concerning the Speculation and Vacancy Tax. To the surprise of most, every property owner registered on title will have to fill in a declaration to claim exemption from the tax. Widespread concern has emerged that this form of “negative billing” will lead to myriad problems. I agree.

Anyone following BC politics will know that the BC NDP’s Speculation and Vacancy Tax has been, and continues to be, extremely controversial. Shortly after signalling, in February 2018, their intent to introduce tax legislation later in the Fall, it became abundantly clear to me that the BC NDP hadn’t thought the tax measure through. I was very critical of the lack of details and the fact that the tax’s interpretation by the Minister of Finance seemed to be changing on a near daily basis.

I was unconvinced that the BC NDP knew what outcome they were trying to achieve with their tax measure. I arranged for briefings; I met with the Minister of Finance where I outlined my many concerns; I posed questions to her in the legislature (e.g. in Question Period); I met with numerous stakeholders. And I personally responded to many hundreds of emails from around British Columbia.

The BC Green efforts started to pay off. In late March government released a second intentions paper outlining a series of thresholds, exemptions and refinements to the geography of affected areas. While I was supportive of these changes, there was still much work that needed to be done.

And so I arranged for more briefings; I again met with the Minister of Finance to once more outline my ongoing concerns; I posed questions to her in the legislature (e.g in Budget Estimates); I met with numerous other stakeholders. And I personally responded to many more hundreds of emails from around British Columbia.

On June 27 I published online an email that I had started to send out to people about my ongoing concerns over the Speculation Tax. Over the summer I once more arranged for more briefings; I met with the Minister of Finance; I met with numerous other stakeholders. And I personally responded to many more hundreds of emails from around British Columbia.

When the BC NDP finally introduced Bill 45: Budget Measures Implementation (Speculation and Vacancy Tax) on October 16, 2018, I acknowledged that they’d gone a long way towards addressing many of the unforeseen negative consequences that I’d raised with them. Yet there were still several key aspects of the bill that caused my BC Green Caucus colleagues and I to reiterate our ongoing concerns.

Prior to the introduction of the Bill, the BC NDP told our caucus that they viewed Bill 45 as a confidence measure. They argued that it arose from a flagship “budgetary policy” announced as part of the 2018 budget. Our position was that our Confidence and Supply Agreement was very clear:

“While individual bills, including budget bills, will not be treated or designated as matters of confidence, the overall budgetary policy of the Government, including moving to the committee of supply, will be treated as matters of confidence“

As you might imagine, a number of (at times difficult) meetings followed with the BC NDP. Concurrently, my caucus colleagues and I united behind the notion that the only way the BC NDP would secure our collective votes was if, and only if, they supported three further amendments (which were subsequently drafted by Legislative Drafters). These amendments ensured that:

- Mayors from affected municipalities would be part of an annual review process with the Minister of Finance that required the Minister to provide metrics that justified keeping the speculation tax in place in their community;

- revenue raised by the tax would be used for housing initiatives within the region it came from;

- the speculation and vacancy tax rate for all Canadians was the same – this brought the rate for non BC-resident Canadians down from 2.0% to 0.5%.

The amended Speculation and Vacancy tax bill eventually passed in the BC Legislature, but not before I was able to ensure that the Minister provide further clarification on record as to its intent.

At this point it’s important to note that the BC Greens take the enormous responsibility British Columbians have granted us very seriously. Our role in the BC Legislature is to ensure stability, yet accountability. And we did just that. We ensured that the BC NDP government did not fall in their declared confidence measure while at the same time working tirelessly to ensure that many of the unforeseen consequences of the poorly-thought-through Speculation and Vacancy Tax were mitigated.

Several times in our meetings with the Minister and/or her staff, or during the briefings with the Ministry, I raised concerns and questions about government’s proposed negative billing during the implementation of the tax (the BC Liberals were apparently asleep at the wheel and didn’t realize this was involved with its implementation). I suggested that some people might get confused and pay the tax even though they didn’t need to. My concerns were dismissed as I was told that the process was going to be easy and transparent, like what is already in place for people claiming the Homeowner Grant.

Sadly, this has not turned out to be the case and the processes to claim a Homeowner Grant and declare an exemption from the Speculation and Vacancy Tax remain separate. And so, while I am not surprised by the public reaction to the rollout of this tax, I am surprised that the BC NDP hadn’t anticipated this.

The BC Greens remain of the opinion that the BC NDP’s Speculation and Vacancy tax is bad public policy.

We believe that a better way forward would be to enable all local governments (not just Vancouver) to introduce vacancy taxes if they felt it was in their community’s interest. At the same time, a speculation tax could be applied exclusively to properties owned by offshore individuals and entities, the Bare Trust loophole could be closed as was done in Ontario, and a flipping tax could be applied when the same property is sold multiple times in a short time period.

We believe that a better way forward would be to enable all local governments (not just Vancouver) to introduce vacancy taxes if they felt it was in their community’s interest. At the same time, a speculation tax could be applied exclusively to properties owned by offshore individuals and entities, the Bare Trust loophole could be closed as was done in Ontario, and a flipping tax could be applied when the same property is sold multiple times in a short time period.

The BC Greens understand the importance of tempering exuberance in the out of control housing market. In fact, we specifically called for a New Zealand-style ban on off-shore purchases as per our call for bold action. We also outlined numerous other measures that could be implemented.

Moving forward, our caucus will continue to ensure stability, transparency and accountability in the BC Legislature.

Clarifying the intent of the Speculation and Vacancy Tax

Over the course of this week, Bill 45 – 2018: Budget Measures Implementation (Speculation and Vacancy Tax) was being debated during committee stage. During this stage, the BC Green amendments were all approved.

Those who have been following this file will know that I have spent an enormous amount of time on it over the last year. When this tax was first introduced in the February budget it was, in my view, poorly thought through and seemed to be an overly blunt instrument that did not effectively target its key overarching goal of dealing with speculation, affordability and vacancy rates. As I noted in March,

“The Speculation Tax … need[s] the introduction of legislation prior to [it] taking effect. Such legislation is expected in the fall. Fortunately we have time to pressure government to fix the problems embedded in their poorly thought out approach to deal with speculation.”

The bill that was ultimately introduced in October was certainly tempered from that which was originally offered through the first intention paper released by the government earlier this year. Many of the concerns we brought to government had been addressed. While it is still not the approach I would have taken, our amendments improved the bill further and will mitigate many of the key issues I had identified.

During committee stage I rose to ask questions and speak to amendments far too many times to reproduce all the Hansard records. However, I took the opportunity to raise a few specific, yet illustrative examples that were brought to my attention from the myriad emails we received and responded to. Below I reproduce the video and text of my exchange with the Minister on these specific examples.

What’s important is that if you have specific questions as to whether or not the speculation and vacancy tax applies to a property you may own, please note that details information is available at gov.bc.ca/speculationtax. Alternatively, you can email: spectaxinfo@gov.bc.ca or phone 1-833-554-2323.

The bill eventually passed on Thursday.

Videos of Exchanges

| Video 1 | Video 2 | |

| Video 3 | Video 4 | |

| Video 5 | Video 6 |

Text of Exchanges

Example 1 (Video 1): Belcarra – only accessible by air or water

A. Weaver: I enjoy this line of questioning. I think it’s very important to get clarification on the intent of the legislation before us. I have three questions on the definition of “specified area” in this section.

The first is with respect to item (l) in specified area. It refers there…. It just says: “…an island, if any, within an area referred to in paragraphs (a) to (j), if the island is usually accessible only by air or water throughout a calendar year.”

The first question is: why was the term island used there as opposed to a general area within these (a) to (j) that are generally accessible only by air or water? I’ll come to a specific example. Within the broader area, there may be, in fact, regions that are only accessible by air or water, even though they lie within the areas covered in (a) to (i).

Hon. C. James: As the member knows, the exclusion, when we looked at how to refine the geographic areas and looked at, as I mentioned in our discussion yesterday, the issue of how you make sure that most vacation homes are excluded…. We took a look at a number of different options, and one of them was to look at refining the geographic area.

That’s why we’ve said that we exclude islands that aren’t accessible, or that only are accessible by air and water — to be able to address those areas that, again, are difficult for commuting and, therefore, in most cases, are not people who are commuting and buying second homes. They’re mainly vacation homes, which is why we’ve listed it under (l) in that way.

A. Weaver: I very much appreciate the answer and the intent of actually including islands.

Why I raised it is that I heard from a resident of Belcarra, which, as the minister will know, is a lovely piece of the Lower Mainland across from Deep Cove. This person actually owns a property in Belcarra that is not accessible by road and is only accessible by air or water.

It seems that the intent of the legislation was to actually ensure that we’re dealing with urban areas where there are issues of commuting and issues of a rental market that’s being at ease here. Clearly, I would have thought the intent of this legislation would not have been to include somebody with a home in Belcarra that is not accessible by road and only accessible by air or water.

My question to the minister is: to what extent does a person who lives in the region — in one of these designated, prescribed areas — have an ability to actually get government to recognize that the spirit and intent of this legislation probably wasn’t meant to apply to an area which is only accessible by air and water but happens to be in one of these geographical regions?

Is there a mechanism that this person, recognizing the spirit of the minister’s previous statement, could go forward to actually determine whether or not this really is appropriate and they were meant to be covered under the government’s intentions?

Hon. C. James: We did specifically look at Belcarra. Part of the logic was, again, looking at the commuting distance. In fact, the commuting distance from Belcarra…. It’s a very short commute to downtown Vancouver. In fact, it’s a shorter commute from others that go from the Fraser Valley or from other distances — North Vancouver, for example. Five minutes away.

It is a municipality though, and I think this is important. As the member asked: what opportunities are there for discussion around these issues? Belcarra, in fact, is a municipality. I met with the Belcarra folks at UBCM. They will have the opportunity, in an informal setting anytime, but in a very formal setting, as the member knows, with the amendment coming forward, to have an opportunity to be able to argue either the strength or weakness of having the municipality included.

The Chair: Noting the time, we’ll take one more question.

A. Weaver: On this topic. I have one more question after this. I don’t know whether….

The Chair: Of course. As long as the minister can address the questions, we’ll do them.

A. Weaver: It’s just to follow up on that further, very briefly.

I’m not talking about the entire region of Belcarra. But within the broader section of Belcarra, there are parts of Belcarra — properties that happen to have cabins on them — that are only accessible by water or air. Therein lies the issue here.

It may be that the municipality itself meets the intent that the minister sought of a commutable distance. However, it’s not a commutable distance for some aspects of this municipality that extend into areas that are actually not an island but are only accessible by air or water.

Again, my question for a specific individual within this broader municipality: is there a mechanism for that individual to seek an exemption, as per my earlier remarks?

Hon. C. James: Thank you for the question, again. I think we did, in fact, look at the commuting time from some of the areas that were only accessible by boat — five to eight minutes to get to the Lower Mainland — so there are commuting pieces there. There aren’t opportunities other than, obviously, coming forward and raising the issue.

There aren’t opportunities built into the legislation, but I expect that people will have the opportunity to argue that changes should be made, if changes are going to be the made to the tax, including the mayor, who, I’m sure, will represent all the members of the municipality.

Example 2 (Video 1): Mudge Island and Nanaimo

A. Weaver: My final question is very brief. It’s from another concerned couple who approached me. I’m just giving a sampling of them because they illustrate the variety of concerns out there. I believe I know the answer, but I’d like to get confirmation from the minister.

The couple lives on Mudge Island in the Nanaimo regional district. They’re concerned that the tax could afford them and that it could kill the property values on Mudge Island. Can the minister confirm — they live in their home full-time on Mudge Island — that Mudge Island is not included in the regions that are prescribed under the specified areas?

Hon. C. James: I think the first piece that the member raised is primary residence. If it’s a primary residence and they live there full-time, then they aren’t captured. It isn’t captured. It’s only second or third homes. But Mudge Island is not captured by the speculation tax as well.

Noting the time, hon. Chair, I move that we rise, report progress and seek leave to sit again.

Example 3 (Video 2): Owned by couple in different countries

A. Weaver: I wasn’t planning to step up here and ask this question, but I’m very pleased the member for Prince George–Valemount did address this specific issue that I was going to raise under section 8.

I’d just like to ask a follow-up on this. I have the same letter, and we’ve been in communication with the same person. A good example that highlights some of the complexity of the application of this legislation — this particular case. The partnership is a partnership where one of the…. They’re not formally married. They’re living separately. One lives in a jurisdiction other than Canada. That person owns 20 percent ownership in the property that is the condo that is owned by the other partner.

So my question to this: given the fact that this couple are not formally married, if the person living in the foreign jurisdiction were able to rent back to her partner here in Canada, would that exempt her from the speculation tax? Yes or no?

They are not married, according to the court of law in Canada. The one person owns 20 percent of the property that the other person lives in full-time. She’s a 20 percent equity owner in the property. They are not married. That 20 percent equity owner lives in a foreign country.

If they rent that 20 percent share of the property to the partner — who they’re partners with but not legally married — would that exempt them, yes or no?

Hon. C. James: I think the first piece that I want to state is I’m not going to give tax information, as the Minister of Finance, specifically to an individual case. I think that’s really important.

I think individuals…. We are working on exactly the same letter that the member has and that the member from Prince George has as well. We are working through those pieces. There are so many unknowns around where the taxes are paid by the individuals. We don’t know that information. It wouldn’t be right for us to be asking that information, unless they were asking for tax information.

We’re quite happy to look at the situation. There may be a number of pieces that fit, but I don’t want to, as I said, jump on something where I don’t have all the information. But we have committed to making sure that we get the information for them.

Example 4 (Video 3): Extending over two lots

A. Weaver: I have a specific example I wish to offer the minister to seek some clarification. It’s a real-world example.

Let’s suppose that there is a person who happens to have a property that’s very old and lives in the riding of Oak Bay–Gordon Head. That property is a small house on a lot, but it’s actually two lots. One lot has the house; the other has an orchard that’s been in place in perpetuity. For the purpose of speculation tax, this might be considered as two properties. However, it’s only one property. It’s always been one property, and it will remain one property.

The question is: is the extra lot to be viewed, in this category here, as part of a whole property or not? Is there a means and ways that this person would be exempted by the administrator, and how would they be exempted by the administrator in this situation?

Hon. C. James: That would be an example where the individual could take it to the administrator and have it examined. I think the key around rules relating to the property is that the residential property — so if it’s the additional parcel, as the member describes — is used for the residence or for purposes ancillary to or in conjunction with the residence.

So as I said, I wouldn’t give the advice. That’s the job of the administrator. But that would be an example where they could take something to the administrator.

Example 5 (Video 3): Extending across two specified areas

A. Weaver: Thank you. That’s very helpful. I have a final question, and it’s relevant to the riding that I represent and part of the municipality that the minister represents.

There are properties in the capital region district where the actual property spans two municipalities. This is quite common along Foul Bay Road, in Oak Bay, where there are many houses that have part of the house in Oak Bay and part in Victoria. I suspect, without going through all of this, that there may exist properties in the province of British Columbia that actually span a jurisdiction that’s in and a jurisdiction that’s out. How would those be treated, if they do exist? And would the administrator automatically treat them in the in or out district?

Hon. C. James: We had a little bit of this discussion earlier. We found one property in the province, in the areas for the speculation tax, that spans inside and outside.

If a portion is inside, then they will be taxed — or subject to the speculation tax. I shouldn’t say they’ll be taxed, because they may have an exemption for other reasons. But it’ll be included as part of the speculation tax.

A. Weaver: Would the component of the property that’s subject to the speculation tax be the percentage of the lot that’s in the property or the total lot? Why I ask that? Let’s suppose there’s a 12-acre parcel of which 100 square metres is in taxation and the rest is not. Would they be collectively subject to the taxation? Again, these are not examples that I know of, but I know of them in Oak Bay–Victoria, as I’m sure the minister does. But there may be some that we’ll find out about.

Hon. C. James: Again, we found one property that fits that example. It will be the case that if a portion of the property is in, the entire property is subject to the speculation tax. But again, we think that this will be a very rare example. We found one. I don’t expect that there will be other examples.

Example 6 (Video 4): Couple – one in Kelowna, the other in Vancouver

A. Weaver: I have three personal stories I’d like to read and see if I can get the minister’s response. The first concerns a UBC professor I have been in touch with who has, most recently, been teaching at the Okanagan campus in Kelowna. They’ve had a home there since 2013, but they have a condo in Vancouver. His wife is teaching at the Okanagan campus, but he’s now teaching at UBC. They’re both UBC professors, but UBC has two campuses, one in the Okanagan and one at UBC in Vancouver. So he teaches in Vancouver; she teaches in the Okanagan.

He was teaching in the Okanagan. He was hit by the city of Vancouver’s empty homes tax last year and has since moved his primary residence to Vancouver as part of it. So now his primary residence is Vancouver to avoid the Vancouver vacancy tax, and his wife is still teaching at UBC Okanagan. His wife spends much of her time at UBC Okanagan.

My question to the minister is this. Can you confirm that this couple would be exempt because of the commuter marriage exemption that we’re discussing, when this fellow’s wife spends a good deal of time in Kelowna for work purposes?

Hon. C. James: Again, I’ll always put the caveat around: based on the information that’s here…. I certainly encourage people to make sure they phone the tax department and talk to the tax department to get the specifics. But on the information that the member has provided, yes, it appears that if one is working in the other place and one residence is the principal residence of the spouse, yes, they would qualify.

Example 7 (Video 4): Couple – live in North Saanich, work & rent in Vancouver

A. Weaver: Thank you. That’s very helpful.

This one’s a little more complex. And that was my understanding as well. I do appreciate hearing the confirmation, subject to the caveats, of course. They’re, of course, subject to caveats.

Another example is…. This one is very interesting. A couple that I know have been in touch with me. They own a house in North Saanich, which is in the covered regions of the capital regional district. They live in the house on weekends. That’s the only house they own. It is in North Saanich. However, they both work in Vancouver, and they rent a property in Vancouver during the week, although they live in North Saanich. This is relatively common these days in Victoria, where people cannot afford to actually own in Vancouver, so they live in the North Saanich area. They take the ferry on Monday to Vancouver. They work there, and they come back on the weekends. They plan to live permanently there, in North Saanich.

My question is: are they eligible for an exemption in this regard?

Hon. C. James: Again, based on the information provided, it would appear that they would be subject to the tax because it wouldn’t be their principal residence. The home in North Saanich would not be their principal residence. It’s not where they’re spending most of their time, so it does appear that they would be subject to the tax.

But I want to make sure that I’m clear on the caveat that everybody has some additional information, and when people talk to the tax department, they often provide further information that a person wasn’t sharing with an individual when they were talking to them. I would encourage people to make sure that they phone, for those kinds of examples, to make sure that they get the information from the tax department.

Example 8 (Video 4): Live in Surrey, work in Vancouver

A. Weaver: I very much appreciate that. I’m not trying to trap the minister at all. I’m trying to get some clarification and some advice that we can actually provide to these people who are rightfully concerned. Members of the opposition have been doing exactly the same thing. We do understand, of course, that the minister cannot provide tax advice.

It’s a bit odd asking questions in this marriage section, but people have asked us how marriage relates to this. This is a complex tax bill, and where people fit in with their individual cases is quite difficult.

The final example here is another woman. Again, she’s not covered under the commuter marriage, I don’t think. However, it’s odd, so maybe we could get kind of a general sense of the minister’s thinking on this issue.

This is an example of a woman who lives with her ailing mother in a family home in Surrey. So she lives in Surrey, her mother is ailing, and she lives there with her. But the woman actually works in Vancouver. She doesn’t want to take the tunnel, along with the member for Surrey–White Rock, so she has a condo in Vancouver, where she works during the week.

She owns the condo, and she also lives in the family home that she owns with her mother in Surrey. They’re clearly not married, but there clearly is a kind of commuter relationship there.

I’m wondering whether she could be exempt if she rented the family home to her mother? Is there a temporary exemption for something like that? I don’t know how this plays out.

Hon. C. James: With the caveat — I think that’s really important to state. If the individual works in Vancouver and has the Vancouver condo as her principal residence, for example, then her mother would be considered a non-arm’s-length tenant. She doesn’t have to rent; she can live in the house. She would not be paying the speculation tax. But again, lots of caveats around that to make sure it’s based on the principal residence — how much time she’s spending between the two places as well.

A. Weaver: Again, I don’t want to ask the minister to give tax or advice on buying or selling property, but I do think it’s important that we have this discussion and make it available to people so as to hear the kind of thinking of where things are going. The reason why I say this is that this particular person, also the condo that I mentioned in downtown Vancouver, is subject to a strata with a no-rental clause in it. So it gets even more complex there.

Unfortunately, this woman is selling her condo in downtown Vancouver. What I would like to get confirmed is that in fact there is place an exemption for 2018 and 2019 for any strata unit that has a no-rental clause in place. So rash decisions about putting a condo on for sale, when the condo is in a strata unit that has a no-rental clause, are not being forced by this legislation.

Hon. C. James: The member is correct. There is a two-year exemption for condos and stratas that have a requirement that you cannot rent the place out.

A. Weaver: I just want to thank the minister — this is very, very helpful — and the opposition for asking these questions. These are important issues, and having these answers on record is going to be very helpful.

Example 9 (Video 5): Strata accommodation properties & Oak Bay Beach Hotel

A. Weaver: On section 27, we’re talking here about strata accommodation properties. I’m wondering if the minister could please give the members here an idea, an estimate, of what type of properties these are, with some examples?

Hon. C. James: Strata accommodation properties that are classed as residential under the Assessment Act would be strata accommodation property short-term rentals, hotels, strata hotel accommodation that has been classed as class 1 or partially class 1 or partially class 6.

These hotels, a number of years ago, were given favourable property tax treatment, for example, to encourage the construction of these short-term occupancy time-shares, hotels.

I guess a way of describing it would be a cross between a strata complex and a hotel — that’s kind of a description — made up of individual strata lots that are pooled together for the purpose of being rented. That’s, I think, kind of the best description I could give.

A. Weaver: I can give some examples, then. Oak Bay Beach Hotel, for example, is a hotel in my riding that has a long history as a hotel, but it’s actually strata units that are rented out through a property rental agreement, and the zoning actually precludes any other use.

There are others in the minister’s own riding. Some are zoned tourist commercial. There are others in the province of British Columbia. In the tourist commercial zoning, for example, which some are zoned as, you actually have restrictions put on by your municipality, and those restrictions actually limit the ability for you to rent more than six months. So I agree. I think we’re on the same page as to what units are there.

My question, then. I understand that there’s no problem for the next two years — well, through 2019, because 2018 is exempt, as well, for these properties. My concern is: what is government’s intent for afterwards?

These properties are significant economic drivers in the region. Oak Bay Beach Hotel, for example, is one of the single biggest suppliers of property tax to the municipality of Oak Bay. They have very little commercial property in the riding, as well as in other jurisdictions. I’m sure there are, in my friend’s riding in Kelowna, tourism commercial properties that have similar zoning, as well.

Hon. C. James: The member, I’m sure, knows this, but the commercial portion is already not classed as residential, so therefore isn’t covered anyway because it’s often class 6 property.

I think the further review around how we deal with these properties is really the time that we gave, in this act, for two years. It gives an opportunity for discussions with the municipalities, with the property owners, etc., to find a long-term solution. This gives us the opportunity to have those kinds of conversations.

Example 10 (Video 6): Medical Exemption in Nanaimo

A. Weaver: With respect to section 33, I have a personal story I’d like to relate to the minister. I’m not asking for tax advice. I’m recommending people go to the information that the minister provided yesterday on the record, and that will be here. But I’ll just give a sense of the intent, because this is an illustrative example.

This is an example of a couple who recently bought a second home in Nanaimo. They live on a small island nearby with their daughter, and they spend several days a week at the Nanaimo property. They bought it so they could be closer to the hospital. They’re elderly.

The property is worth less than $400,000. It’s a $300,000 property. They don’t want to rent it out, because they’re elderly, they’re concerned about medical issues, and they want to go there if they have to be there for medical reasons. Right now, they only have to be there on and off, but they might have to be there at any time for a more extended period of time.

I’m just asking if the minister could please confirm to me that the couple is not covered by the medical exemption, yet they are covered by the fact that the property is $300,000, which is under the $400,000 exemption.

The idea here is that while they have bought a property to go every now and again, it’s still not being used full-time. They’re not needing it full-time. But because it is

The idea here is that while they have bought a property to go to every now and again, it’s still not being used full-time. They’re not needing it full-time, but because it is under $400,000, they are exempt.

I’m wondering if the minister, without providing tax advice, could confirm that the general spirit of this would be that they would have an exemption because it’s under $400,000, but they’re not eligible for the medical exemption.

Hon. C. James: I appreciate that I must have said it often enough. Based on the information that the member provided — recognizing that the individual should make sure they get tax information from the taxes people — yes, if it’s less than $400,000 there, that will cover it, and they will not pay the speculation tax. As the member says, from the information he has given, they wouldn’t appear to be covered under the illness, but they would be covered under the $400,000.